In 2025, cannabis isn’t a gold rush. It’s a grind.

Most stocks are down more than 90% from their highs. Capital is tight. Retail shelves are crowded with low-margin products. At this year’s Benzinga Cannabis Capital Conference in Chicago, the optimism of earlier cycles gave way to something more sober: survival talk.

Two industry veterans, Rachel Wright, CPA and founder of Verdant Strategies and 420 CPA, and Seth Yakatan, founder of Katan Associates International, offered candid, unfiltered perspectives on what’s really happening behind the scenes. Wright, one of the earliest CPAs to specialize in cannabis, works closely with operators navigating complex tax rules, compliance and expansion. Yakatan, a fixture in capital markets and early-stage investing, has guided dozens of companies through growth, collapse and realignment.

They’re still standing. And they’re not sugarcoating anything.

From Chaos To Compliance: ‘We Actually Have Banking Now’

When Wright first started working in cannabis more than a decade ago, most businesses didn’t have books — or if they did, they were a mess.

“We would have to essentially create books for people based on information that we had — POS systems, if they had a cash ledger, things like that,” she said. “Fast forward a few years, now we actually do have banking… we also have real legit payroll companies that are supporting the industry.”

The maturation of professional services, from accounting to legal support, is helping operators run cleaner, more efficient businesses. But Wright says success still hinges on who’s in charge.

“Sometimes the founders need to step aside and hire the professionals,” she said. “And let the professionals do what the professionals do.”

Operational discipline isn’t optional anymore. She cited price compression across all markets as one of the biggest threats, especially in newer states like New York, where companies don’t get a long runway before margin pressure kicks in. “You have to learn how to operate a real business. Data is key. Cash is king. Managing that is really, really key.”

Over the last 12 months, Wright says her firm helped save cannabis clients more than $50 million through tax amendments and audit work. And despite years of industry lobbying to eliminate Section 280E of the federal tax code, she doesn’t see it as a death sentence.

“I think 280E is navigable,” she said. “I don’t see it as much of a problem — and not as much of a motivation to reschedule.”

‘If The Government Gives, It’s Going To Take Away’

That last point surprised many attendees. While most operators have called for federal rescheduling to fix 280E burdens, Wright takes a contrarian stance.

“I want to preserve the small and medium-sized businesses. We don’t want 7-Elevens carrying cannabis,” she said. “I like to preserve the culture — the people who’ve been in this industry for a long time.”

For Wright, rescheduling isn’t a guaranteed win. It’s a trade-off.

“If the government gives, it’s going to take away,” she warned. “It’s not going to give a free carrot to us at all. It’s going to come with a price.”

That price, in her view, could be new excise taxes that ultimately harm small businesses more than 280E ever did.

‘Don’t Believe The Hype’: Yakatan On Capital, THCA And Europe

Seth Yakatan didn’t mince words either.

“You’re at a really tough spot in the industry,” he said. “The models that were underwritten… haven’t largely worked. Or some of them haven’t worked.”

For existing operators, his advice is simple: “Go in and dominate the markets you’re in and hold serve.”

For new investors? Proceed with caution.

“I’m telling them to analyze each macro state-level economy that they’re looking at,” he said. “Base your future investment judgment on historical survival performance.”

When asked about hemp-derived THCA products, a booming but controversial segment, Yakatan was blunt:

“Don’t believe the hype. Cannabis and hemp are not markets for tourists. Stay out if you’re not in. And if you’re in, you know what you know.”

Hype vs. Reality: Where The Smart Money’s Looking

Yakatan says there’s still opportunity, especially in private lower-middle market companies with functioning models, but it’s no longer a race for scale.

“It’s a game of pennies now,” he said. “Pennies add up.”

On the product side, he flagged one trend that’s both overhyped and legitimate: infused pre-rolls. Brands like Jeter, Stiiizy and Aura are dominating SKU velocity, and two-gram disposable vapes are next.

“In markets where they’re not [common], they’re going to come,” he said.

Wright echoed the importance of staying agile across geographies, product verticals and structure. Whether asset-light or asset-heavy, she said, the best strategy depends on the market.

“We need to evolve geographically, product, service offering, verticals,” she said. “In some states, you might want to go asset-heavy. In others, you might want to go asset-light and just get your brand out.”

Both Wright and Yakatan acknowledged the pull of international markets, especially Europe. Yakatan called Germany’s rollout “part of the ‘soup du jour’ in news cycles,” and cautioned that many U.S. companies are using European hype to distract from domestic struggles.

“Seven of the 30 largest U.S. cannabis companies have a European operation story that’s masking other issues inside the business,” he said.

Wright, on the other hand, is already active in Europe and says her international tax background made it a natural next step.

“I was ecstatic,” she said of cannabis expanding in Europe. “I started planting seeds, getting to know people — movers and shakers — that are already there.”

The Bottom Line: Run A Real Business

Wright and Yakatan may operate in different parts of the cannabis economy, but their core message is the same: survive by getting serious.

No shortcuts. No saviors. Just smart, lean, experienced leadership.

