Get in Touch

We love to help & we love to listen. Please fill out the form

below and we’ll get back to you within a day

Cognition Therapeutics Inc (NASDAQ:CGTX) rose 12.10% to $0.45 during after hours on Thursday, following a surge of 20.82% gain during regular hours.

What Happened: The hike in Cognition Therapeutics’ stock price is attributed to the promising results from its Alzheimer’s drug, Zervimesine. The drug achieved a 95% efficacy rate in its Phase 2 trial. The trial also reached a 50% enrollment milestone, further boosting investor confidence in the drug’s potential.

Why It Matters: The Alzheimer’s drug market has been a hotbed of activity recently. InMed Pharmaceuticals Inc. (NASDAQ:INM), for instance, experienced a sudden surge in its stock price after releasing new preclinical data demonstrating the potential of its therapeutic candidate for Alzheimer’s disease.

Price in Action: According to Benzinga Pro data, Cognition Therapeutics' stock rose 20.82% to $0.41 during regular trading, followed by an additional 12.10% gain to $0.45 in after-hours trading.

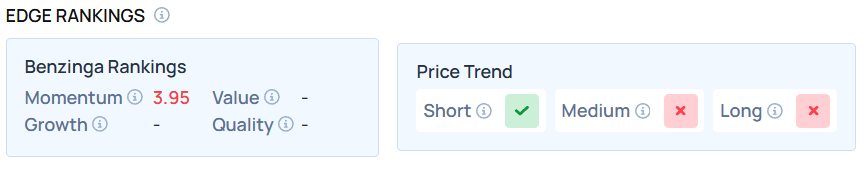

Benzinga's Edge Stock Rankings indicates Cognition Therapeutics has momentum in the 3rd percentile. For the complete picture on the stock, click here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: Martin Gregor on Shutterstock.com

Biotech

Jul 04, 2025La Rosa Holdings (NASDAQ:LRHC) stocks experienced a significant drop of 23.47% during after-hours trading on Thursday The drop follows the surge of 87.37%, which was the result of the company’s announcement of its first-half revenue for 2025

What Happened: The real estate company’s stock closed at $0.15 on July 3. However, it fell to $0.11 during after-hours trading. This represents a 23.47% decrease in value.

La Rosa Holdings, a real estate company, reported a revenue of $38.4 million for the first half of 2025, representing a 19.4% year-over-year growth. This announcement led to an 87% surge in the company’s stock, which closed at $0.15 on Thursday.

Why It Matters: La Rosa Holdings’ strategic decisions, such as the approval of a $500 thousand stock buyback plan in April, have also contributed to its positive market performance.

In July, the company’s shares soared after it reported a preliminary unaudited revenue of $38.4 million for the first half of 2025. This was a milestone for the company, which had also seen a 19.4% year-over-year growth.

Price in Action: According to Benzinga Pro data, closing at $0.15, La Rosa's stock surged 87.27% following strong revenue news. The dip of $0.11 in after-hours trading, reflects continued volatility.

Benzinga’s Edge Stock Rankings indicate strong value potential (40.29) of La Rosa's stock. Here is how the stock fares on other parameters.

Photo Courtesy: Who is Danny on Shutterstock.com

Read Next:

Equities

Jul 04, 2025Mark Cuban and Tesla Inc (NASDAQ:TSLA) CEO Elon Musk may not agree on everything these days, except, perhaps, the potential for a viable third political party. But one thing they do share is the number of people who admire them.

What Happened: Musk and Cuban are both examples of the entrepreneurial spirit that Americans can use to achieve great things through hard work and perseverance, such as creating businesses and becoming extremely wealthy.

While Musk and Cuban created companies in different sectors, they share several commonalities, such as rewarding loyal early employees and adopting a hands-on management style.

The similarities and success could be why Musk and Cuban scored so well in a recent Benzinga poll asking about who would be the best business mentor. The other options in the poll were NVIDIA Corporation (NASDAQ:NVDA) CEO Jensen Huang, Meta Platforms (NASDAQ:META) CEO Mark Zuckerberg and Amazon.com Inc founder Jeff Bezos.

"Of the following, who would you be most likely to pick as your business mentor?" Benzinga asked.

The results were:

The poll found that Musk was the top choice for a potential business mentor — a result likely tied to his reputation as the world's richest person and his relentless work ethic, which often involves sacrificing sleep to focus on his ventures.

Ranking second was Cuban with 30% of the vote. Cuban has been someone that investors and entrepreneurs have looked up to for years thanks to his appearances on "Shark Tank" and being very public with his ownership and running of the NBA's Dallas Mavericks.

Huang ranked third — a testament to the success he's achieved at Nvidia, the company he famously co-founded in a Denny's booth.

Zuckerberg and Bezos scored the lowest totals in the poll.

You may not be a billionaire like Mark Cuban, but you can uncover hidden gems in the stock market using our proprietary data and pattern recognition — check out five stocks flying under the radar that deserve your attention.

Why It's Important: Musk winning the poll isn't likely a surprise given the huge fandom he has thanks to leadership roles at Tesla, SpaceX, xAI and other companies. Musk is the most followed person on the social media platform X.

These days, Musk is often viewed as one of the best entrepreneurs and visionaries of the last 100 years. While some people may disagree with Musk politically or over ideals, they often respect the work he has done to forever change sectors like electric vehicles, clean energy and space exploration.

Cuban's role on "Shark Tank," which began in season 2 and recently came to an end, has helped him gain millions of fans worldwide and also led to him being one of the most loved sharks on the show.

