2010 Fund Performance Period 2

The mutual fund is now on schedule for a summer 2010 launch. If, after reading the blog content you might have an interest in participation, please consider reading why this blog exists.

- [Jan 2008: Reader Pledges Toward Mutual Fund Launch]

- [May 2008: Frequently Asked Questions]

- Our story in Barron's [A New Kind of Fund Manager]

- [November 2009: General Updates, Questions]

---------------------------------------------------------------------------

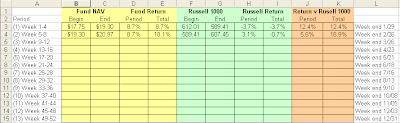

I will post an update of performance versus Russell 1000 every 4 weeks; we moved to a new tracking system in 2009 (Investopedia.com) as the old system would not allow shorting of individual stocks, among other "technical issues" that often came up. Hence while the website and portfolio began in August 2007, we "began anew" in terms of performance with portfolio "B" as of early 2009. Detailed history on latter 2007 and 2008, as well as 2009, [Jan 7, 2010: 2009 Final Performance Metrics] can be found on the above mentioned tab. For 2010 our second 4 week period is now complete. (Data is through last Friday's closing prices)

(click to enlarge)

Almost all the action in period 2 was in the first few weeks, as concerns about Greece first weighed on the market than melted away as talks of bailouts came to light in week 2. The market - now conditioned to moral hazard - repeated the same feats as it did in 2008/2009 as bailout after bailout was announced or rumored... it celebrated. Hence a 8%ish correction in mid January to early February was largely culled by the end of period 2. Earnings season continued as did economic news but those mostly took a back seat to macro events. There were no standout sectors as in most periods the past year - everything sort of moved together; the one standout was the US dollar of all things. China continued tightening measures and emerging market indexes trailed US stocks.

For the second "four week" period of 2010 the fund returned +8.7%, versus the market's +3.1%, so an outperformance of +5.6%.

On a cumulative basis the return is +18.1%, versus the Russell 1000's -0.7%, so an outperformance of +18.9% for the year to date. (thus far 8 weeks)

Period 2 achieved both absolute performance (making money) and relative performance (outperforming the market). The yearly goal of beating the index by 15% has already been achieved so perhaps a time to shut down shop for the year and hit the beach until Jan 2011.

------------------------------------------------------------------------------------

*** Long/Short Fund Discussion below

Overview: Almost all gains this period came in the first half as we rode volatility first down and up - much of it came from index exposures as well as a well timed long US dollar trade. Staying out of the way during the heavy selling was a key as we protected our capital, and hence did not have to make up losses for the rest of the period. Most of our long exposure had been extinguished as stock after stock had broken their respective 50 day moving averages in the previous period so with a market in precarious position we mostly relied on index positions. Once S&P 1085 was broken the 200 day moving average in the mid 1040s came into play - I did not expect it to happen as quickly as it did, but with our first -3% day in ages Thursday of week 1, it happened. Fast. From there it was mostly a rebond on bailout hopes, and then sideways action to finish the period. Economic news was actually quite weak in week 4, but with Ben Bernanke reiterating 'easy money' in Congressional testimony Wed/Thu of that week, this was all the market needed to remain happy.

Please note on the right margin of the blog is an archive in which you can see all these events in chronological order, clicking on any link within the sentences below will take you to that transaction - a summary below:

Week 1: The fund was positioned 22.5% short, 12.5% long and 65% cash as the S&P 500 had broken a key support level of 1085 the previous week. The 200 day moving average was down in the mid 1040s which was a "goal" to reach before lifting shorts. Of course Monday of that week we bounced... you don't mess with Magical Mondays. Another bounce came Wednesday but I wrote that conditions remained from a textbook rollover...which eventually happened.

- On the Wednesday bounce, I cut back positions in Braskem (BAK), F5 Networks (FFIV), and Market Vectors Brazil Small Cap (BRF). This left us only with 4 material long positions.

- Thursday morning as we were just under resistance and I thought a rollover would still happen... as the market began to sell off I put 11% of the portfolio into put positions; that worked out nicely. Thursday ended up being a -3% down day, the first one of those in a long time so we took profits on 75% of the puts very late in the session. Much of it was in the +40% gain range.

- Also Thursday I cut 2/3rds of Atheros Communications (ATHR) as it broke the 50 day moving average - that left us with only 3 material long positions.