“Where I see people failing,” said Wright, “is in efficiencies, staffing, leadership team, a full business plan… It’s really just like running a business. It’s the fundamentals at the end of the day.”

Photo: Shutterstock

In September 2024, Aurora Cannabis Inc (NASDAQ:ACB) launched a CBD lozenge in collaboration with Vectura Fertin Pharma (now Aspeya, Inc.), a pharmaceutical firm owned by Philip Morris International (NYSE:PM). The dissolvable product, branded Luo, debuted on Aurora’s medical platform in Canada.

To some observers, it looked like a stealth alignment between cannabis and Big Tobacco. But according to Aurora CEO Miguel Martin, the story is more nuanced.

“Our relationship really is with Vectura Fertin,” said Martin, noting the company now goes by the name Aspeya. “It’s a broader health and wellness company, and it’s really not so much with PMI, even though they have their own connection.”

Aurora’s strategy, he says, is grounded in medical science, not brand crossovers.

“We have always had a very conservative, pharmaceutically minded approach,” Martin told Benzinga. “To be able to partner with someone with [Vectura’s] history, and particularly the technology they were bringing to ingestible cannabinoids, was exciting for us.”

The companies launched the Luo lozenge in Canada as a physician-authorized product for patients seeking controlled CBD delivery. Aurora handles distribution through its direct-to-patient ecommerce platform. Martin said the partnership has been well-received and could expand in the future.

“This is really about learning and understanding… how that kind of science-based, medical approach is received. And it’s been very well received,” he said. “Our patients have enjoyed them. Hopefully, there’s opportunity for other brand extensions.”

Also read: World’s Largest Tobacco Company Is Investing In Medical Cannabis: Here’s What To Know

When asked whether this represented a deeper alignment with legacy industries, Martin was clear:

“Right now, it’s about partnering and working with thoughtful, science-based, medically oriented companies,” he said.

Aurora has similar relationships with prescribers, wholesalers and pharmaceutical partners across markets like Germany, Australia and the UK.

A Pharma-First Cannabis Strategy

The Luo lozenge deal, combined with Aurora’s global medical push and Canada-first manufacturing strategy, fits into a broader vision Martin has reinforced consistently: that cannabis should follow pharmaceutical norms—from delivery methods to regulatory rigor.

Also read: Zyn Changed Nicotine Forever – Are Cannabis Pouches The Next Big Thing?

“We’re experts in medical cannabis,” he said. “That’s where all of our profitability comes from. If a partnership helps us improve patient outcomes and deliver consistency, we’re open to it.”

For now, that means dissolvable CBD lozenges backed by pharma-grade R&D. Whether future deals bring Aurora closer to companies like PMI remains to be seen. But Martin insists the priority is patients, not optics.

“If it wasn’t additive or accretive to our financials, we wouldn’t do it,” he said. “We don’t chase headlines—we build around what works.”

Photo: Shutterstock

Editor’s note: This article has been updated to reflect the accurate percentage of the German population participating in the medical cannabis market.

Shares of Aurora Cannabis Inc (NASDAQ:ACB) fell roughly 20% on Wednesday following the company’s fiscal Q4 and full-year 2025 earnings report, even after reporting record-high medical cannabis revenue, adjusted EBITDA and positive free cash flow.

But CEO Miguel Martin isn’t sweating the reaction.

“It was record earnings, record EBITDA, record free cash flow for the year,” Martin told Benzinga. “Given the totality of the year and the quarter we put forth, I think it’s a bit of an overreaction, but I understand it. I know people are sensitive.”

A Temporary Dip, Not a Trend

The company forecasted a short-term dip in international cannabis sales for the current quarter. Some investors seized on that detail, sending the stock lower.

“All [the guidance] said was that Q1 was going to be a little bit less in revenue and EBITDA connected to international cannabis than Q4,” Martin explained. “We expect it to come back in Q2. We expect to be free cash flow positive for Q1 and for the year.”

That Q1 softness, he added, is tied to short-term challenges in two of Aurora’s core international markets.

“In Poland, it’s about the regulatory process for patients to get prescriptions. In the UK, we had a little bit of timing as we brought on some new distributors,” Martin said. “We think both will normalize, and neither should have an impact outside of Q1.”

Focused On Medical, Not Chasing Recreational

Medical cannabis accounted for 75% of Aurora’s Q4 revenue and nearly 90% of its gross profit.

“All of the profitability comes from medical cannabis and our investment in Bevo,” Martin said, referring to the company’s non-cannabis plant propagation business. “Our expertise and history is in medical cannabis.”

Aurora still operates in Canada’s adult-use market, but Martin made it clear that the segment is a small piece of the puzzle.

“Its purpose is to learn and innovate and get insights. We’ve right-sized it for us as we focus on profitability and growth. Right now, there are no plans to phase it out.”

Aurora also exited its Uruguay operations last year. Martin said the decision came down to commercial reality, not regulatory disappointment.

Also read: Legal Cannabis, 10 Years Later: Real Data From The First Country To Do It

“We thought there’d be opportunities to produce in Uruguay and then sell in Brazil. Unfortunately, with THC, it became challenging to certify and sell those products. It just didn’t work out for us.”