A recent Benzinga poll found Cuban to be the favorite shark with 40% of the vote. Ironically, he also tied at 32% of the vote with Kevin O'Leary for the least favorite shark.

Similar to Musk, Cuban could be a person that many either hate or love, with no middle ground. Many love Cuban's approach on "Shark Tank" of making quick deals and not giving other sharks time to propose deals. Others likely think it hurts the integrity of the show.

Cuban could be ruthless on "Shark Tank," but also showed a human side, often with deals made for products he didn't know but his daughters did, and making investments in entrepreneurs with good stories and a hard work ethic.

The study was conducted by Benzinga from July 1, 2025, through July 3, 2025. It included the responses of a diverse population of adults 18 or older. Opting into the survey was completely voluntary, with no incentives offered to potential respondents. The study reflects results from 102 adults.

Read Next:

Image created using pictures from Shutterstock.

Education

Jul 03, 2025Earnings

Jul 03, 2025La Rosa Holdings (NASDAQ: LRHC) announced on Thursday that it had surpassed 3,000 real estate agents across its network.

The company also reported preliminary unaudited revenue of approximately $38.4 million for the first half of 2025, representing approximately 19.4% year-over-year growth.

Joe La Rosa, CEO of La Rosa, said the company’s flexible brokerage model consistently attracts top-producing agents by offering competitive compensation, including revenue share programs, a 100% commission option with low fees, and additional income opportunities through ancillary services and integrated technology solutions.

Also Read: La Rosa FY24 Revenue Jumps 119%, CEO Reiterates FY25 Topline Goal Of $100 Million

The company expects to file its full financial results for the fiscal second quarter of 2025 and the Form 10-Q with the SEC soon.

La Rosa stock plunged over 90% year-to-date. On April 16, La Rosa announced a $0.5 million stock buyback program. As of December 31, 2024, the company held cash and equivalents (including restricted cash) of $3.58 million.

Price Action: LRHC stock is down 11.10% at $0.0795 premarket at last check Thursday.

Read Next:

Earnings

Jul 03, 2025Each trading day features hundreds of headlines and press releases on Benzinga Pro, a source for traders to see the latest news on the overall market and individual tickers.

The 2025 year is half over with July now here, which is likely hard for many to believe. Here is a look at the most searched stocks on Benzinga Pro for the first half of 2025. Current prices and year-to-date performance are based on June 30 market close prices and do not include dividends.

1. SPDR S&P 500 ETF Trust (NYSE:SPY)

2. Tesla Inc (NASDAQ:TSLA)

3. NVIDIA Corporation (NASDAQ:NVDA)

4. Palantir Technologies (NASDAQ:PLTR)

5. Hims & Hers Health Inc (NYSE:HIMS)

6. UnitedHealth Group (NYSE:UNH)

7. CoreWeave Inc (NASDAQ:CRWV)

8. Super Micro Computer Inc (NASDAQ:SMCI)

9. Advanced Micro Devices (NASDAQ:AMD)

10. Oklo Inc (NYSE:OKLO)

Read Also: Nvidia Vs. Microsoft Vs. Apple: Which Stock Reaches $4 Trillion First?

Honorable Mentions: The following stocks were the 11th to 20th most-searched tickers on Benzinga Pro for the first six months of 2025.

11. Invesco QQQ Trust (NASDAQ:QQQ)

12. Apple Inc (NASDAQ:AAPL)

13. Amazon.com Inc (NASDAQ:AMZN)

14. Coinbase Global (NASDAQ:COIN)

15. Meta Platforms Inc (NASDAQ:META)

16. SharpLink Gaming (NASDAQ:SBET)

17. D-Wave Quantum (NYSE:QBTS)

18. Asset Entities (NASDAQ:ASST)

19. Circle Internet Group (NYSE:CRCL)

20. Pony AI (NASDAQ:PONY)

Why It's Important: The top 10 list for the first six months of 2025 looked similar to the month of June, with eight of the companies the same.

UnitedHealth Group, which has appeared in only one top 20 over the past three months, ranked sixth thanks to the strong interest in the ticker at the start of the year.

Super Micro Computer similarly ranked eighth for the first half of 2025 despite only a ninth place rank in April and not being in the top 20 in May or June. The stock was particularly popular during the first three months of the year.

If the top 10 holds steady for the rest of the year, the top three stocks would match the 2024 year, but in a different order. In 2024, it was Nvidia ranked first, followed by Tesla and the SPDR S&P 500 ETF Trust. The three stocks now rank in opposite order through the first six months of the year.

Outside of the top 10 there weren't many huge surprises with themes such as cryptocurrency, AI and quantum computing being strong in the first six months of 2025.

Apple ended the first half of the year ranked 12th, despite previously ranking in the top 10 in several months to start the year. Other Mag 7 stocks such as Amazon and Meta also ranked in the 11 to 20. Alphabet ranked just outside of the top 20 for the first half of the year at 22nd place. Nowhere to be found in the top 25 was Microsoft, a member of the Mag 7 and the second most valuable company in the world.

Stay tuned to Benzinga Pro for more market-moving news and to track the top tickers.

Read Next:

Long Ideas

Jul 02, 2025Prairie Operating Co (NASDAQ:PROP) on Wednesday announced the acquisition of certain assets from Edge Energy II LLC in an off-market transaction.

The transaction amount was $12.5 million in cash, funded through the company’s credit facility. This resulted in a non-dilutive transaction for shareholders.

