iPhone in China today and tomorrow

iPhonAsia.com interview with Hong Kong’s NeonPunch.com

The editors of NeonPunch.com, a gadget site in Hong Kong, posed several questions for the editor of iPhonAsia (yours truly). Here are my responses.

Where are you based? How much time is spent here in HK? or China?

I am based in the San Francisco Bay Area. I live about an hour north of the Silicon Valley and the wine country (Napa and Sonoma) is a short drive away.

I travel to the Asia regularly and spent last November touring China. I visited Beijing, Shanghai and Hong Kong. For those who are interested, I posted a travelogue covering each leg of my China trek, which included side ventures to several Shanzhai ji markets.

My blog (iPhonAsia.com) has been an ambassador that has allowed me to meet many new people. I owe a debt of gratitude to readers throughout Asia. They have been gracious hosts when I’ve visited their homeland and many have shared tips on breaking iPhone/telecom stories.

Can you tell me what your background is? Are you ex-Apple or ex-telecom?

My background is in the financial services industry. I spent 10 years as a retail broker (9 with Merrill Lynch), and then another 15+ years on the software/technology side of the business. When I managed money, I covered the telecom industry with a focus on Asia. I left my formal association with the industry two years ago, and this gave me the opportunity to begin sharing my thoughts publicly (i.e. iPhonAsia.com).

I have been invited to speak at a number of iPhone and now iPad developers meetups in the Silicon Valley and I delivered a presentation on iPhone in Asia at Apple’s HQ in Cupertino last September.

I am also a longtime Apple (AAPL) shareholder and follow Apple’s (AAPL) financials closely, yet I typically do not convey stock market (buy/sell) analysis via iPhonAsia. Although I have occasionally poked fun at investment analysts’ > miss-calls

Which iPhone do you use and how many apps do you have?

I have the original “gen one” iPhone (yes I stood in line in 2007) and the iPhone 3GS. I can’t wait for the “fourth gen” iPhone which I hope to see later this summer.

I have about 70 apps on my iPhone and use about a half-dozen every day. Several have proved very handy when traveling in Asia. I know Hong Kong well but relied heavily on the Beijing and Shanghai Taxi Guide apps. I also used China Bites (China Menu) to order food in restaurants. iPhone GPS/maps in taxis saved me substantial time and money. A tip to US travelers heading overseas: Spend a few dollars and purchase a one-month international data-plan before you get on the plane. This will save you the heartbreak of huge roaming/data charges.

Where did you get the idea to start the blog and how long have you been running it?

iPhonAsia grew out of my ownership in Apple (AAPL) stock. I have always been enamored with Apple’s products, and believed in their mobile strategy and ability to execute. I built a core position in AAPL not long after the first iPod launched.

In late 2007 there was tremendous media speculation over iPhone in Asia and how/when Apple might enter China, Japan and Korea. There were also many press reports that omitted or miss-reported important facts about iPhone’s entry into China.  For example, journalists often did not understand the politics in China’s telecom industry and the dynamics of the tumultuous telecom industry restructuring that played out from 2007 to the present day. I often shared background information with fellow Apple shareholders and this was the genesis of iPhonAsia.com (launched in January 2008). My aim has been to dig a bit deeper and provide pertinent information to AAPL investors and Apple/iPhone fans. Instead of focusing on dry financials, I thought it would be more interesting for readers if I blogged on iPhone and mobile telecom in Asia. I don’t have grand ambitions for my site (it remains non-commercial) other than to share news and insights.

For example, journalists often did not understand the politics in China’s telecom industry and the dynamics of the tumultuous telecom industry restructuring that played out from 2007 to the present day. I often shared background information with fellow Apple shareholders and this was the genesis of iPhonAsia.com (launched in January 2008). My aim has been to dig a bit deeper and provide pertinent information to AAPL investors and Apple/iPhone fans. Instead of focusing on dry financials, I thought it would be more interesting for readers if I blogged on iPhone and mobile telecom in Asia. I don’t have grand ambitions for my site (it remains non-commercial) other than to share news and insights.