Growing International Markets

More than 60% of Aurora’s medical cannabis revenue now comes from outside Canada. Martin said that global growth will continue in familiar markets.

“Germany has roughly 0.4% of the adult population in the medical cannabis system. Canada’s got 1%. So there’s plenty of upside there,” he told Benzinga. “In the next 12 months, it’s going to be focused on increasing our market share in those locations.”

While Aurora does operate a GMP-certified facility in Germany, Martin said most production remains centered in Canada.

“Because these are pharmaceutical products, we believe that the vast majority of our products sold globally will be produced in Canada.”

The Bevo Bet

Aurora’s Bevo Farms unit posted 32% year-over-year growth, and Martin highlighted a new revenue stream: orchids.

“We think Bevo will continue to be profitable and support what we’re trying to do. It’s a wonderful adjacency for us, even if it’s not in the cannabis business,” he said.

Martin emphasized that profitability—not brand synergy—is what drives investment decisions.

“If it wasn’t profitable or accretive to our financials, we wouldn’t have done it.”

The Real Risk

“The biggest risk is perception,” Martin said. “Five years ago, people had big expectations for cannabis and they didn’t materialize. Now it’s hard for people to differentiate companies. Today, there are only a handful of companies that are free cash flow positive, have no debt and have a real strong growth trajectory, and we’re one of them.”

He also pointed to timing and policy volatility as ongoing challenges.

“We’re not seeing markets close or places legalize and then undo that. We’re talking about big economies here. Medical cannabis is profitable and it’s growing. And if you believe in it, Aurora should be a pick,” Martin concluded.

Photo: Shutterstock

Telomir Pharmaceuticals Inc. (NASDAQ:TELO) on Wednesday announced new preclinical data showing that its lead candidate, Telomir-1, prevented cellular aging in human progeria cell lines obtained from the Progeria Research Foundation.

In this study, conducted by Smart Assays, Telomir-1 was tested in cells taken directly from a child with HGPS.

The study evaluated cell viability, reactive oxygen species (ROS), and intracellular calcium signaling—a marker of mitochondrial dysfunction—under normal and stress-induced conditions.

Also Read: EXCLUSIVE: Telomir Pharma To Raise $3 Million Via Equity Financing To Fund Its Rare Disease IND

Key preclinical findings

Telomir-1 increased survival in a dose-dependent manner, both under basal conditions and even under stress conditions induced by copper and iron—two metal ions known to accelerate aging by generating oxidative damage and destabilizing DNA and telomeres.

Progeria cells exhibited abnormally high levels of reactive oxygen species (ROS), a hallmark of cellular aging. Telomir-1 normalized these levels under basal conditions and even when ROS was further elevated by toxic metal exposure.

Iron-induced calcium overload—a signal of mitochondrial damage and a known feature of HGPS—was significantly reduced with Telomir-1, indicating restored mitochondrial regulation and improved cellular energy balance.

Why It Matters

Progeria, or Hutchinson-Gilford Progeria Syndrome (HGPS), is an ultra-rare pediatric disorder caused by a mutation in the LMNA gene. This mutation produces an abnormal progerin protein, which drives rapid biological aging in children.

The only FDA-approved therapy for progeria, Zokinvy (lonafarnib), is a farnesyltransferase inhibitor that has been shown to extend lifespan by an average of 4.3 years.

The company says that Zokinvy does not reverse the underlying disease pathology or halt cardiovascular deterioration, which remains the leading cause of death.

Telomir-1 is designed to regulate intracellular metal ions, reduce oxidative stress, restore mitochondrial function, extend telomere length, reverse muscle loss, and reset age-associated DNA methylation patterns—critical biological pathways implicated in progeria and broader age-related diseases.

The new data also build on previously reported studies in zebrafish and C. elegans nematodes harboring the wrn gene mutation (a model of adult progeria, or Werner syndrome), where Telomir-1 significantly extended lifespan, restored telomere length, reversed muscle degeneration, and normalized molecular age markers.

Telomir is currently finalizing IND-enabling studies for Telomir-1 and plans to engage with the U.S. Food and Drug Administration (FDA) to explore regulatory pathways, including the potential for orphan drug designation. The company is evaluating multiple rare disease indications for initial clinical development.

Price Action: TELO stock traded higher by 2.69% to $1.91 premarket at the last check on Wednesday.

Read Next:

Photo by Gorodenkoff via Shutterstock

Intelligent Bio Solutions Inc. (NASDAQ:INBS) on Wednesday announced that Managed Waste Service plans to implement INBS’ Intelligent Fingerprinting Drug Screening System across its New South Wales operations, including its land clearing and green waste processing sites.

Managed Waste Service is an Australia-based waste management provider.

The decision marks Managed Waste Service’s first move into in-house drug testing across multiple locations. More than 20 sites are engaged in remote testing operations.

Managed Waste Service plans to conduct pre-employment, random, and for-cause testing on-site, giving operational teams complete control over safety processes without the disruption associated with traditional outsourced models.