Edward Kovalik, Chairman and CEO, said this strategic and highly accretive bolt-on acquisition enhances its footprint in the DJ Basin.

The Edge Energy acquisition represents a strategic addition of approximately 11,000 net acres, expanding Prairie’s DJ Basin footprint to approximately 60,000 net acres.

The attractive mix of current production and future development of the Edge Energy assets enhances Prairie’s inventory depth, accelerates near-term development plans, and supports continued cash flow growth, the company said.

The company plans to commence development of the acquired assets in August 2025, starting with the fully permitted Simpson pad. Simultaneously, the company will permit additional PUD locations to enable future development. This acquisition delivers immediate scale, existing production, and a clear path to growth through high-quality operated drilling inventory.

Prairie Operating held $14.97 million in cash and equivalents as of March 31, 2025, according to Benzinga Pro.

Price Action: PROP stock closed higher by 1.50% to $3.04 on Tuesday.

Read Next:

Image via Shutterstock

M&A

Jul 02, 2025M&A

Jul 02, 2025M&A

Jul 02, 2025Each trading day features hundreds of headlines and press releases on Benzinga Pro, a source for traders to see the latest news on the overall market and individual tickers.

Here is a look at the most searched stocks on Benzinga Pro for June 2025. Current prices and year-to-date performance are based on June 30 market close prices and do not include dividends.

1 SPDR S&P 500 ETF Trust (NYSE:SPY)

2. Tesla Inc (NASDAQ:TSLA)

3. NVIDIA Corp. (NASDAQ:NVDA)

4. Palantir Technologies Inc (NASDAQ:PLTR)

5. Circle Internet Group (NYSE:CRCL)

6. CoreWeave Inc (NASDAQ:CRWV)

7. Applied Digital Corporation (NASDAQ:APLD)

8. Hims & Hers Health Inc (NYSE:HIMS)

9. Advanced Micro Devices (NASDAQ:AMD)

10. Oklo Inc (NYSE:OKLO)

Did You Know?

Honorable Mentions: The following stocks were the 11th to 20th most-searched tickers on Benzinga Pro in June.

11. Klotho Neurosciences Inc (NASDAQ:KLTO)

12. Cyngn Inc (NASDAQ:CYN)

13. SharpLink Gaming Inc (NASDAQ:SBET)

14. Invesco QQQ Trust (NASDAQ:QQQ)

15. Coinbase Global Inc (NASDAQ:COIN)

16. Eyenovia Inc (NASDAQ:EYEN)

17. Robinhood Markets Inc (NASDAQ:HOOD)

18. Meta Platforms (NASDAQ:META)

19. Apple Inc (NASDAQ:AAPL)

20. SRM Entertainment Inc (NASDAQ:SRM)

Why It’s Important: The SPDR S&P 500 ETF Trust remained the most-searched ticker for a third straight month. Tesla moved back to second place for top searches after ranking fourth and third in the last two months, respectively.

Nvidia fell from second place to third, but kept a streak going of being one of the top three most-searched tickers each month in 2025.

New to the top 10 for June were Circle, CoreWeave, Applied Digital and Oklo. Circle was a new IPO in June and started its first month in fifth place. CoreWeave went public in March and after placing in 11th place in May, jumped to sixth place.

New IPOs have a history of being trending stocks for the first month or two and then dropping out of the top 20.

Advanced Micro Devices climbed back into the top 10 after ranking in the 11 to 20 range for several months.

Apple declined a lot in June, going from 10th to 19th place. This marks the first time Apple has been out of the top 10 since February.

Dropping out of the top 10 in June were UnitedHealth Group, Asset Entities, Super Micro Computer and D-Wave Quantum.

Cryptocurrency continued to be a popular trend with Coinbase and Robinhood ranking in the top 20 and several companies that have bought cryptocurrency or established a crypto asset reserve ranking in the top 20.

Stay tuned to Benzinga Pro for more market-moving news and to track the top tickers.

Read Next:

Photo: Shutterstock

Entertainment

Jul 01, 2025As Wall Street moves more and more into the retail crowd’s high-conviction, high-volatility trade appetites, Defiance ETFs is pushing it one step further: abandoning the basket and going straight for the bulls — and the bears.

Its latest creation is a series of single-stock leveraged ETFs that hone in on some of the riskiest, most speculative areas of the market: quantum computing, voice AI and next-gen nuclear power.

In an interview with Benzinga, Defiance ETFs CEO Sylvia Jablonski explained the reasoning behind this lineup — Defiance Daily Target 2X Short IONQ ETF (NASDAQ:IONZ), Defiance Daily Target 2X Long OKLO ETF (NASDAQ:OKLL) and Defiance Daily Target 2X Long SOUN ETF (NASDAQ:SOUX) — why she’s risking it all on early-stage innovation names and what retail traders need to know before diving into these hotshot funds.

The new ETFs provide 2X daily long and short exposure to three budding technology firms: IonQ Inc (NYSE:IONQ), a leader in quantum computing; SoundHound AI (NASDAQ:SOUN), a voice AI solutions company and Oklo Inc (NYSE:OKLO), a firm that specializes in designing small nuclear fission reactors.

As defined by Jablonski, the unifying thread is straightforward: “We selected these names because each represents a disruptive, early-stage technology with the potential to reshape major industries — nuclear energy, AI and quantum computing. These are high-conviction, high-volatility stories that align well with the goals of tactical traders seeking targeted exposure through 2X daily leverage.”