After a few months of blogging my posts began to be picked up by mainstream news organizations and some iPhonAsia info also found its way into investment firm research reports. I am particularly grateful to Fortune/CNN (Philip Elmer-DeWitt) and the All Things Digital (The Wall Street Journal’s John Paczkowski) for their coverage and links.

What do you think is the real reason behind the teeter-tottering of China Mobile bringing in the iPhone?

Preface: Before I continue, I should emphasize that many of my responses in this interview are based on flat out guesswork. Apple rarely comments publicly and details are kept under wraps … hence crystal-ball gazing is often all I’m left with.

The Apple/China Mobile relationship (never ending “talks”) is a long and winding tale. One dynamic at play is the fact that Apple and China Mobile are both hugely successful and well-financed companies who have something special to offer (Apple has revolutionary products/platform and China Mobile has 500 million subscribers) and neither wants to capitulate to the other. The primary impediments to a deal include:

The Apple/China Mobile relationship (never ending “talks”) is a long and winding tale. One dynamic at play is the fact that Apple and China Mobile are both hugely successful and well-financed companies who have something special to offer (Apple has revolutionary products/platform and China Mobile has 500 million subscribers) and neither wants to capitulate to the other. The primary impediments to a deal include:

Apple’s reluctance to build a “single-carrier” (can’t be deployed elsewhere) iPhone – a virtually necessity to support China Mobile’s TDSCDMA 3G.

Apple’s reluctance to build a “single-carrier” (can’t be deployed elsewhere) iPhone – a virtually necessity to support China Mobile’s TDSCDMA 3G.- Apple’s strong resistance to any customization that would support a non-Apple platform (albeit compromises were made for China Unicom)

- China Mobile and Apple’s “competing” desire to control wireless value-added services (WVAS) revenues – e.g. music, apps/games, ringtones, messaging, cloud storage services, etc.. Apple has iTunes/App Store and China Mobile wants its Monternet and Mobile Market.

- Apple’s reluctance to simply rollover and take China Mobile’s deal terms. I’m sure China Mobile sees things the exact opposite way (i.e. “we won’t roll over and concede to Apple”).

China Mobile’s big bet on Android and OPhones. NOTE: OPhones are TDSCDMA 3G handsets, built by various manufacturers, running China Mobile’s Open Mobile System, an Android-based OS customized to support China Mobile’s WVAS.

China Mobile’s big bet on Android and OPhones. NOTE: OPhones are TDSCDMA 3G handsets, built by various manufacturers, running China Mobile’s Open Mobile System, an Android-based OS customized to support China Mobile’s WVAS.

Despite the impediments listed above, I believe Apple and China Mobile will ultimately come to terms. The reasons why a deal will eventually get done include:

- Apple wants to offer iPhone to China Mobile’s truly massive subscriber base (nearly 500 million mobile customers).

- China Mobile’s OPhone offerings have thus far underwhelmed and have failed to capture a large volume of new TDSCDMA 3G subscribers. China Mobile needs a showstopper smartphone.

- iPhone remains quite popular and China Mobile recognizes that iPhone demand will accelerate when price-points drop.

China Mobile won’t publicly admit as much, but I suspect they are concerned that a new “fourth generation” China Unicom (Apple) iPhone, rumored to be launching later this summer, will be very attractive to highly valued on-contract subscribers. China Mobile is already suffering leakage of grey-market iPhone subscribers who are “upgrading” to China Unicom’s faster WCDMA 3G network. Grey-market iPhone owners had heretofore been using their real (but illicitly obtained) iPhones on China Mobile’s EDGE 2G network.

