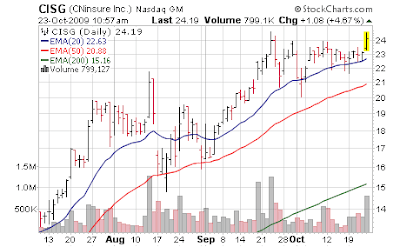

Bookkeeping: Selling Half of CNinsure (CISG)

Chinese insurance firm CNinsure (CISG) is up about 4.5% on double the normal volume in just the first 90 minutes. Maybe there was a positive brokerage note out on this name... I don't see any particular news and earnings are not for a while. I assume something is up, but who knows what it is.

As the stock is peaking, and potentially forming a double top (or a double top breakout) I will sell half our stake north of $24 and look to rebuy lower OR... if the name clears the mid $24s, we'd be interesting in buying say north of $25 as that would mark a potential new leg up. I'm ambivalent on which it is...

Speaking to the greater market we are in a no man's land spot here... white noise. Until we get to new highs (>S&P 500 1100) or retrace more severely it's just high frequency trading machines milking the market and collecting their cute rebates. With the gap filled we are boxed in at the low 1070s with the 20 day moving average, and 1100 as a ceiling; a good area for daytraders to play in, but not our thing. What I am seeing is a lot of earnings reports being sold off since the market already anticipated quite a large amount of positive surprises. So a new catalyst (further destruction of the US dollar?) is needed.

Speaking to the greater market we are in a no man's land spot here... white noise. Until we get to new highs (>S&P 500 1100) or retrace more severely it's just high frequency trading machines milking the market and collecting their cute rebates. With the gap filled we are boxed in at the low 1070s with the 20 day moving average, and 1100 as a ceiling; a good area for daytraders to play in, but not our thing. What I am seeing is a lot of earnings reports being sold off since the market already anticipated quite a large amount of positive surprises. So a new catalyst (further destruction of the US dollar?) is needed.

I'll look to pick some spots to increase positions in a few names if the tide brings them in further... otherwise a holding pattern.

[Aug 27, 2009: CNinsure Report Solid but Many Acquisition Costs/Benefits Running Through Numbers]

[Aug 24, 2009: CNinsure - China's Version of Prudential?]

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.