The first week of 2024 saw significant stock price appreciation for most of the 30 stocks Viridian Capital Advisors credit ranks weekly. As a proxy, the MSOS ETV rose 12.84%, the sharpest uptick since the HHS announcement at the end of August. There was no particular news to account for the uptick except for confirmation from the DEA that they are indeed studying the issue of rescheduling. The market just came back from the beaches wanting to believe.

Viridian believes that a move to schedule 3 with the benefit of eliminating 280e is likely. However, we are less inclined to think that the President will somehow push this through in time for the election. The DEA's process includes public comment periods and opportunities for challenges to its proposed rule-making. The timing to run this gauntlet is unclear but likely longer than the market wants to believe.

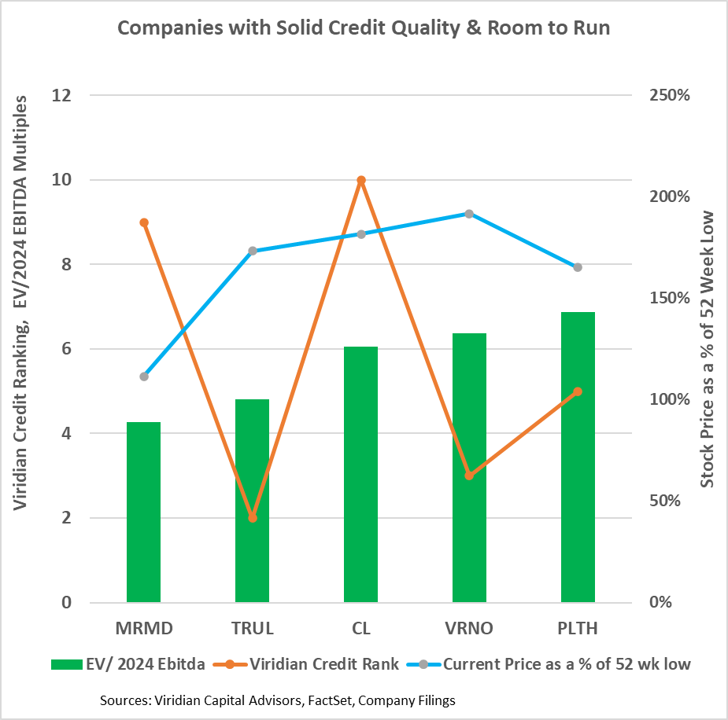

Against this backdrop, we applied several screens to look for attractive investments:

-

We restricted our search to companies ranked in the top ten in the Viridian Capital Credit Tracker Model, assuring that if positive catalysts are delayed, the companies chosen will have the staying power to survive the rugged environment we see in early 2024.

-

We restricted our search to companies trading at less than 2x their 52-week lows, eliminating d several companies that we think highly of but believe may be susceptible to a pullback, including Grown Rogue GRIN, Glass House Brands GLASF, and Curaleaf CURLF, trading at 3.3x, 2.6x, and 2.1x their 52-week low respectively.

-

Of the seven remaining companies, we picked the five trading at the lowest EV/2024 EBITDA. Each of the five companies in the chart is trading at less than 7x EV/2024 EBITDA. Green Thumb GTBIF and TerrAscend TSNDF were eliminated.

Marimed MRMD is trading at only 1.1x its 52-week lows and was only up 1.9% last week. Part of this underperformance stems from the company's missing its 3rd quarter estimates. However, we believe it is well poised for 2024 and trades at only 4.3x consensus 2024 EBITDA.

Trulieve TCNNF was up 14.4% last week but continues to trade at only 1.7x its 52-week low and 4.8x its 2024 consensus EBITDA. The company has made significant improvements to its balance sheet and overall profitability and has strong optionality with regard to a potential Florida adult use conversion.

Cresco CRLBF is the riskiest credit on the chart, ranking at #10; however, trading at only 1.8x its 52-week low and 6.06x 2024 EBITDA, the company will likely outperform the market.

Verano VRNOF is the third strongest credit in our rankings, and at 6.4x 2024 EBITDA, it has significant upside potential with lower-than-average pullback risk.

Planet 13 PLNH had a difficult 2023, with lower Las Vegas crowds and some stumbles in establishing its Florida presence, resulting in a modestly negative EBITDA year. Analysts are projecting significantly better results for 2024, and we take comfort in the low-leverage balance sheet.

The beginning of 2024 is a tricky investment climate. We have seen too many stocks trading up significantly based on rumors of imminent regulatory changes, only to drift lower as these catalysts fail to appear. Investors should look for solid companies that do not require changes to survive and are priced at a discount.

The Viridian Capital Chart of the Week highlights key investment, valuation and M&A trends taken from the Viridian Cannabis Deal Tracker.

The Viridian Cannabis Deal Tracker provides the market intelligence that cannabis companies, investors, and acquirers utilize to make informed decisions regarding capital allocation and M&A strategy. The Deal Tracker is a proprietary information service that monitors capital raise and M&A activity in the legal cannabis, CBD, and psychedelics industries. Each week the Tracker aggregates and analyzes all closed deals and segments each according to key metrics:

-

Deals by Industry Sector (To track the flow of capital and M&A Deals by one of 12 Sectors - from Cultivation to Brands to Software)

-

Deal Structure (Equity/Debt for Capital Raises, Cash/Stock/Earnout for M&A) Status of the company announcing the transaction (Public vs. Private)

-

Principals to the Transaction (Issuer/Investor/Lender/Acquirer) Key deal terms (Pricing and Valuation)

-

Key Deal Terms (Deal Size, Valuation, Pricing, Warrants, Cost of Capital)

-

Deals by Location of Issuer/Buyer/Seller (To Track the Flow of Capital and M&A Deals by State and Country)

-

Credit Ratings (Leverage and Liquidity Ratios)

Since its inception in 2015, the Viridian Cannabis Deal Tracker has tracked and analyzed more than 2,500 capital raises and 1,000 M&A transactions totaling over $50 billion in aggregate value.

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Cannabis is evolving—don’t get left behind!

Curious about what’s next for the industry and how to stay ahead in today’s competitive market?

Join top executives, investors, and industry leaders at the Benzinga Cannabis Capital Conference in Chicago on June 9-10. Dive deep into market-shaping strategies, investment trends, and brand-building insights that will define the future of cannabis.

Secure your spot now before prices go up—this is where the biggest deals and connections happen!