China Mobile won’t publicly admit as much, but I suspect they are concerned that a new “fourth generation” China Unicom (Apple) iPhone, rumored to be launching later this summer, will be very attractive to highly valued on-contract subscribers. China Mobile is already suffering leakage of grey-market iPhone subscribers who are “upgrading” to China Unicom’s faster WCDMA 3G network. Grey-market iPhone owners had heretofore been using their real (but illicitly obtained) iPhones on China Mobile’s EDGE 2G network.

If the rumored forthcoming iPhone 4G (fourth gen) for China Unicom includes the WAPI/WiFi combo, this could greatly accelerate iPhone adoption and put pressure on China Mobile to respond with an iPhone offering of their own. I have long postulated that an iPhone deal with China Mobile would most likely be for a low-priced iPhone 2G (EDGE). However, if China Mobile steps up and commits to a large pre-purchase (5 to 7 million units would be my guess), Apple might build a special model iPhone for China Mobile that includes a chipset supporting TDSCDMA + WAPI/WiFi. There is no reason why Apple can’t potentially deliver both a low-price EDGE 2G model and a TD-SCDMA 3G iPhone, with the caveat being a large pre-purchase commitment in the case of the “TD” iPhone.

Apple already knows a low-price EDGE 2G model will sell, and it won’t be a single carrier iPhone. A low-priced (perhaps smaller in size) 2G iPhone can be a strong seller in many large pre-paid (no contract) markets beyond China (e.g. India, Brazil, Russia, Indonesia and throughout Southeast Asia).

For readers interested in more background, I recommend they read a March 2009 post > Apple’s iPhone in China Negotiations

What do you think about the speed of uptake of the iPhone in China?

Grey-market iPhone sales continue at a steady pace and by most accounts are outpacing the official (China Unicom) iPhone sales. WiFi capability and lack of high deposit requirements are the primary attractions of grey-market iPhones. By some estimates there are now some 2+ million iPhones (1.55 million grey-market + 450,000 official) in China. That’s impressive considering iPhones have only been legally available in China for a few months.

The uptake of the “official” China Unicom iPhone has been modest. The last leak from a China Unicom source (end of December 2009) revealed that about 300,000 official iPhones had sold since the October 30, 2009 launch. China Unicom has recently stepped up iPhone marketing and I expect the pace of sales has also bumped up. Just my guess, but I expect we have now passed 450,000 units in China. A pace of 90,000 iPhones per month might be considered a big hit in many world markets, yet this volume is likely below China Unicom’s targets. But no one is panicking. There is a second and third act to this play.

Why haven’t the “official” iPhone sales in China been greater? Two key reasons –

- Notwithstanding subsidy options, the deposit fee requires a substantial initial cash outlay that puts the iPhone out of reach for many potential buyers.

- No WiFi on the “official” iPhone – Grey-market iPhone sellers are waiving their WiFi-ready iPhones in the face of prospective buyers and touting lower price-points without the high deposit requirement.

I should emphasize that there are many benefits that come with the “official” iPhone, not the least of which are:

- Subsidized (discounted) price for those willing to go on contract.

- The deposit fee is high, but it’s rebated back (portion allocated back each month) and offsets your monthly plan costs.

- A real warranty.

- Ability to load iPhone OS software updates without any concern about “bricking” – a big issue for many jail-broken grey-market iPhones.

- Many fun/cool “for China” apps are preloaded on the China Unicom iPhone.

Background on the first models built for China: Perhaps with a bit of encouragement from China’s Ministry of Industry and Information Technology (MIIT), China Unicom convinced Apple to build a special model for the China Market. This iPhone has a non-standard chipset without WiFi capability (WiFi removed at the hardware level) and many “for China” apps come pre-loaded on the iPhone + a link to Unicom’s Wo Portal. Apple almost certainly won concessions for this custom build. My guess is that the concessions were price (more expensive for China Unicom versus standard model iPhones) and a volume purchase commitment – rumored to be 5 million iPhones. I do not believe China Unicom paid for 5 million iPhones upfront, and nor do I believe the 5 million were to be allocated to just the two initial iPhone models built for China (model A1324 based on iPhone 3G and model A1325 based on iPhone 3GS). However, I do believe China Unicom has made a minimum purchase commitment to Apple and will ultimately deliver on their promise.