Also Read: EXCLUSIVE: Intelligent Bio Solutions Q3 Gross Profit Jumps By 91%

Why It Matters

The Intelligent Fingerprinting Drug Screening System offers a quick, noninvasive method of screening for recent drug use through fingerprint sweat analysis, delivering results in under ten minutes.

Intelligent Bio Solutions’ technology enables Managed Waste Service to implement a scalable, portable solution that aligns with the nature of their fieldwork, whether testing at a remote clearing site or managing compliance across several waste facilities simultaneously.

This implementation reflects Intelligent Bio Solutions’ continued expansion into safety-critical industries, with environmental services now joining a growing portfolio of sectors adopting sweat-based drug testing.

Intelligent Bio Solutions provides drug testing.

Over 450 organizations in 24 countries use its technology to streamline and simplify workplace testing.

In June, SMARTOX, a U.S.-based provider of drug and alcohol testing products and services, said it deployed over 50 Intelligent Fingerprinting Drug Screening Readers and facilitated over 7,000 screening tests, including over 1,500 tests in 2024 alone.

As adoption grows in the U.S. Forensic Use Only market, Intelligent Bio continues to actively pursue FDA clearance for its opiate test system for codeine.

This effort aims to enable expansion into broader U.S. markets this year, including workplace drug testing, using its innovative fingerprint sweat-based testing technology.

Price Action: INBS stock is up 1.55% at $1.96 during the premarket session at the last check on Wednesday.

Read Next:

Apple Inc. (NASDAQ:AAPL) has been logging a majority of revenue declines over the past few quarters – unusual for a company long viewed as a flagship growth stock. But for investors still expecting explosive upside from Cupertino, it may be time for a portfolio recalibration.

Despite the iPhone maker’s premium brand equity and robust ecosystem, the “growth” narrative around Apple is increasingly misplaced, says analyst Sandeep Rao of Leverage Shares in exclusive comments shared with Benzinga via email.

Apple Revenue Growth, Innovation Slowing

The company’s latest net sales trend shows just a 12% year-over-year increase – a figure that barely keeps pace with inflation. When adjusted for price hikes, actual unit growth appears stagnant.

Worse, innovation seems to be slowing. Apple’s product lineup, while polished, lacks the wow factor or competitive edge needed to convert new users in droves. Unlike the Android universe, which offers a range of devices at multiple price points, Apple’s model seems geared toward retention – not aggressive expansion.

With little in the way of AI leadership and a Services segment facing margin pressure (more on that in a moment), Rao says, “Apple is better understood as a ‘value’ stock instead of a ‘growth” stock.’” And that’s not necessarily a bad thing.

For dividend-driven investors, Apple may be carving out a new niche. While its 0.5% yield pales in comparison to energy giants, it beats peers like Nvidia Corp (NASDAQ:NVDA). And its global consumer base and strong balance sheet position it as a potential bellwether for economic stability.

If you’re seeking the next breakout tech name, Apple may no longer fit the bill. But for those seeking stability and modest income, it might just be settling into a new, quieter kind of greatness.

Read Next:

Photo: Shutterstock

President Donald Trump has proposed giving parents $1,000 to invest for their children at birth. A Benzinga reader poll asks which of the Magnificent 7 stocks parents should consider buying and holding for 18 years under the new plan.

What Happened: Trump’s plan for $1,000 investment accounts for parents of newborns could give them a head start on investing in mutual funds, ETFs, and individual stocks, including fast-growing names like the Magnificent Seven stocks.

Benzinga recently asked readers which Mag 7 stock they would invest the $1,000 in.

“Under Trump’s $1,000 baby investment plan, which Mag 7 stock would you invest the money in for the best 18-year return?” Benzing asked.

The results were:

- NVIDIA Corporation (NASDAQ:NVDA): 21%

- Apple Inc (NASDAQ:AAPL): 17%

- Alphabet Inc (NASDAQ:GOOG)(NASDAQ:GOOGL): 14%

- Meta Platforms (NASDAQ:META): 14%

- Amazon.com Inc (NASDAQ:AMZN): 12%

- Microsoft Corporation (NASDAQ:MSFT): 12%

- Tesla Inc (NASDAQ:TSLA): 10%

The winner of the poll was Nvidia with 21% of readers picking this stock as the one they would invest in and hold for the next 18 years to add wealth to their children’s investment account. Apple was a close second at 17%, with Alphabet and Meta tied for third at 14%.

Tesla ranked last in the poll of the Mag 7 stocks with 10% of the vote, while Microsoft and Amazon tied for fifth with 12%.

Did You Know?

- Congress Is Making Huge Investments. Get Tips On What They Bought And Sold With Our Easy-to-Use Tool

Why It’s Important: Trump’s plan for $1,000 investment accounts could have a bullish impact on the stock markets as it would create consistent new investment sources for top stocks and ETFs with every child born between Jan. 1, 2025 (retroactively) and Jan. 1, 2029

Parents could be faced with the tough choice of investing in a broad market fund like the SPDR S&P 500 ETF Trust (NYSE:SPY) that produces annual returns of 10% to 12% or to be more aggressive and pick some growth stocks.

