As a primer, $2.85 billion cap Sothebys BID does not own Sotheby's International Realty (SIR), however, sales agents and franchise affiliates do "benefit from an association with the venerable Sotheby's auction house, established in 1744."

In February 2004, Realogy Holdings Corp RLGY entered into a long-term, strategic alliance with Sotheby's, the operator of the auction house. The agreement provided the licensing of the Sotheby's International Realty name and the development of a full-franchise system.

How Wealthy Is UHNW?

"The Global Luxury Residential Real Estate Report 2015," co-authored by Wealth-X, draws the line at $30 million and above when it considers who actually meets the criteria for ultra-high net worth (UHNW) real estate buyers.

However, the median UHNW individual has a net worth of $87 million; notably, 7 percent of these individuals earned their wealth through the real estate industry.

Just in case you didn't get your copy of the SIR inaugural 2015 report, do not fret; below are a few key takeaways.

Buyer Profile

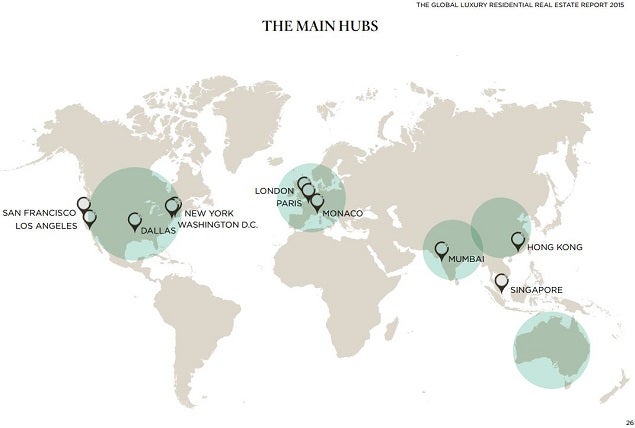

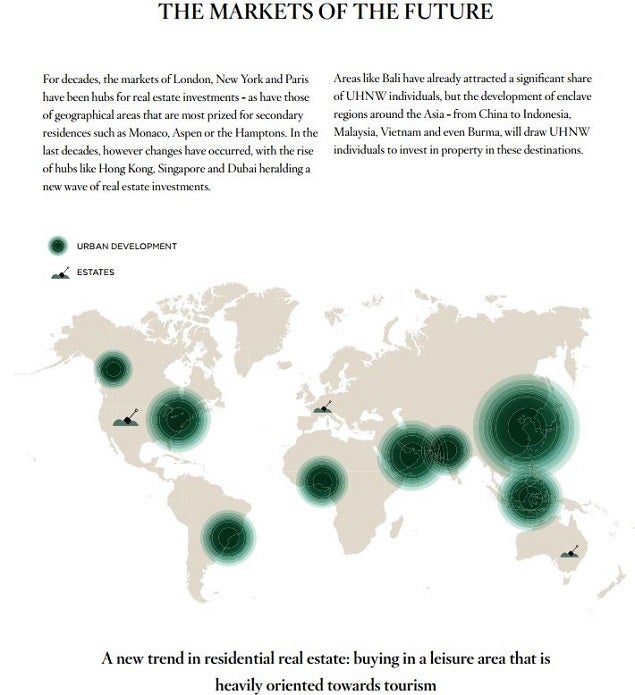

Luxury Real Estate Hubs

Here are the factors that top luxury real estate locations have in common:

- Concentrated business environment – often related to the finance industry.

- Proximity to some of the world's largest markets.

- English proficiency.

- Stable real estate markets.

- Strong and consistent historical economic performance.

- Strong and stable institutional frameworks.

- High living standards, taking into account such factors as weather, health, leisure activities and transport.

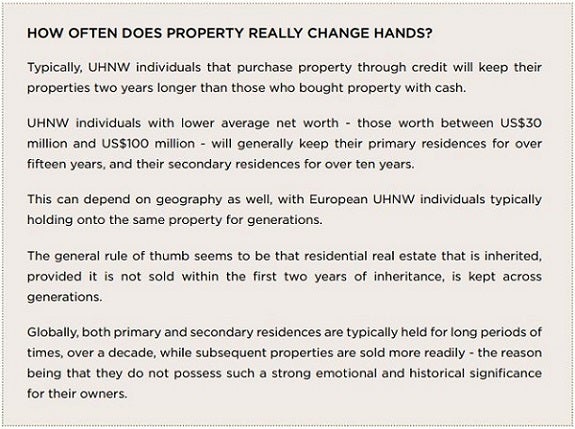

The Art Of The Deal

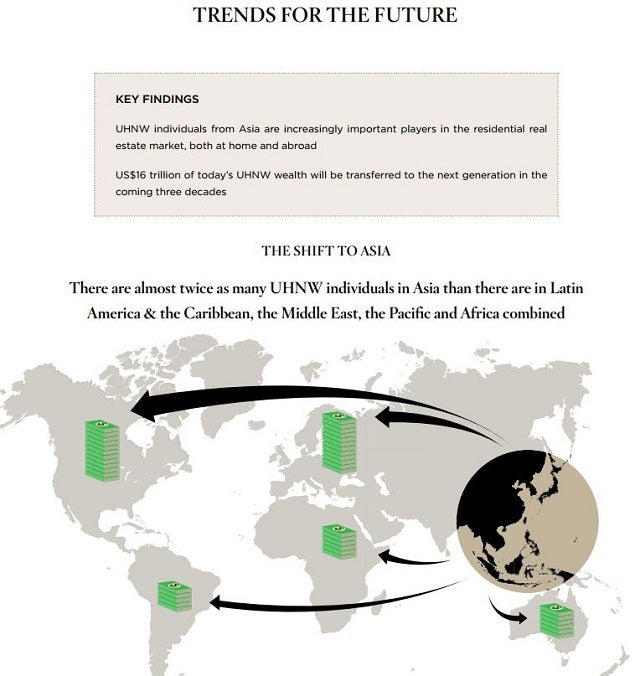

Skating To Where The Puck Is Headed

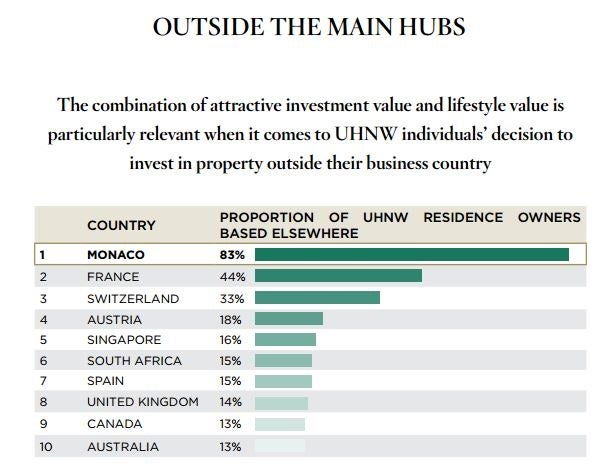

Expatriate Investing Preferences

An International Shift

Bottom Line

These trends should make it easier to locate and identify the billionaire next door. However, savvy U.S. investors already know that Omaha, Nebraska has at least one pin in the map.© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.