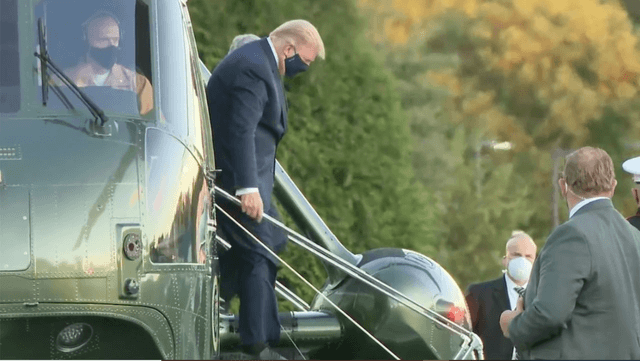

President Trump exits Marine One at Walter Reed National Military Medical Center after being diagnosed with COVID-19 (photo via Fox 5 New York).

Military DEFCON 5, Market DEFCON 3

After President Trump announced on Thursday that he and the First Lady were being tested for COVID-19, Twitter users made Tim Hogan's tweet about spotting Boeing E-6 Mercury planes go viral. Quoting Hogan's tweet, Alexandra Chalupa described the purpose of that plane in alarming, but essentially correct, language.

In fact, as Marc Ambinder, Christiaan Triebert and others pointed out, those "doomsday" planes are always airborne as part of America's nuclear deterrent.

That discussion of America's nuclear deterrent brought to mind the DEFCON (defense condition) system of alerts. In that system, DEFCON 5 is the least severe alert state, and DEFCON 1 is the most severe. America is currently at DEFCON 5, but investors ought to be at DEFCON 3.

Political Risk Is Systemic Risk

A few weeks ago, a Finnish business journalist asked me which candidate would be worse for the market. I told her that the risk in the near term wasn't either candidate winning, but neither candidate winning. In other words, the best thing for near term returns was a decisive election night victory. In a recent article ("As Election Looms, Investors See Uncertainty. They Don't Like It."), investment professionals interviewed by the New York Times made similar points. For example:

“The single biggest comment that I hear is, ‘I want an election, I want a result of an election that is so clear that it can’t really be contested,’” said Doug Rivelli, president of the institutional brokerage firm Abel Noser in New York.

In the same article, Steve Sosnick, chief strategist at Interactive Brokers, raised the prospect of force being used to decide the issue:

I can’t remember a time where U.S. citizens had to worry about whether there would be a peaceful transfer of power, and whether all parties would have any doubt in accepting the electoral results.

Last Wednesday, I would have characterized the systemic risk associated with that political uncertainty as DEFCON 4. Now that President Trump has been hospitalized with COVID-19, I would elevate that to DEFCON 3.

Hedging Against Systemic Risk

In the brief video below I show a couple of ways of hedging systemic risk out past the election. The basic approach is this:

- Select one or more index-tracking ETFs as a proxy or proxies for your portfolio. For simplicity's sake, in the video I have assumed your portfolio is highly correlated with the S&P 500, so the ETF used is the SPDR S&P 500 Trust SPY.

- Calculate how many shares of the proxy ETF or ETFs correspond with the dollar value of your portfolio.

- Decide how much downside you're willing to risk.

- Scan for the optimal puts on your proxy ETF to protect against any risk greater than you're willing to tolerate.

If your portfolio includes a significant amount of fixed income, precious metals, or other non-stock asset classes, a similar approach can be used with proxy ETFs for those asset classes. Since it's relatively inexpensive to hedge against systemic risk out to late November now, investors ought to consider doing so.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.