Choosing just one Magnificent 7 stock is probablyn’t the best recommendation as it would provide less diversification and be high-risk, high-reward.

A look at past returns shows the Mag 7 stocks have been high performers and outperformed the market. Here are the five-year returns:

- Apple: +126.6%

- Alphabet: +147.4%

- Amazon: +61.7%

- Microsoft: +145.0%

- Meta: +193.6%

- Nvidia: +1,466.5%

- Tesla: +392.4%

All of these stocks, except for Amazon, outperformed the five-year gain of 95.1% for the SPY.

For those looking for diversification between the Mag 7 stocks, the Roundill Magnificent Seven ETF (BATS:MAGS) offers exposure to all seven stocks.

If the investing accounts idea goes through, it would be interesting to see if any parents publicly track the holdings and their performance over an 18-year time frame.

Read Next:

- EXCLUSIVE: S&P 500 To Hit New All-Time Highs Again In 2025? Majority Say Yes, 27% Predict This Range

The study was conducted by Benzinga from June 13, 2025, through June 16, 2025. It included the responses of a diverse population of adults 18 or older. Opting into the survey was completely voluntary, with no incentives offered to potential respondents. The study reflects results from 170 adults.

Photo: Shutterstock

Christopher Perkins, President of CoinFund and a former Wall Street executive, believes the next chapter of crypto adoption hinges on clarity—regulatory, technological, and strategic.

In an interview with Benzinga, Perkins discussed everything from AI-powered networks to staking yields, tokenized fund structures, and Washington’s evolving stance on digital assets.

At the heart of Perkins’ long-term thesis is a commitment to fundamentals over hype.

When asked about the investability of AI-token and DePIN projects, he was blunt: “We don’t like to invest on narrative. We like to invest on fundamentals.”

CoinFund has made numerous bets in the space.

“It’s all about utility. It’s all about understanding the value that is derived from that utility,” he said, pointing to examples like autonomous lawn robots powered by hyper-precise location data from DePIN networks.

Perkins is no stranger to regulatory entanglements.

A former managing director at Citi during the Dodd-Frank era, he learned early on that “you can’t win the game if you don’t know the rules.”

Today, he sees the absence of a clear taxonomy, particularly around what constitutes a security versus a commodity, as the biggest hurdle to U.S. innovation.

“What we’re confronted with right now… is glitter clarity,” he said, referring to the SEC’s ambiguity under former chair Gary Gensler.

Perkins remains optimistic about the new administration, describing the approach under President Donald Trump and current congressional leaders as “principled” and “coordinated.”

Stablecoins, in his view, are on the verge of a breakout.

With a Senate vote on stablecoin legislation expected soon, Perkins pointed to growing interest from the U.S. Treasury and traditional finance institutions.

“Today, we’re at $250 billion in stablecoin market cap. That could expand to $2 trillion, according to the Treasury.” For DeFi, this capital influx could be transformative.

“There’s no yield today. Guess what? That’s a depreciating asset unless you find yield… and those agents, those AIs that are now coming on the scene, are going to help optimize that.”

On staking, Perkins sees parallels between proof-of-stake layer-1s and traditional finance benchmarks.

Also Read: Bitcoin, Ethereum Lead $1.9 Billion Digital Asset Inflows Amid Global Tensions, CoinShares Finds

“Every single layer-1… has a benchmark rate. That rate can unleash an entire array of fixed-income products.”

While most retail users focus on price action, institutions are eyeing yield curves and staking-derived returns as the next structured product opportunity.

Perkins is also enthusiastic about tokenization, calling it crypto’s “secret power of capital formation.”

He noted that the meme coin market reached $40 billion last year, compared to just $30 billion for the entire venture capital market.

“Anyone with an internet connection around the world can access these asset classes,” he said. With minor regulatory assistance, tokenized fund structures could democratize exposure to previously inaccessible public markets.

Asked about the future of blockchain architecture, Perkins avoids binary arguments. “We’re not monolithic versus modular maxis,” he explained.

While institutions tend to prefer modular ecosystems for control and customization, monolithic chains like Solana continue to deliver high-throughput applications that are difficult to ignore.

Perkins also addressed growing interest from retail giants in consumer-facing stablecoins.

“Walmart and Amazon are talking about launching one. The banks are watching… it’s going to be a battle for distribution.”

On regulation, Perkins applauded recent efforts by the CFTC and the SEC’s crypto task force to engage meaningfully with DeFi experts.

“The very act of understanding informs policy. Hopefully we get to a place where we clarify what is decentralized, what is not, and how it’s regulated.”

Perkins says founder quality is his north star.

“We invest in the strongest of founders across every single vertical,” stressing that CoinFund’s thesis rests on one principle: find the value, not just the hype.

Read Next:

Image created using artificial intelligence via Midjourney.

The SPDR S&P 500 ETF Trust (NYSE:SPY) slipped Friday amid rising tensions between Israel and Iran, but Benzinga readers remain bullish, predicting new all-time highs later this year.

