Elon Musk saw his net worth drop by over $20 billion since his May 8 appearance on SNL.

What Happened: The Tesla Inc TSLA CEO has been the subject of controversy after his SNL appearance sent the price of Dogecoin falling by over 30% in a day after he referred to it as a “hustle.”

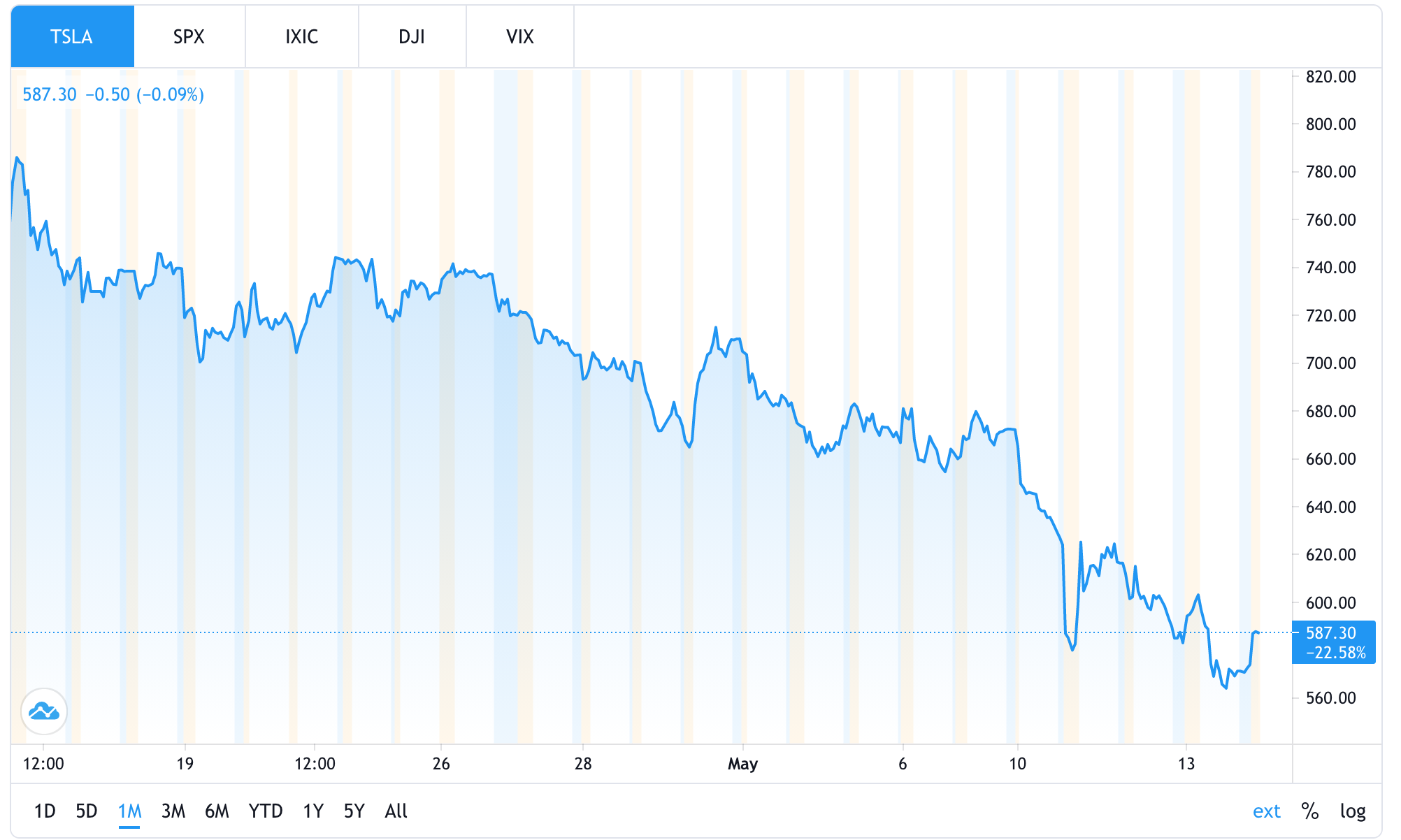

In the week that followed, Musk proceeded to tweet in DOGE’s favor once again while the shares of his own company fell by over 15%.

Tesla shares fell from $672 to $571 over a period of seven days, taking Musk’s net worth down by $20.5 billion to $145.5 billion according to Forbes’ most recent estimates.

On Wednesday, Musk caused yet another stir in the crypto markets after his announcement that Tesla would no longer accept Bitcoin as payment.

Wow. pic.twitter.com/jAAmmmFJtl

— TradingView (@tradingview) May 12, 2021

Why It Matters: Tesla’s decision to revoke the Bitcoin payment option and Musk’s comments might have implications beyond the crypto market, suggested Wedbush Securities analyst Dan Ives.

In an interview with CNBC, Ives called the decision “confusing and a risk to investors in crypto and the company’s stock.”

See also: Tesla Suspends Vehicle Purchases Via Bitcoin Over Environmental Concerns

The analyst, who has an outperform rating on Tesla, added that Musk’s “shocker” could increase volatility for the company’s stock.

Price Action: Tesla shares dipped slightly during after-hours trading but had re-entered positive territory during the pre-market session to $585 at press time.

Meanwhile, the leading cryptocurrency Bitcoin, was trading at $50,666 and its market dominance had fallen to 40.66%, according to CoinMarketCap.

Image: Daniel Oberhaus on Wikimedia Commons

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.