That is to say, they’re bespoke for individual investors who don’t wish to bet broadly, they wish to bet large and specifically.

Of the three, Oklo is arguably the riskiest move — pre-revenue still, new to the public through SPAC, as well as in an industry long beset by regulatory challenges and public distrust. Yet Jablonski has a different perspective.

“Oklo is pioneering next-gen nuclear fission with compact reactors designed for modern energy needs,” Jablonski replied, citing the company’s progress towards licensure, power purchase agreements, and endorsements from prominent supporters like Sam Altman.

Its volatility and binary milestone-based narrative render it “well-suited for a leveraged ETF structure,” particularly in a time when nuclear is receiving renewed attention due to the global energy crisis, decarbonization initiatives, and bipartisan political backing.

“Oklo is one of the most advanced players in the small modular reactor space. Its design is scalable, efficient, and aimed at off-grid and decentralized use cases,” Defiance said. “It's positioned as a first mover in what we see as a major inflection point for clean, dispatchable energy.”

At the other end of the speculative spectrum are IonQ and SoundHound AI, two firms banking on longer-term, but fast-converging, tech megatrends.

With IonQ, Defiance is providing what it deems the “Nvidia of quantum,” a public pure-play in a space with increasing institutional demand and deep-pocketed deals.

“IonQ is the first publicly traded pure-play quantum computing company and a leader in trapped-ion hardware. It has strong commercial partnerships, growing revenue, and institutional support. IONZ provides a direct, amplified way to trade this frontier technology as it moves from lab to real-world applications. The company has relationships with the top MAG7 tech leaders as well, an integration with that crowd could propel opportunities,” Jablonski said.

With SoundHound, she sees voice AI as an emerging layer in industries as diverse as auto to customer service.

“Quantum and voice AI could change the face and revenues of many industries in the future. Soundhound for example, could change the way that we experience customer service — clients like Mercedes Benz and Honda have taken note,” Jablonski said. “With quantum, we are talking about a multi-trillion-dollar industry, in its infancy.”

Defiance’s new offerings also indicate a change in behavior among retail investors. While thematic ETFs swelled in popularity during the past decade, many investors now desire greater control and more intensity.

“Traders want precision,” Defiance ETFs stated. “Many are moving away from broad thematic ETFs in favor of single-stock strategies that let them express specific views. These products allow investors to lean into the individual stories they follow closely and believe in.”

And while daily leveraged ETFs aren't new, applying them to disruptive early-stage names marks a new chapter, one that comes with serious risk. Defiance isn't shying away from that, instead emphasizing that these are tactical tools, not long-term investments.

"We're transparent that these are tactical trading tools. The daily reset structure is clearly disclosed, and we emphasize investor education," said Jablonksi. "We design these products for traders who understand the risk-reward dynamics of short-term, leveraged exposure."

The timing of Defiance’s quantum play is also coinciding with the recent launch by Tradr of its 2X Long QBTS Daily ETF (BATS:QUBX), an ETF dedicated to Quantum Computing Inc (NASDAQ:QUBT). While Defiance is taking a single-stock, leveraged approach, QUBX provides exposure to a smaller quantum company.

“IONQ is the Nvidia of AI, QUBX gives exposure to a smaller up and comer,” Defiance ETFs said. “Both are a testament to the interest in trading the quantum theme.”

In short, the ETF race to the future of computing has started.

From atomic to artificial brains, Defiance’s new ETFs are wagering that individual traders need more than market-cap-weighted exposure. They need access to the next phenomenon, with leverage.

Whether these products ignite a new era of retail trading innovation or are too unstable to manage remains to be seen.

Read Next:

Photo: Shutterstock

Sector ETFs

Jul 01, 2025Apple Inc (NASDAQ:AAPL) became the first public company to pass the $1 trillion and $3 trillion market capitalization milestones.

The company is now one of three that are nearing the lucrative $4 trillion mark. A new poll predicts whether Apple will be the first to pass this new milestone.

What Happened: While Apple has been the first American company to pass many of the market capitalization milestones, NVIDIA Corporation (NASDAQ:NVDA) has gained significant value in recent years and is currently the most valuable public company.

At the end of June, there were three publicly traded companies with market capitalizations of $3 trillion or more that would be the most likely to hit the $4 trillion milestone. Here are the companies and their market caps at the end of June:

Benzinga recently polled social media followers to see which company they believe will hit the $4 trillion market capitalization first.

"Which company do YOU think will be the first to reach a $4 trillion market cap?" Benzinga asked.

The results on Instagram were:

Benzinga ran the same poll on Threads, with readers having the following results:

Overall, Nvidia significantly won the polls with nearly 80% of the vote, ranking well ahead of the other two companies. This result comes with Nvidia currently in the market capitalization lead, but often trading places with Microsoft in recent months.

Read Also: EXCLUSIVE: S&P 500 To Hit New All-Time Highs Again In 2025? Majority Say Yes, 27% Predict This Range

Why It's Important: Nvidia also wins the poll with the most significant return over the last one year and five years. Here are the current year-to-date, one-year, and five-year returns of the three companies based on June 30 prices.

| Company | Year-to-Date | One-Year | Five-Year |

| Nvidia | +14.2% | +27.1% | +1,544.0% |

| Microsoft | +18.8% | +8.9% | +141.2% |

| Apple | -15.9% | -5.3% | +125.4% |

Compare those returns to the SPDR S&P 500 ETF Trust (NYSE:SPY), which tracks the S&P 500. The ETF is up 5.7% year-to-date and has returned 13.3% over the last year and 97.9% over the last five years.