Background on the first models built for China: Perhaps with a bit of encouragement from China’s Ministry of Industry and Information Technology (MIIT), China Unicom convinced Apple to build a special model for the China Market. This iPhone has a non-standard chipset without WiFi capability (WiFi removed at the hardware level) and many “for China” apps come pre-loaded on the iPhone + a link to Unicom’s Wo Portal. Apple almost certainly won concessions for this custom build. My guess is that the concessions were price (more expensive for China Unicom versus standard model iPhones) and a volume purchase commitment – rumored to be 5 million iPhones. I do not believe China Unicom paid for 5 million iPhones upfront, and nor do I believe the 5 million were to be allocated to just the two initial iPhone models built for China (model A1324 based on iPhone 3G and model A1325 based on iPhone 3GS). However, I do believe China Unicom has made a minimum purchase commitment to Apple and will ultimately deliver on their promise.

China Unicom can do several things to accelerate iPhone sales, and they’ve already undertaken key initiatives, including:

- Training their sales staff to most effectively sell iPhone.

- Undertaking a massive national iPhone marketing/advertising campaign (print, billboards, TV, etc.).

- Conducting a 46-city iPhone user experience road-show.

- Setting up a separate “official” iPhone Store on Taobao.com.

Yet, by far and away, the most important and direct means for China Unicom to stimulate sales would be to reduce the initial iPhone cash outlay (price/deposit).

Background on the deposit requirement: Because credit card use is relatively rare in China (and credit ratings are not a major concern to most Chinese consumers), there is a risk in subsidizing the iPhone purchase price. A new iPhone subscriber could sign-up for a more expensive “power-user” 2-year iPhone service contract– with the maximum calling minutes and data-usage, and thereby get a heavily subsidized (discounted) or even “free” iPhone. This same customer could later walk away from the contract with his/her new iPhone (“come find me”) without making the required monthly payments.

In the West, many consumers are motivated to make timely payments to avoid a poor credit score. But consumers in China don’t buy on credit so “who cares” about damaged credit? Obviously, China Unicom, the party at risk (subsidizing iPhone), cares. Consequently, China Unicom has opted to require an upfront deposit. This deposit is rebated back to subscribers (an equal portion each month) over the life of the 2-year cellular service contract.

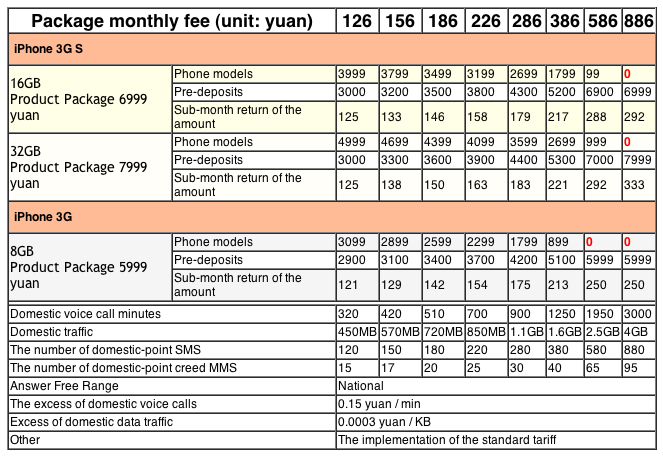

![]() There may be ways to reduce the high deposit requirement. In Hong Kong, via Hutchison “3,” there are several iPhone plan options (e.g. the DBS ComPass Visa) that allow subscribers to forego the upfront deposit. Perhaps China Unicom will look to adopt a similar program for subscribers in the People’s Republic of China?