- Then DragonWave (DRWI) & EnerNOC (ENOC) broke support, taking us out of 60-66% of both positions, leaving us with 1 material long position.

- Out last material long position Assured Guaranty (AGO) finally broke down Thursday afternoon so we were stopped out of a good portion of that position as well.

- After locking in gains on hotel company Wyndham Worldwide (WYN) it finally fell to support and filled a gap Friday morning - so we bought back our exposure and more.

- I had bought long dollar calls and ETF (UUP) the previous week, so with the calls up 36% in just 5 days, I sold 1/3rd of the UUP ETF calls to lock in gains as they did their job as a hedge.

- Friday was another horror show, before a huge rally in the last hour as the major indexes all bounced off their 200 day moving average. I did some intraday trading on the selloff, and luckily took the majority of profits abuot an hour before the reversal - mostly because I was feeling chock full of gains and did not want to be greedy.

Week 2: Having had all our major long positions taken away via stop losses (except for the Wyndham Worldwide added the previous Friday) our long exposure was low coming into this week, at only 8%. But with the market having sold off so sharply and locking in our profits short exposure was also small at 9% - much of that being "long dollar". Cash was immense at 83%. The S&P 500 was now in a large range, between the 200 day and 50 day moving averages - almost a 55 point range.

- I began a new stake in Seagate Technology (STX) which had impressively held up well during the previous week carnage and had a PE of 6.

- Closed out a long term position in Priceline.com (PCLN) as it broke support, but mostly because it was not a position we had added to in a long time. Within a few days it had another blowout quarter of course, but we would not of benefited much since it was such a small part of the portfolio.

At this point "guess the bailout" - a favorite of 2008 and 2009 was back in vogue so I was wary of short exposure since I knew speculators would rejoice. I also thought it would hurt the dollar, and help the euro (even though it made little sense intellectually), so I took some more dollar exposure off the table in anticipation of a "bailout rumor". And by Tuesday we had our whispers of bailout leaked. The S&P 500 of course spiked and we were back to our old market of moral hazard again.

- I added back to DragonWave (DRWI) as it went back above the 50 day moving average.

- 2 of the positions we had been stopped out the previous week, F5 Networks (FFIV) and Atheros Communications (ATHR) were added back to as they regained their 50 day moving averages.

Week 3: Most of our short exposure remained "long dollars" so even as the market bounced it ended up working for us. We entered the week 8% short (almost all "long dollar"), 14% long (some of the positions bought back after the bailouts surfaced in week 2, but still a lot of cash (78%) as the S&P 500 remained below the 50 day moving average. Of course we had our now expected Monday morning mark up. Weak volume continued to dominate almost every upward day - a stark constrast to historical action. Since I was traveling the back half of the week, and the following week we curtailed activity versus normal.

- The Wyndham Worldwide (WYN) we had bought in the panic in week 1 had bounced to (near) mid January highs so with a 10.5% gain in a week and half, we took half off the table.

- American Superconductor (AMSC) was stuck below the 200 day moving average and had not bounced with much of the rest of the stock market, so we closed out the last 0.3% we had left.

- Skyworks Solutions (SWKS) looked like it was in an early stage breakout so I began rebuilding the position.

By Thursday of the week, as all major indexes had recaptured their 50 day moving averages on yet another low volume "V" shaped bounce, I declared the correction over. The NASDAQ and S&P 500 had not yet recaptured their simple moving averages but as far as exponential moving averages, the deed was done.

Week 4: With things looking better we had a much higher long bias coming into the week, 24%. Short exposure was under 6% (again most of it being "long dollar") with 70% cash.

- Since almost every stock I had added back (or in the case of Seagate Tech, bought from scratch) ad bounced in a V shape method, I took 30-50% off the table in each - ATHR, STX, FFIV, SWKS. They were due to stall since most had detached from almost any sight of any moving average since the bounces had been so fast. I also sold 80% of Rackspace Holdings (RAX) as it ran into resistance.

- I closed Brazilian chemical producer, Braskem (BAK) as it seemed not to be rebounding with the pack.

- Thursday morning as the market took a big hit on bad unemployment data, I got back the Seagate Technology (STX) [plus more] that I had taken profits on Monday morning. For whatever magical reason the market rallied sharply late Thursday, to make almost all the pain go away.

[Feb 2, 2010: 2010 Fund Performance Period 1]

[Jan 7, 2010: 2009 Fund Performance - Final Edition]

For previous years please see tab 'Performance / Portfolio' (we were using other tracking mechanisms at the time)

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.