Nvidia has rapidly risen in value and just became a $1 trillion company in May 2023. In less than two years after hitting that milestone, the company was the most valuable in the world.

Another recent Benzinga poll asked readers to pick which magnificent seven stock they would invest $1,000 in for the next 18 years, based on President Donald Trump's proposal for $1,000 investing accounts for newborns.

Nvidia won that poll with 21% of the vote. Apple ranked second with 17% and Microsoft tied for fifth place with 12% of the vote.

Nvidia continues to be a favorite stock among retail investors, with AI continuing to be a large theme and companies looking to the semiconductor company for new chips and products to help them grow in the sector.

Read Next:

The study was conducted by Benzinga from June 27, 2025, through June 28, 2025. It included the responses of a diverse population of social media followers. Opting into the survey was completely voluntary, with no incentives offered to potential respondents. The study reflects results from 4,160 people on Instagram and 47 people on Threads.

Image: Shutterstock

Exclusives

Jul 01, 2025The first half of 2025 was nothing short of a roller coaster for Bitcoin (CRYPTO: BTC), marked by historic highs, sharp corrections, and exciting recoveries.

What Happened: The apex cryptocurrency blasted to a new all-time high in January, driven by optimism over a crypto-supportive U.S. administration under President Donald Trump.

Major institutional investments, such as Strategy Inc.'s (NASDAQ:MSTR) large BTC purchases, also added to the momentum.

However, this rally couldn't be sustained for long. Trump's sweeping tariff policies spurred macroeconomic uncertainty, sending risk-on markets into a tailspin. The result—Bitcoin plummeted below $75,000, its lowest level in nearly six months.

But if sixteen years of Bitcoin have taught us anything, it’s that things don't remain the same for long.

See Also: Why Crypto Investors Are Receiving Internal Revenue Service Warning Letters

Bitcoin made a powerful recovery, fueled by tariff exemptions and trade de-escalation, and went on to set a new all-time high of $111,970. Market sentiment has been buoyed by continued institutional interest and a gradual rebound in network activity. Overall, it gained about 15% in the first six months of 2025.

Looking ahead, analysts remain divided but optimistic about Bitcoin’s prospects for the rest of the year.

Michael Terpin, CEO of Transform Ventures and author of the book "Bitcoin Supercycle, expected the King Crypto to trend upward in the second half.

"While I don't see a 10x growth in the next six months, I do see a clear path to $200,000 and a blowoff top fueled by the explosion in Bitcoin treasury companies of $250,000 or higher," he stated. "This is where every four-year cycle moves from the bubble pop of Bitcoin Summer to the road to capitulation at the end of Bitcoin Fall."

Closely aligned with this projection was Kadan Stadelmann, blockchain developer and chief technology officer of Komodo Platform.

"Many factors point towards a Bitcoin price of between $180,000 and $250,000 by year's end, including increased investment by U.S. retirement funds, global sovereign wealth funds, nation-states via strategic Bitcoin reserves, and Bitcoin Treasuries in the private sector," Stadelmann told Benzinga.

Several firms have been emulating the playbook popularized by Strategy, which involves buying and holding Bitcoin in corporate reserves. Even the Trumps have jumped aboard, with the Trump Media and Technology Group (NASDAQ:DJT) setting aside $2.3 billion to create a Bitcoin treasury.

Meanwhile, even analysts from financial biggies like VanEck, Fundstrat and Standard Chartered anticipate a 2025 BTC high of $180,000 to $250,000 based on institutional adoption and patterns from past markets.

But amid these daring calls, Peter Schiff’s unwavering skepticism persists, who, despite Bitcoin's recent recovery, is convinced that he’ll "eventually be proven right." No prizes for guessing what he has predicted about Bitcoin!

Price Action: At the time of writing, Bitcoin was exchanging hands at $107,678.46, up 0.34% in the last 24 hours, according to data from Benzinga Pro. The coin traded 3.27% away from its all-time high.

Photo Courtesy: Rido on Shutterstock.com

Read Next:

Cryptocurrency

Jul 01, 2025News

Jun 30, 2025News

Jun 30, 2025MIRA Pharmaceuticals, Inc. (NASDAQ:MIRA) on Monday revealed new animal study results from SKNY-1, a next-generation oral therapeutic.

The company says the findings further support the advancement of SKNY-1 toward Investigational New Drug (IND) enabling studies.

With obesity and smoking representing two of the leading causes of preventable death and a combined global market opportunity exceeding $200 billion, MIRA intends to prioritize SKNY-1 as a potential cornerstone asset pending the completion of the acquisition of SKNY Pharmaceuticals, Inc.

In a zebrafish model that mimics human obesity and craving behaviors, SKNY-1 demonstrated weight loss, suppression of appetite and craving for high-calorie diets, and reversal of nicotine-seeking behavior—all achieved within six days of oral treatment.

Also Read: EXCLUSIVE: MIRA Pharmaceuticals Lead Program Ketamir-2 Shows No Brain Toxicity In FDA-Mandated Study

SKNY-1 is being developed as an oral alternative to GLP-1 injectables, which are often limited by nausea, GI discomfort, injection reaction, and growing concerns around muscle loss.

SKNY-1 reduced body weight by approximately 30% after six days of oral treatment. Treated animals weighed about 10% less than healthy controls. The company said the weight loss was not accompanied by muscle density changes.

Treated animals showed an increase in breathing rate, which is a reliable signal that their metabolism was speeding up.

