UK FTSE 100 - Key Levels To Watch For 1st Oct 2009

Fundamental Analysis

The FTSE 100(UKX) initially traded higher in the morning yesterday but was unable to hold on to the gains within the first hour of trading and then a wave of selling took hold throught the day.

The FTSE has gapped down in the morning trade and is holding the crucial 5000 level.

The market leading stocks such as BP, Barclays, Marks and Spencer and BHP Billiton are showing signs of stabilisation after the early morning hemorrhage.

Activity in Britain's manufacturing sector has fallen for the second month in a row, spurring fears that recovery in the sector may be some way off.

The Chartered Institute of Purchasing & Supply's Purchasing Managers Index fell to 49.5 in September, down from 49.7 in August. A mark below 50 signifies contraction as opposed to growth. However, the average PMI reading for third quarter of 2009 was 49.9, the highest quarterly figure since Q1 2008.

The main variable towatch out for today will undoubtedly be the Non Farm Payrolls data, as traders positions themselves prior to the release.

Technical Analysis

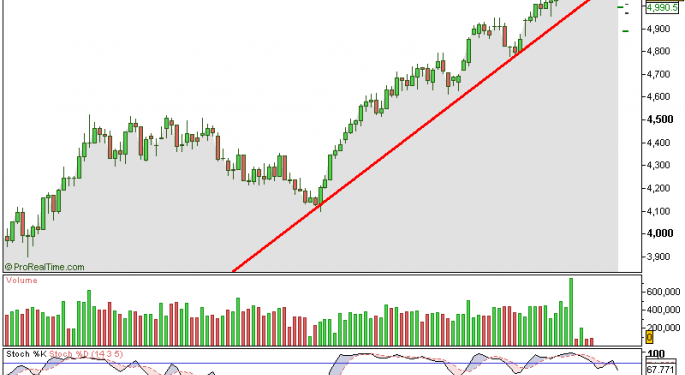

The chart attached shows that we seem to have stalled with the upward momentum and we have a potential break of the the key support line.

Support levels are;

5013, 5000, 4990, 4970

Resistance levels are;

5035 , 5050 , 5066

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Markets