What Happened: The SPDR S&P 500 ETF Trust reached 57 new all-time highs in 2024 and several so far in 2025, helped in part by optimism for a new White House administration.

The ETF hit a high of $613.23 on Feb. 19 before closing at $612.93 for the day. Since then, the ETF has gotten back over $600 several times including recently on June 11 when it hit an intraday high of 605.06.

Benzinga recently asked readers to predict if the ETF, which tracks the S&P 500 Index, will hit new highs again this year.

“The SPDR S&P 500 SPY Trust hit an all-time high in February. Do you think it can set a fresh high this year?” Benzinga asked.

The results were:

- SPY will hit $613.24 to $625.00: 27%

- SPY will hit $640.01 to $655.00: 23%

- SPY will hit $625.01 to $640.00: 21%

- SPY has already topped $613.23: 13%

- SPY will hit $670.01+: 10%

- SPY will hit $655.01 to $670.00: 7%

The poll found that a majority of readers believe the S&P 500 is going to hit new all-time highs later this year. The top vote getter was the $613.24 to $625.00 range at 27%, which would see the SPY just setting new highs and trading up around 2.3% to 4.3% higher than the ETF currently trades.

The next highest vote-getter was the $640.01 to $655.00 range, which represents a 6.8% to 9.3% increase from current ranges.

Ultimately, 88% said the SPY will set new all-time highs with 13% saying the ETF has already topped for the year (the numbers don’t add up to 100% due to rounding).

Read Also: EXCLUSIVE: Should Fed Chair Powell Resign? Here’s What Benzinga Readers Said

Why It’s Important: The lowest vote totals were the SPY hitting $670.01 or more and hitting the $655.01 to $670.00 range, which shows that investors are optimistic for new all-time highs, but not as high as these potential ranges.

A similar result was found when Benzinga recently asked about Bitcoin hitting new all-time highs this year.

The leading vote getters were ranges closest to the existing all-time high figure, while overly optimistic price targets got low percentages of votes in that poll.

The main difference is in that poll, Bitcoin already hitting the highest price for 2025 ranked last among five options with 14% of the vote.

Tariffs, macroeconomic concerns and now increased global tensions are all factors that will likely weigh into whether the SPY and Bitcoin hit new all-time highs in 2025.

Read Next:

The study was conducted by Benzinga from June 10, 2025, through June 13, 2025. It included the responses of a diverse population of adults 18 or older. Opting into the survey was completely voluntary, with no incentives offered to potential respondents. The study reflects results from 111 adults.

Image: Shutterstock

At last week’s Benzinga Cannabis Capital Conference in Chicago, Vladimir Bautista, co-founder and CEO of Happy Munkey, was named the recipient of this year’s Bob Fireman Award for Entrepreneurship, an annual recognition presented by MariMed Inc. (OTC:MRMD) to leaders who exemplify integrity, impact, and community commitment in the cannabis space.

The award, now in its third year, honors the legacy of the late Bob Fireman, co-founder and CEO of MariMed, who passed away in December 2022. Fireman was a pioneer of the legal cannabis movement and a lifelong civil rights advocate, beginning his activism in the 1960s. The accolade is meant to recognize cannabis executives who not only succeed in business but also champion social progress.

“Bob was an entrepreneur through and through, but he was also a passionate advocate for the legalization of cannabis and righting the wrongs of the War on Drugs,” said Howard Schacter, chief communications officer at MariMed, in an exclusive statement to Benzinga. “He’d be proud that we’re presenting this year’s award to Vlad, who has built a successful cannabis business while also using his platform to advocate for change in policies and his community.”

From Harlem Legacy To Legal Leader

Bautista, a New York City native raised in Sugar Hill, Harlem, began his journey in cannabis in the legacy market well before New York’s legalization framework emerged. With his team at Happy Munkey, he helped transform underground culture into above-ground opportunity, launching a lifestyle brand, hosting widely acclaimed cannabis events and eventually opening licensed dispensaries in Uptown Manhattan and Downtown Brooklyn.

On receiving the award, Bautista shared a powerful message on LinkedIn:

“I didn’t take the traditional path to entrepreneurship. My journey started in the legacy market, in a world where people who looked like me were criminalized—not celebrated—for their connection to this plant,” he wrote. “This award isn’t just for me. It’s for those who died, who were incarcerated, who were deported. It’s for the legacy pioneers who laid the foundation and were never given the credit. It’s for the culture that raised me and the communities still fighting for their seat at the table.”

Bautista also praised his partners Omar, Jay and Ramon Reyes, his investor Matt, and the broader Latino community. “Y para todos los Latinos del mundo: esto también es para ustedes [For all Latinos in the world: this is also for you]. We’re not just participants in this industry. We are the reason it exists.”

Carrying The Torch

Previous honorees of the Bob Fireman Award include Loriel Alegrete, CEO of 40 Tons, who was recognized in 2024 for her work combining cannabis entrepreneurship with restorative justice efforts.

Bautista’s win reflects a broader shift in the industry, which increasingly acknowledges the importance of legacy voices, immigrant roots, and community-based leadership in shaping the future of legal cannabis.