In untreated obese animals, fat buildup in the liver was about 50% higher than normal. SKNY-1 reversed this buildup, bringing liver fat back to healthy levels. At the same time, cholesterol levels—including LDL (‘bad' cholesterol) and HDL (‘good' cholesterol)—also returned to normal without affecting fat levels in the blood.

Obese animals were eating 2–3 times more high-calorie food than normal. SKNY-1 dose-dependently reduced the behavior—high-dose animals ate less than healthy controls. The drug also made the animals less likely to pursue food in stressful environments and reduced obsessive food-seeking in tests designed to measure craving.

SKNY-1 significantly reduced the desire to seek out and consume nicotine. At the high dose, their behavior matched that of healthy animals with no nicotine craving.

Obese animals had extremely high levels of leptin (a hunger-regulating hormone) and unusually low levels of ghrelin (the ‘hunger signal'). SKNY-1 normalized both hormones, improving the body's ability to regulate hunger and energy use.

Obese animals had too much dopamine in their brains, likely tied to increased reward and cravings. SKNY-1 reduced these dopamine levels—but only at the lower dose. The high dose did not affect dopamine, suggesting the drug can reduce cravings without overstimulating the brain.

Price Action: MIRA stock is down 1.20% to $1.23 during the premarket session at the last check on Monday.

Read Next:

Photo by shisu_ka via Shutterstock

Biotech

Jun 30, 2025Each week, Benzinga’s Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here's a look at the Benzinga Stock Whisper Index for the week ending June 27:

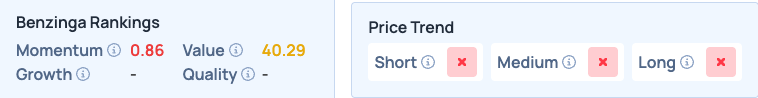

Prologis (NYSE:PLD): The logistics real estate company saw increased interest from readers during the week. The company was recently named to the TIME 100 Most Influential Companies list in the "Leaders" category. Investors may be gearing up for second quarter financial results, which are set for July 16. The company has beaten funds from operation estimates from analysts in four straight quarters, while revenue has missed analyst estimates in six straight quarters. Prologis could be fitting several themes for investors with a dividend payment and operating in the growing logistics REIT market. The stock was nearly flat on the week, as seen on the Benzinga Pro chart below and shares are up only 1.3% year-to-date in 2025.

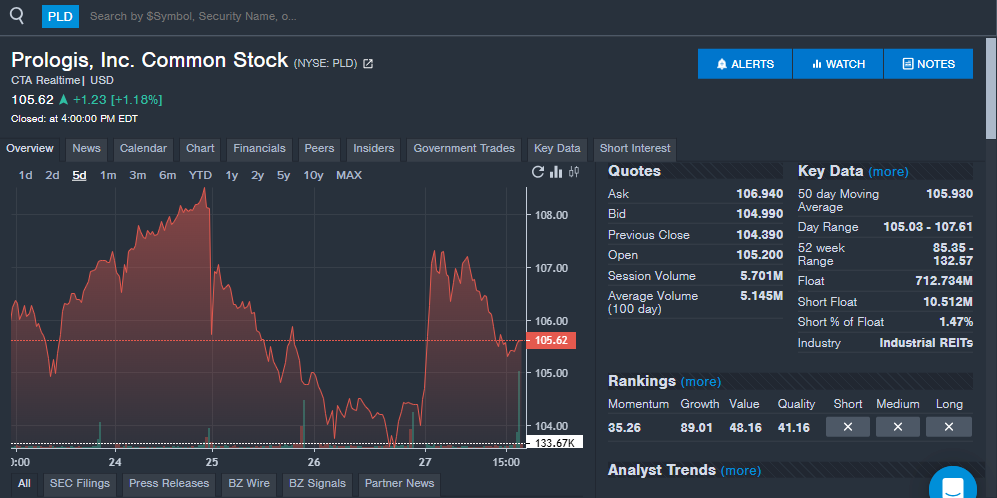

Global-E Online (NASDAQ:GLBE): The ecommerce solutions company saw strong interest from readers during the week with the stock price up 6%. The company reported first-quarter financial results in May with sales beating analyst estimates. The company saw 30% year-over-year sales growth and gross merchandise value also rose 34% year-over-year in the quarter. Global-E Online also reported growth in its Adjusted EBITDA with the operating loss narrowing. The company reiterated its full year guidance after the quarter. Along with financial results, Global-E Online also announced a new three-year strategic partnership with Shopify, extending an existing long-term partnership for first-party and third-party solutions.

"We had another quarter of strong results, demonstrating our ability to grow fast even within macroeconomic turbulent times with Q1 results coming in at or above the midpoints across our guidance," founder and CEO Amir Schlachet said.

Schlachet said the company's pipeline is very active and the company is seeing increased interest in its services.

Agilent Technologies (NYSE:A): The life sciences and diagnostics company saw increased interest from investors during the week, which comes after the company reported quarterly financial results last month. Agilent reported 6% year-over-year sales growth, which beat analyst estimates. The company beat revenue estimates from analysts for a fourth straight quarter and ninth time out of the last 10 quarters. The company's earnings per share also beat analyst estimates, which kept a streak of more than 10 straight quarters beating estimates in place. Agilent reaffirmed earnings per share guidance for the full year and raised its full-year sales guidance, saying that it will be able to mitigate most of the impacts of tariffs.

