In a new report, Morgan Stanley analyst Carmen Nuzzo discussed the ways inequality can impact the economics of a country and what that means for investors.

In addition, Nuzzo highlights the recent trends in inequality, particularly in developed markets (DMs).

Why Does Inequality Matter?

According to Nuzzo, inequality is not just about income, but includes imbalances based on education, health services, gender, age and race. In the long term, even the wealthiest participants in an economy have a vested interest in a certain degree of widespread income prosperity.

“If the distribution is too uneven with a persistent and widening gap between the top and the bottom of the scale, it prevents broad participation in the welfare gains of growth, and, over time, risks corroding the economic and social fabric of a country,” Nuzzo explained.

Is Inequality Getting Better Or Worse?

While inequality among different countries tends to be globally trending lower, income inequality within many DM countries has been on the rise in recent years.

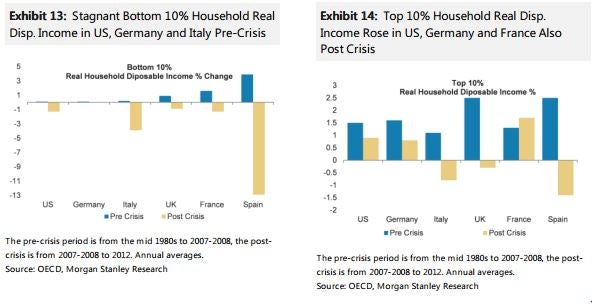

Disposable income growth for the bottom 10 percent of earners in many DM countries has lagged the income growth of the top 10 percent both before and after the Financial Crisis.

Stock Picks

Morgan Stanley believes companies that are able to embrace complexity and have solid supply chains and technological advantages are well positioned to handle the growing inequality gap.

The firm's top stock picks include the following names:

- Constellation Brands, Inc. STZ

- Estee Lauder Companies Inc EL

- WhiteWave Foods Co WWAV

- Mondelez International Inc MDLZ

- Ryanair Holdings plc (ADR) RYAAY

- Delta Air Lines, Inc. DAL

- Spirit Airlines Incorporated SAVE

Disclosure: The author holds no position in the stocks mentioned.

Image Credit: Public Domain© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.