MariMed executives presented the award onstage at the conference in front of hundreds of industry leaders, investors and policymakers, marking one of the event’s emotional high points.

Photo: Benzinga

Each week, Benzinga’s Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here’s a look at the Benzinga Stock Whisper Index for the week ending June 13:

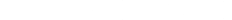

Intuit Inc (NASDAQ:INTU): The owner of TurboTax and other financial products saw strong interest from investors during the week. The company saw Wells Fargo maintain an Overweight rating and raise the price target from $825 to $880. Intuit stock trades near all-time highs and has been gaining momentum since third-quarter results in May. The company beat analyst estimates for both revenue and earnings per share in the quarter. Analysts raised their price targets back in May with Wells Fargo latest note signaling more confidence in the company. Intuit’s Mailchimp also unveiled a new set of tools at FWD: London during the week, which may create optimism for the potential of this segment.

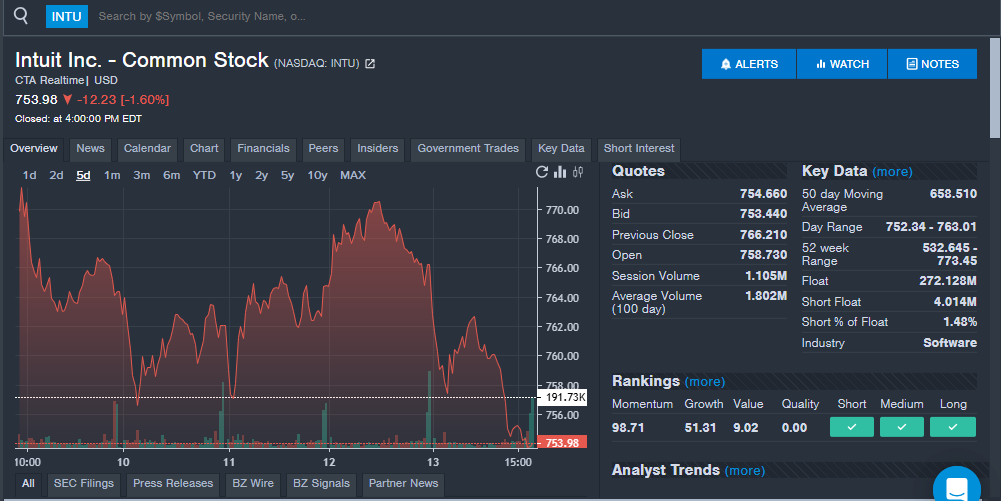

Casella Waste Systems (NASDAQ:CWST): The solid waste removal company returns to the Stock Whisper Index with shares near all-time highs. Casella previously appeared on the list in April ahead of first-quarter financial results. A stock like Casella could be attracting investors given the mostly recession proof element of the sector and as part of an industry that could avoid tariffs. The company recently announced it will ring the Opening Bell at the Nasdaq on Tuesday, June 17, which could keep the stock in the spotlight next week.

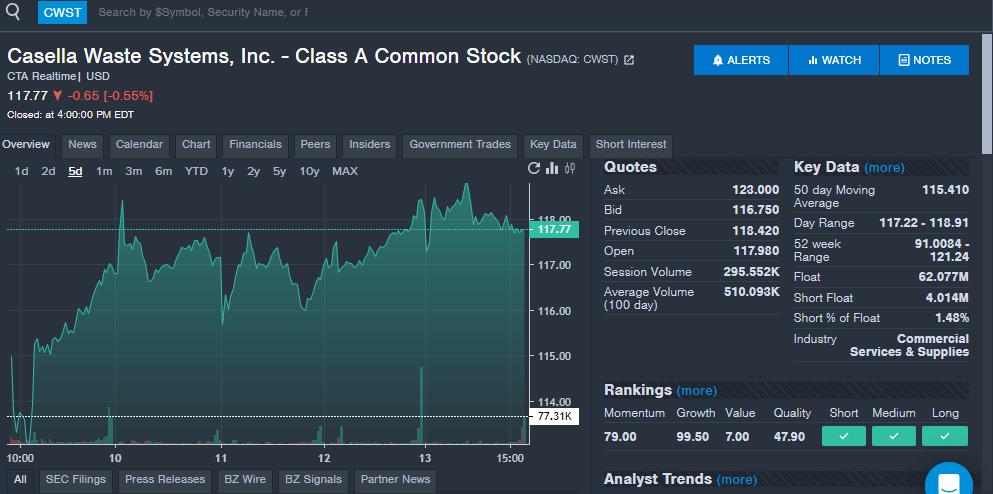

Carpenter Technology Corporation (NYSE:CRS): The specialty metals company saw increased interest from readers during the week. The company reported third-quarter results in April with earnings per share beating estimates for a fifth straight quarter, while revenue came in shy of analyst estimates. Shares near all-time highs and are up over 45% year-to-date. The company received several analyst notes in recent weeks with BTIG maintaining a Buy rating and raising the price target from $255 to $275 and Benchmark maintaining a Buy rating and raising the price target from $250 to $300.

