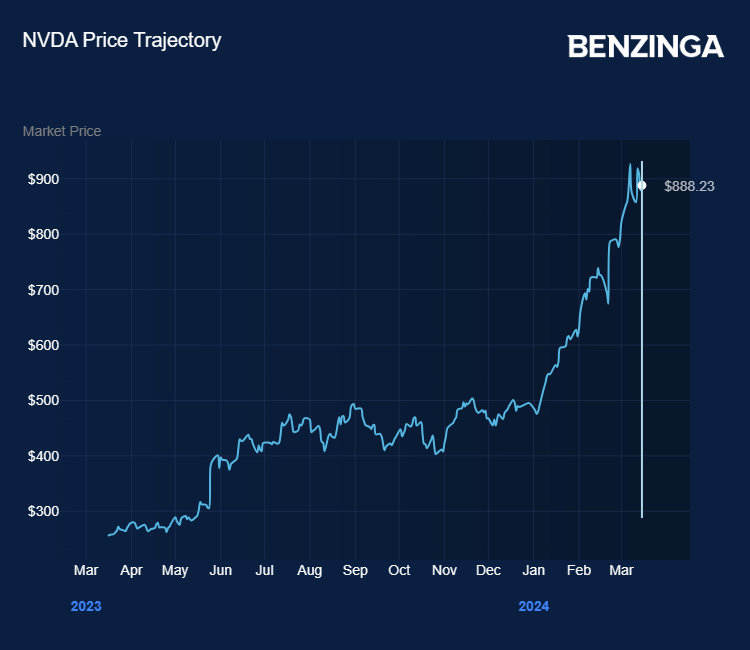

NVIDIA Corp NVDA blazed the trail for artificial intelligence-related stocks, raising some fears of overvaluation and a mounting tech bubble.

Not so, said analysts at Goldman Sachs this week, as earnings growth expectations warrant current lofty share price gains.

While Nvidia returned 522% since the start of 2022 and 84% year-to-date, Goldman analyst Ryan Hammond said the company’s price/earnings ratio was broadly unchanged since the start of 2023 with nearly all its return attributable to a higher stream of earnings.

For the sector, fears of a bubble could be largely discounted, he said. Three-year earnings growth expectations among the largest 10 tech stocks were around 15%, lower than the 24% seen during the tech bubble of 2000, while valuations were at 28x earnings, much lower than the 52x seen in 2000.

Also Read: Biden To Present Intel With CHIPS Act Award, Cementing Arizona As Semiconductor Hotspot

Three Subsequent Phases Of The AI Industry

Hammond believed that following the current, first, phase of AI which kicked off in 2023 with the emergence of ChatGPT — and provided Nvidia with huge profits — there would be three subsequent phases of the AI trade offering many investment opportunities.

Phase 2 — Infrastructure: “This will focus on those companies beyond Nvidia that are involved in the infrastructure necessary to build AI,” Hammond said.

This phase included other fabless chip designers such as Broadcom Inc AVGO and Advanced Micro Devices Inc AMD, and fab manufacturers like Intel Corporation INTC and GlobalFoundries Inc GFS.

Also included were manufacturers of chipmaking equipment and data center providers, as well as utilities as the growing demand for chips requires increased electricity.

Cloud providers such as Microsoft Corporation MSFT and Amazon.com Inc AMZN would be phase 2 beneficiaries.

Phase 3 — Enabled Revenues: In this phase, companies with business models incorporating AI in product offerings would boost revenues.

“We screen for companies that mention revenue-enhancing AI use cases,” said Hammond.

Here, the main beneficiaries would likely be software companies, including Adobe Inc ADBE, interactive services such as Meta Platforms Inc META and tech hardware providers like Apple Inc AAPL.

Phase 4 — AI Productivity: “Eventually, the AI trade will focus on companies across a variety of industries that can embrace the technology to improve their productivity,” said Hammond.

At the industry group level, Hammond thought software and services and commercial and professional services had the best potential earnings growth opportunities from AI adoption via labor productivity.

Hammond believed investors would trade Phases 2 and 3 faster than Phase 4 as it takes longer for firms to adapt to the possibilities of the productivity gains potential of AI.

Firms might also be initially reluctant to adopt AI technology if staff believed their jobs would eventually be replaced.

Exchange-traded funds that give investors exposure to the growing tech trends include the Global X Artificial Intelligence & Technology ETF AIQ, which gained 8% in 2024 and the iShares Semiconductor ETF SOXX, which was up 17% year-to-date.

Now Read: QuickLogic Shares Zoom 616% In 4 Years: Could This Chipmaker Be On A Nvidia-Style Trajectory?

Photo: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.