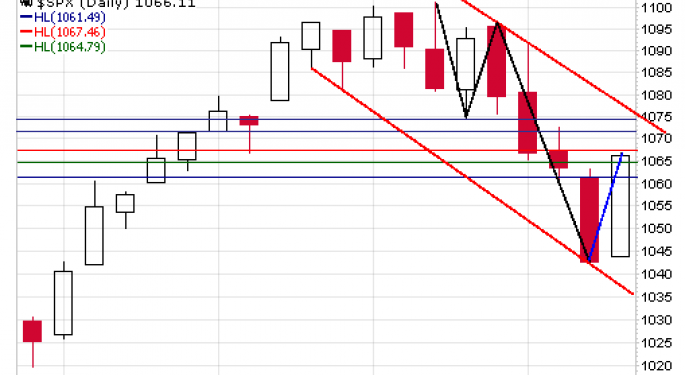

SPX 1066 - The Battle is at Hand

I'm sure it must have been quite satisfying from a bullish viewpoint to watch the Index " Rise In Price " taking out a resistance level then regrouping before heading up to test the next resistance level.

Today after the rebound from 1042.19 the Index carried out a RIP clearing resistance levels 1056.15 - 1061.49 - 1064.79 in an orderly fashion reaching an intraday high of 1066.83 . With a close above 1064.79 at 1066.11 the Index recovered 23.48 points or 39.7% of the 59.17 points that were lost in the previous six sessions. With todays action the RSI reversed and rose back above 50 going from 41.23 to 50.34.

Perhaps it is symbolic that the Index closed at almost 1066 . There was a "battle" then and there will be another in the coming sessions. From a bullish view, the Index will again test the resistance at 1067.46 . If it is able to clear that level then 1069.11, 1071.78 and 1074.45 [ also the DR1 value] will be the Upside targets. The real "battle" will probably commence as the Index nears the upper boundary of the descending channel somewhere between 1071.78 and 1074.45. After that the Index will .....to be continued tomorrow after we have a better idea as to whether the present leg was a 4 or a 1.

Resistance and Support Data is given below.

RESISTANCE

- WR4- 1166.24

- WR3- 1139.19

- DR4- 1128.30

- WR2- 1112.14

- DR3- 1105.16

- WR1- 1095.87

- MR1- 1094.1

- DR2- 1082.02

- DR1- 1074.06

SUPPORT

- WS1- 1068.82

- WS2-1058.04

- DS1- 1050.92

- DS2- 1035.74

- WS3- 1030.99

- DS3- 1012.60

- MS1- 1005.95

- WS4- 1003.94

- DS4- 989.46

DEFINITIONS

- DR-WR-MR

- Daily Resistance- Weekly Resistance- Monthly Resistance Levels

- DS-WS-MS

- Daily Support- Weekly Support- Monthly Support Levels

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Intraday Update Markets