Wheaton Precious Metals Corporation (NYSE:WPM): Gold mining stocks have dominated the Stock Whisper Index in recent weeks and this week its Wheaton Precious Metals seeing strong interest from readers as the stock trades near all-time highs. The price of gold has soared in recent weeks and silver hit a new 12-year high. In May, Wheaton Precious Metals beat earnings per share and revenue estimates from analysts. Gold and silver related stocks are likely to see continued strong interest going forward even ones like Wheaton that are near all-time highs.

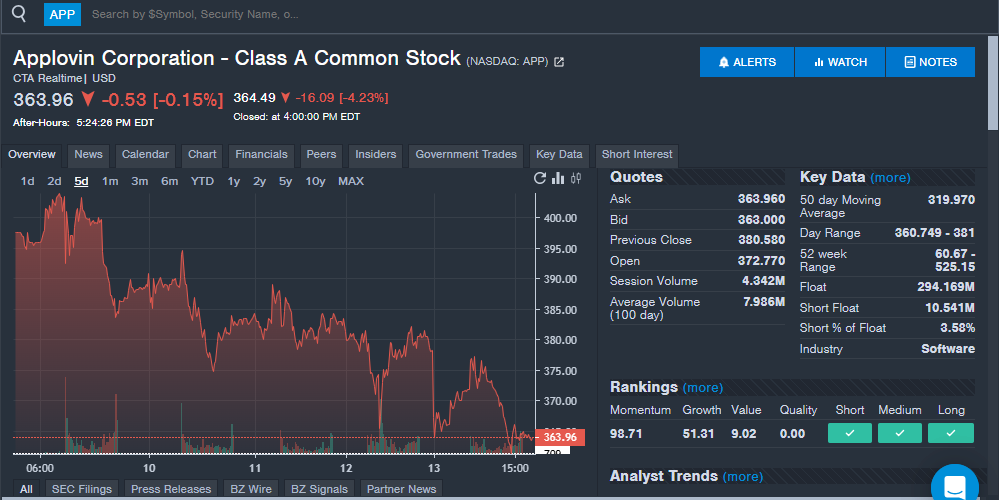

Applovin Corporation (NASDAQ:APP): The mobile technology company saw increased interest thanks to analyst investor notes and a new short report. Applovin has been the subject of multiple short reports in recent years and this time around it was Culper Research alleging the company poses national security risks due to ties to China. Culper said Applovin CEO Adam Foroughi has denied the company has Chinese ownership or operational ties to China, but the short seller is skeptical and said Chinese national Hao Tang has backed the company since at least 2017. Culper put out a short report on AppLovin in February previously Muddy Waters and Fuzzy Panda Research are other companies with short reports on the company. The company recently beat analyst estimates for revenue and earnings per share in the first quarter. Despite the short reports, analysts have remained mostly in support of the company. JPMorgan recently maintained a Neutral rating on the stock, but raised the price target from $355 to $400. Morgan Stanley maintained an Overweight rating on the stock and raised the price target from $420 to $460. Applovin shares were down 9% during the week, but the stock remains up over 12% year-to-date and up over 300% in the last year.

Stay tuned for next week’s report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next:

Toppoint Holdings Inc. (NYSE:TOPP) on Wednesday announced that it has signed a memorandum of understanding with the Municipalidad Distrital de Chancay in Peru, marking the beginning of a collaboration to overhaul the area’s waste management system. The financial terms of the MoU were not disclosed.

With Chancay’s mega port construction fueling a sharp rise in construction waste, the deal targets sustainable solutions to meet growing environmental challenges.

Toppoint Holdings CEO Leo Chan and Chancay Mayor Juan Alberto Alvarez Andrade signed an MoU to create a joint framework for designing a modern waste management system tailored to the region’s expanding residential and industrial sectors.

Also Read: JPMorgan Dials Back Saia Expectations After ‘Shocking’ Q1, Weak May Tonnage

The collaboration aims to tackle rising construction and industrial waste by assessing the feasibility of a new landfill, transfer station, and recycling initiatives while launching immediate studies and policy planning to attract strategic partners and sustainable investment.

“This partnership underscores Toppoint’s dedication to delivering sustainable infrastructure solutions in rapidly growing global markets,” said Leo Chan, CEO of Toppoint Holdings.

“Chancay is a region in the midst of profound transformation, and we understand the vital role that advanced waste management systems play in supporting its continued growth.”

Chancay, in Lima’s Huaral Province, is becoming a key logistics and trade center in South America, spurred by its new deep-water mega port. This rapid growth is driving urbanization and industrial activity, creating an urgent need for modern waste management solutions to support development and safeguard the environment.

In another deal signed in late May, Toppoint Holdings announced it had signed a strategic MOU with Guangzhou-based air cargo firm Jinyangcheng to explore joint air freight operations.

The partnership initially focused on cargo movement through JFK Airport, with plans to expand to major U.S. and international hubs. The agreement supported Toppoint’s global expansion strategy and strengthened its trans-Pacific logistics capabilities.

Price Action: TOPP shares closed 1.08% higher at $1.88 on Tuesday.

Read Next:

Photo via Company