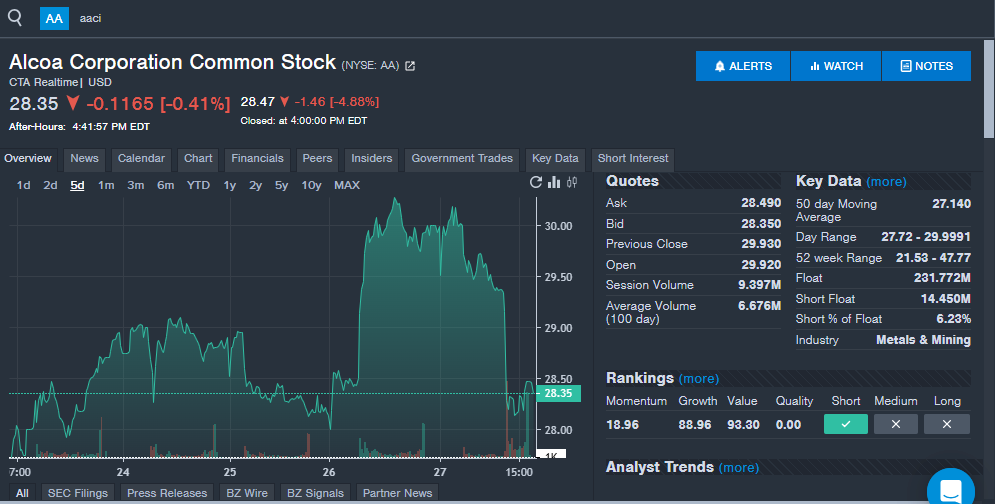

Alcoa Corporation (NYSE:AA): Investors showed increased interest in the metals company ahead of its July 16 second-quarter financial results. Analyss expect the company to report earnings per share of 57 cents and revenue of $2.96 billion. The company has beaten analyst estimates for earnings per share in four straight quarters and seven of the last 10 quarters overall. Revenue has been more mixed with a miss in the last quarter and five beats and five misses over the last 10 quarters. Investors are likely looking to hear more on the impact of tariffs for the company. Alcoa reported $20 million in additional costs in the first quarter due to the impact of tariffs on Canadian aluminum imports. The forecast for the second quarter impact from tariffs was $90 million.

“This is the most material impact to Alcoa, as approximately 70% of our aluminum produced in Canada is destined for U.S. customers,” Alcoa CEO William Oplinger said.

He estimated the annual cost of the 25% tariff could reach as high as $425 million.

Investors will likely want to hear that these numbers have not gone up and that higher metals prices and demand could help offset some of the increased costs.

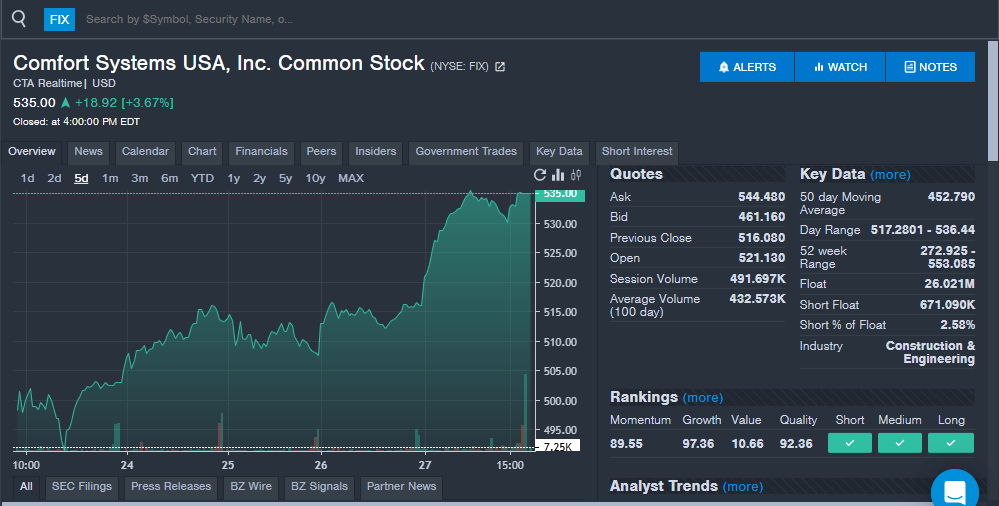

Comfort Systems USA (NYSE:FIX): The HVAC and electrical company saw increased interest from investors with shares at all-time highs. While most investors may not be familiar with the company, Comfort Systems has shown consistent growth and has a history of beating analyst estimates. Second quarter financial results are expected in June. Analysts expect the company to report earnings per share of $4.78, up from $3.74 in last year's second quarter. The company has beaten analyst estimates for earnings per share in more than 10 straight quarters. Analysts expect the company to report quarterly revenue of $1.97 billion, up from $1.54 billion in last year's second quarter. The company has beaten analyst estimates in two straight quarters and nine of the last 10 quarters overall. Analysts have raised price targets on the stock in recent months and the new quarterly results could see more analyst action.

Stay tuned for next week’s report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next:

Exclusives

Jun 28, 2025HIVE Digital Technologies Ltd (NASDAQ:HIVE) is charging ahead with plans to nearly triple its hashrate to 25 EH/s by the fourth quarter of 2025. But while the ambition is clear, the execution risks are anything but negligible — especially in Paraguay, where much of this growth is concentrated.