There may be ways to reduce the high deposit requirement. In Hong Kong, via Hutchison “3,” there are several iPhone plan options (e.g. the DBS ComPass Visa) that allow subscribers to forego the upfront deposit. Perhaps China Unicom will look to adopt a similar program for subscribers in the People’s Republic of China?

I believe that Apple and China Unicom are now cooperating on multiple ways/means to offer the forthcoming “next generation” iPhone model(s) at competitive price-points. Look for China Unicom to get more aggressive on iPhone pricing later this summer. There is powerful iPhone price elasticity in China and a lower price (and/or elimination of high deposit requirements) could generate substantially higher sales.

Who are these people buying this expensive phone?

On my recent travels through China I was amazed to encounter so many seemingly “income-challenged” youth who found a way to afford a “real” (not Shanzhai) iPhone. While incomes are lower in China relative to the West, household savings rates are high. Rainy day money can sometimes be spent on items that deliver both utility and status. An iPhone is often the family’s means to connect with the outside world – surf the Net, text/e-mail, read news, watch videos, use GPS/maps, use social media and have fun with games/apps, etc. iPhone has a value far beyond a throwaway Shanzhai ji cell phone.

Of course, many in China have no problem affording an iPhone. There are an estimated 340,000 millionaires in China and there is also a growing middle-class. An estimated 290 million Chinese households can be classified as middle-to-upper class with monthly incomes ranging from 5,000 CNY to 15,000 CNY ($732 to $2,196 USD).

If WiFi is coming to the China iPhone what in your opinion is the real reason why it wasn’t allowed the first time?

There were several reasons why WiFi on mobile calling devices (phones) was initially banned in China, and it’s also fairly clear why a compromise has now been reached (WAPI/WiFi), although it’s still not definitive that Apple will go along with the compromise (but I’m betting they will) …

There were several reasons why WiFi on mobile calling devices (phones) was initially banned in China, and it’s also fairly clear why a compromise has now been reached (WAPI/WiFi), although it’s still not definitive that Apple will go along with the compromise (but I’m betting they will) …

Carriers have been petrified over the proliferation of voice-over-Internet protocol (VoIP) applications now finding their way on to smartphones. WiFi + VoIP could eventually allow consumers to make their phone calls away from the carriers’ cellular networks. As VoIP calling grows, so too does carriers’ greatest fear … becoming “dumb pipes” – just antiquated cellular transmission networks (“pipes”) that consumers no longer use (“dumb”).

Carriers have been petrified over the proliferation of voice-over-Internet protocol (VoIP) applications now finding their way on to smartphones. WiFi + VoIP could eventually allow consumers to make their phone calls away from the carriers’ cellular networks. As VoIP calling grows, so too does carriers’ greatest fear … becoming “dumb pipes” – just antiquated cellular transmission networks (“pipes”) that consumers no longer use (“dumb”).

Another reason for the WiFi ban was China’s support for their competing standard – Wireless LAN authentication and privacy infrastructure (WAPI). Naturally China would prefer that consumers utilize the “indigenously innovated” (China built) WAPI versus WiFi (802.11). The WAPI versus WiFi story is long and convoluted … so I’ll spare readers the details. For those who are interested, I recommend you read the following iPhonAsia > post

Why did China authorize the WAPI/WiFi stack? Prior to April of 2009, only WAPI was allowed on mobile phones. Yet there are not nearly as many WAPI hotspots in China as there are WiFi hotspots (in theory WiFi is just for computer usage). Moreover, there were very few mobile phones being manufactured in China with WAPI capability. This led to a serious problem for Chinese authorities. Consumers were voting with their pocketbooks and buying up millions of grey-market smartphones (including iPhones) with WiFi. Naturally these phones were accessing the tens of thousands of WiFi hotspots across China. Very cool for consumers, particularly since there are virtually no unlimited data plans in China and consumers, who’ve used up their monthly data-surfing allocation, would often switch away from the carriers’ networks in favor of WiFi. So, unless China institutes a massive crackdown on the illicit sales of grey-market handsets (not likely to happen), the proliferation of WiFi-enabled smartphones would continue and “WAPI only” phone sales would suffer. The only way to stem the tide of illicit sales of “WiFi only” handsets was to come up with a King Solomon’s compromise … allow both WAPI and WiFi to be stacked together on smartphones. This solves multiple problems … it allows China to obtain their WAPI royalties and gives consumers what they want, official WiFi-enabled smartphones that can connect to ubiquitous WiFi hotspots or WAPI as coverage expands.

