Teslas getting charged in a Wawa parking lot last month. Photo via author.

When Winning Streaks Stop

In a post in August (Tesla And The Quest For Alpha), we wrote about how a factor we started using in our security selection process in May of 2020 had started to underperform, as exemplified by Tesla, Inc.'s TSLA performance.

Tesla exemplifies the recent challenges of our security selection process. How it does over the next several months will likely impact how we pick stocks going forward, so I thought it might be useful to sketch this out a bit.

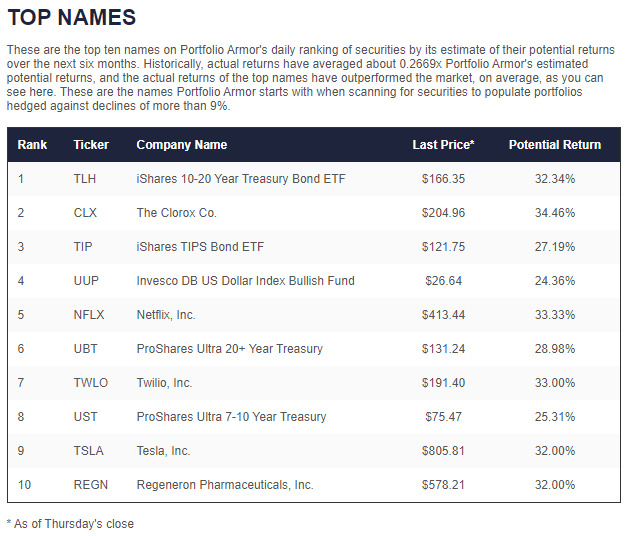

Each day the stock market is open, our system selects the names it estimates will have the highest potential returns over the next six months, based on a handful of factors that gauge stock and options market sentiment. We started tracking a new factor in September of 2019, and after several months of observation added it to our top names selection process in late May of 2020. On May 28th, the new factor applied to four stocks in our top ten, Tesla, Netflix, Inc. NFLX, Twilio, Inc. TWLO, and Regeneron Pharmaceuticals, Inc. REGN.

Screen capture via Portfolio Armor on 5/28/2020.

We then noted that those top names selected with our new factor outperformed over the next six months:

Three out of the four names selected by the new factor generated positive returns, with Tesla more than tripling.

We pointed out that most of the other times the new factor picked Tesla in 2020, its performance was good over the next six months. But, unfortunately, the factor also picked Tesla right near its peak in January of this year.

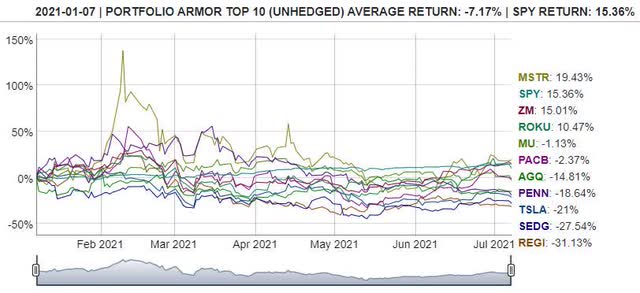

Picking Tesla In January 2021Tesla dropped 21% in the six months after it hit our top names on January 7th of this year.

The line with the big spike in early February in that chart is the Bitcoin stock MicroStrategy, Inc. MSTR. It posted a positive return over the next six months from January 7th, but you can see the same issue here, of our new factor picking stocks near their peaks. Let's look at what the new factor is, because it has picked MSTR as a top name again recently, as well as TSLA.

We then went on to describe the new factor.

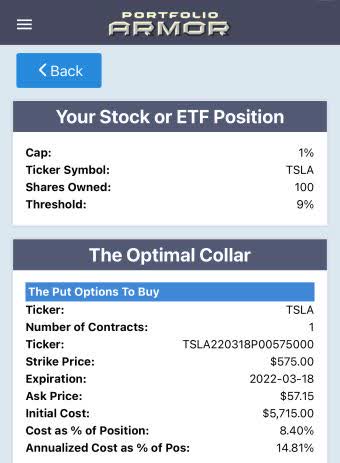

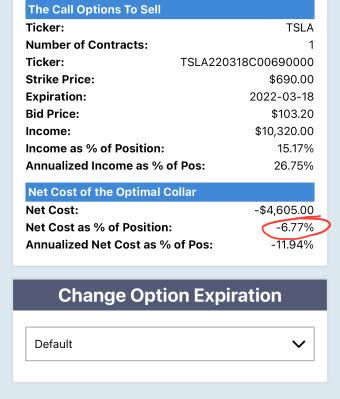

The New FactorThe new factor we added is essentially a measure of options skew. Our hedging algorithm scans for an optimal collar to protect against a greater-than-9% decline in a security over the next several months, while capping its possible upside at 1% or the current money market yield, whichever is higher. Here's what that looked like for Tesla on Friday, when it was again one of our top ten names.

Screen captures via the Portfolio Armor iPhone app.

The number circled in red there, -6.77%, is the net cost of the collar. That cost was negative because options market participants were willing to pay a lot more for the out-of-the-money (OTM) call option on Tesla (a bet that the stock would be higher next March) than for the OTM put option (a bet that the stock would be significantly lower next March). A cost of -6.77% was low enough (negative enough) to put Tesla in the top ten on a ranking of the new factor alone on Friday.

That post was published at 4:13am on Monday, August 23rd, so "Friday" above referred August 20th. Tesla was one of our system's top ten names on Friday, August 20th.

What Prompted That Post

What prompted that post was an email we received in August asking, essentially, why our recent performance numbers were bad. In response, we wrote,

In broad strokes, we found a factor that generated big alpha, and applied it to our process at the end of May of last year. It did well until the end of the year, selecting names like Tesla. Then it started to do poorly selecting names like Tesla early this year. So, the weighting we give this factor in our selection process has been coming down recently, but based on its past performance, it's still quite high. And I'm hesitant to put my thumb on the scale to knock it down further, because it might be right in picking names like Tesla now.

When Winning Streaks Start Again

So far, it looks like our system was right to pick Tesla-like names in August. Here's the performance of our top ten names from August 20th as of Friday's close.

As you can see, not all of our top ten from August 20th have been winners so far. Notably, the two losers, West Pharmaceutical Services, Inc. WST and Moderna, Inc. MRNA were business riding the COVID-19 vaccination wave. Tesla was the second best performer out of this cohort as of November 5th, trailing only the bitcoin miner Marathon Digital Holdings, Inc. MARA.

Spending More Time Winning Than Losing

It's probably impossible to time these things perfectly, but as we continue to collect data, we may be able to spend more time in winning streaks. It's likely that our selection factors have peaks and troughs that repeat; at some point, perhaps we'll stop using them when they approach a previous peak and start using them again when they approach a previous trough.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.