Read Also: HIVE Digital Energizes Paraguay Site With Major Bitcoin Mining Expansion

"Scaling to 25 EH/s is an ambitious goal. While we're on track, there are always execution risks," says CFO Darcy Daubaras in an exclusive email interview with Benzinga. Among them: hardware shipping delays, global supply chain snags and construction setbacks.

HIVE is betting on Paraguay's abundant hydropower and favorable climate to drive efficient mining. But can the country's infrastructure keep up with HIVE's scale-up?

Daubaras acknowledges the challenges. "Risks do exist. These include regulatory changes, limitations in grid infrastructure, and dynamics of regional trade."

In other words, even the most miner-friendly environment can pose headaches when you’re building out industrial-scale data centers.

To mitigate the risk of the ramp-up, HIVE has boots on the ground. Its president in Paraguay, Gabriel Lamas, is a veteran electrical engineer who previously held key roles at Bitfarms and Paraguay's national utility, ANDE. Under his leadership, HIVE is focusing on grid integration, reliability, and energy optimization.

"His deep technical knowledge and proven track record in energy optimization ensure we maintain HIVE's high standards as we scale in South America," says Daubaras.

Still, the question lingers: Can Paraguay deliver the power, political stability and grid reliability needed to keep the lights on at 25 EH/s?

If the answer is yes, HIVE may emerge as one of the most efficient and greenest miners on the planet. If not, the hashrate dream could hit an electric wall.

Read Next:

Photo: Shutterstock

Cryptocurrency

Jun 25, 2025HIVE Digital Technologies Ltd (NASDAQ:HIVE) is putting its money, or rather, its Bitcoin (CRYPTO: BTC), where its mouth is.

While most Bitcoin miners scramble for capital or take on high-interest debt, HIVE is doing something different: using the BTC on its balance sheet to fund growth. But as CFO Darcy Daubaras admits in an exclusive email interview with Benzinga, this strategy is a double-edged sword.

"Utilizing Bitcoin from our treasury to fund growth provides us with flexibility without incurring debt," Daubaras says. "However, it demands disciplined timing and robust treasury management."

Translation? It's bold, but not without danger. Bitcoin's notorious price swings could wreak havoc on HIVE's liquidity and net asset position. In plain terms: when BTC dips, so might HIVE's wiggle room.

This isn’t just a paper risk either. Daubaras warns that volatility can "affect borrowing capacity, financial covenants, and risk tolerance among lenders or investors." In a downturn, just when capital is most needed, HIVE could find itself handcuffed.

Read Also: HIVE Digital Energizes Paraguay Site With Major Bitcoin Mining Expansion

And the regulatory fog doesn't help. Shifting accounting standards for crypto assets could complicate how this balance sheet strategy plays out. Yet, despite these risks, Daubaras is clear on one thing: "HIVE does not use our BTC as a pledge or as collateral against debt or other obligations."

In other words, they're not gambling the house. Still, they're definitely playing high-stakes poker.

It's a sharp contrast to competitors who are piling on debt or diluting shareholders. HIVE's play is leaner, greener (they use hydro power), and highly leveraged—but only in terms of Bitcoin conviction.

Investors watching this bet unfold should ask: can HIVE time the market well enough to turn Bitcoin into a sustainable growth engine?

Or will the very asset that makes HIVE unique become its biggest constraint?

It's a bold bet—and a reminder that crypto remains a double-edged tool in capital strategy.

Read Next:

Image created using artificial intelligence via Midjourney.

Cryptocurrency

Jun 25, 2025Beeline Holdings (NASDAQ:BLNE) announced Wednesday that its subsidiary, Beeline Title Holdings ("Beeline Title"), has closed one of the first-ever residential real estate transactions funded through the sale of a cryptocurrency token backed by real property.

Nick Liuzza, CEO of Beeline Holdings, said several mortgage lenders are already developing funding models that involve converting cryptocurrencies to U.S. dollars at closing.

But for these models to function at scale, they need a title company that not only understands blockchain transactions but also has the infrastructure to disburse and reconcile them in compliance with federal and state regulations, Liuzza added.

Also Read: Beeline Breaks $1 Billion Barrier, Bets Big On AI And Short-Term Rental Surge

Beeline's first cryptocurrency-enabled transaction is the beginning of a broader rollout. Beeline Loans, another subsidiary, is set to launch its full cryptocurrency token funding platform nationally in early August 2025. Beeline Title will provide the title and closing services for each transaction unless borrowers elect to use an outside title company.

Importantly, Beeline Title will open this platform to all mortgage lenders, giving them access to a cryptocurrency token transaction reconciliation, compliance, and disbursement solution.

Liuzza said its team built Linear Title, a privately held title agency in the U.S., before merging with Real Matters and going public on the Toronto Stock Exchange (TSX).

Through 2019, they closed over one million title transactions across all 50 states, and this new platform is an extension of that expertise tailored to the next generation of mortgage transactions.

In the first week of June, Beeline announced it was launching a debt-free home equity access product using stablecoins. This product offers cash without monthly payments or interest.

The product, set for full launch in July, aims to boost Beeline's revenue growth and profitability starting in the fourth quarter of 2025.

Price Action: BLNE stock closed higher by 29.1% at $1.42 on Tuesday.

Read Next:

Photo by SWK Stock via Shutterstock

Cryptocurrency

Jun 25, 2025Quick Contact

Address

1 Campus Martius Detroit,

MI 48226, United States

Phone

Get in Touch

We love to help & we love to listen. Please fill out the form

below and we’ll get back to you within a day

Customer Support

© 2023 Benzinga APIs | All Rights Reserved