Do you know what the most popular apps are in China?

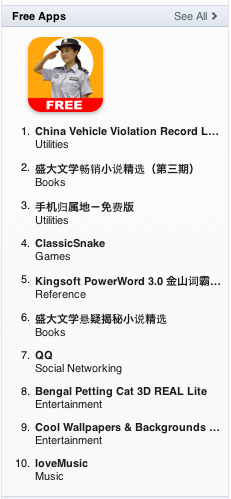

![]() The most popular apps in China (free and paid and top grossing) can be viewed on Apple’s China App Store. There is also a separate App Store for Hong Kong. The top apps can be found by launching iTunes and clicking over to the App Store.

The most popular apps in China (free and paid and top grossing) can be viewed on Apple’s China App Store. There is also a separate App Store for Hong Kong. The top apps can be found by launching iTunes and clicking over to the App Store.

The number one paid app in China is the Plants vs. Zombies game. The number one free app in China is China Vehicle Violation Record Lookup. The top-grossing (made the most $ for the developer) app in China is Autonavi (GPS Navigation).

The number one paid app in China is the Plants vs. Zombies game. The number one free app in China is China Vehicle Violation Record Lookup. The top-grossing (made the most $ for the developer) app in China is Autonavi (GPS Navigation).

There are also several non-official app stores in China that offer apps for those who’ve jail-broken their iPhones. NetDragon’s Panda Space is popular and provides many free and paid apps. Naturally, there are risks associated with loading non-authorized apps (possibly voiding your warranty and potentially “bricking” your iPhone if jail-breaking is required to load the rogue apps) and I do not recommend that users go “off the reservation” in search of non-vetted apps.

Have you been in contact with any Chinese developers?

Yes, many are regular iPhonAsia readers and I have corresponded with app developers throughout Asia. I had the pleasure of meeting face-to-face with a number of very talented iPhone developers during my last trip to China.

Bo Wang, of iBokan is currently running an iPhone developers training program in Beijing. I attended one of his classroom sessions while in Beijing. There are also many thousands of expat Chinese developers in the greater San Francisco Bay Area. Many attend regular iPhone/iPad meetups in the Silicon Valley to exchange ideas and collaborate on projects.

I am also a member of the Silicon Valley China Wireless Technology Association and have met many executives and developers from China who find their why to the Santa Clara Valley.

Is Android a threat to iPhone in China – or is there a bigger issue at hand?

Android is worthy competition to the iPhone/iPad SDK, and clearly many who develop for iPhone also code for Android. The biggest problem for Android developers is “fragmentation.” Android’s price-point (free) and openness has lead many carriers and handset manufacturers to “do their own thing” with the Android code. This means that one size (build) does not fit all. A developer may need to recode an Android app multiple times to ensure that it functions on different handset skews (e.g. different versions of handsets customized for different carriers). Developers often grow frustrated with having to build so many versions of the same Android app.

Android is worthy competition to the iPhone/iPad SDK, and clearly many who develop for iPhone also code for Android. The biggest problem for Android developers is “fragmentation.” Android’s price-point (free) and openness has lead many carriers and handset manufacturers to “do their own thing” with the Android code. This means that one size (build) does not fit all. A developer may need to recode an Android app multiple times to ensure that it functions on different handset skews (e.g. different versions of handsets customized for different carriers). Developers often grow frustrated with having to build so many versions of the same Android app.

Apple’s recent litigation against HTC may eventually lead to new problems for Android. While Apple’s patent suit did not name Google, many of the named infringements clearly targeted Android. This legal action will take a many months, if not years to resolve, but it’s something to watch with interest.

Despite the issues with Android, Google’s offering has two important advantages – a very deep pocket ($Google) and a compelling price (“free”) albeit with ports open to Google’s advertising business.

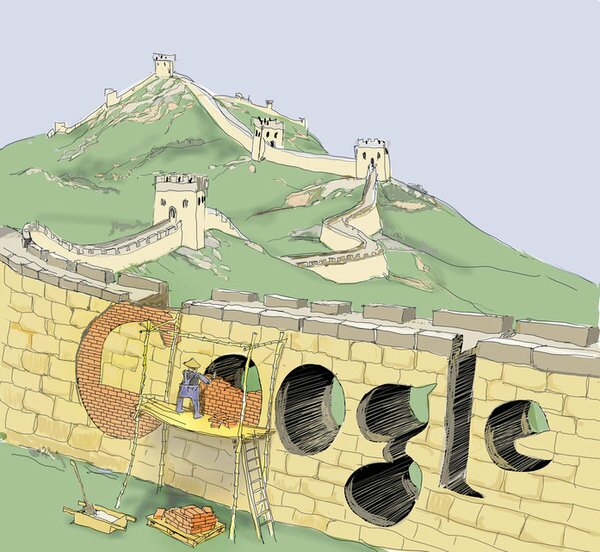

An interesting sidebar issue has been Google’s “status” in China. Google has been re-evaluating its role in China in the wake of the recent well-publicized cyber-attacks and Google’s not so veiled accusations of China’s involvement in the hacking G-Mail accounts. For those interested, I’ve written several posts on the Google in China story:

Google’s China gambit less about censorship and more about defense of IP

Google’s China gambit less about censorship and more about defense of IP- Google’s China gambit – Defiance of compliance may prove costly

A long story short… in the wake of the cyber-hacking scandal, Google may be abandoning the “search” business in China, but Android will survive.

Neither Google nor Apple are going to back away from mobile anytime soon. I expect both companies to compete and cooperate on future mobile initiatives.

Apple retail – good or bad? Are there authorized retailers in China that mirror the Apple Store already like we have in HK? Or is this going to revolutionize computer retail in China?

There are many phony “Authorised” (British spelling is often used in the signage) Apple Retailers in the People’s Republic of China. The majority of these Apple “wannabes” are in fact not authorized by Apple. There are just a handful of authorized Apple resellers in China and the only Apple-owned store is at Sanlitun Village in Beijing, managed by John Ford.

Sidebar: iPhones can be purchased through several China Unicom Wo Stores and affiliated retailers, including select BestBuy and Carrefour stores, and the Apple Store at Sanlitun. Back in November 2009, China Mobile took steps to cutoff planned iPhone distribution through various retailers. Read > China Mobile playing hardball with potential iPhone distributors.

Hong Kong has several authorized Apple retailers. I was very impressed with the Fortress Stores when I last visited Hong Kong. Sir Li Ka Shing has done a fine job in representing the Apple brand. In every Fortress Store I entered, the staff was knowledgeable and courteous.

Hong Kong has several authorized Apple retailers. I was very impressed with the Fortress Stores when I last visited Hong Kong. Sir Li Ka Shing has done a fine job in representing the Apple brand. In every Fortress Store I entered, the staff was knowledgeable and courteous.

That said, there are very few … check that … there are no retail stores that deliver an experience like the Apple Store. When it comes to the secrets of Apple’s success, product comes first, but near the top of Apple’s success ingredients is the Apple retail experience. Nothing is left to chance. When you walk in the door, product is neatly laid out for a “hands on” shopper experience. You will also find plenty o

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.