The major REITs traded mostly lower on Friday with a few exceptions. Ahead of the weekend, the units are re-pricing the effects of a strong jobs report which suggests more definitely the likelihood of the Fed raising interest rates, perhaps more than expected.

Independence Realty Trust IRT was the biggest loser in the sector Friday, with a loss of 2.10%:

By trading back down toward the level of the June lows, these units are, in effect, re-testing those lows. It would be bearish to close much lower than that area just above $20 per share. Independence Realty Trust is the Philadelphia, Pennsylvania residential REIT paying a 2.70% dividend.

Related: Like Dividends? Then You'll Love These High-Yield Investments

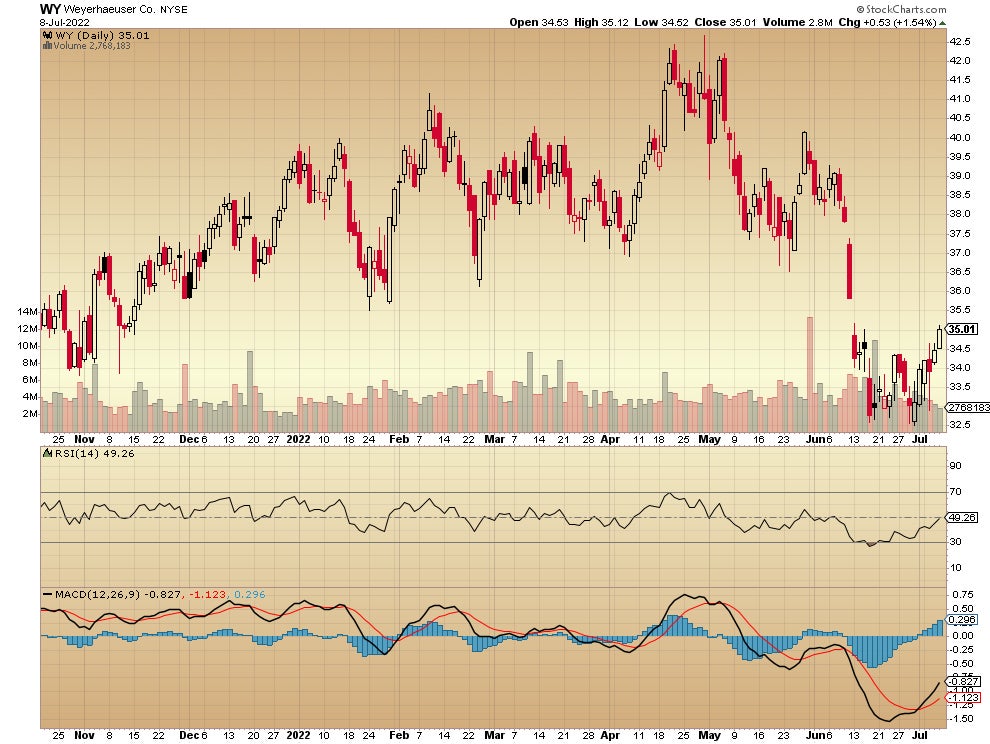

Weyerhaeuser Co WY managed to go the other way, closing the day up by 1.54%:

It appears to be headed for the “gap down” area just below $36 where the REIT suffered a serious mid-June collapse. Note how different the trend is compared to the Indepence Realty price chart pictured above. Weyerhaeuser is continuing upward with obvious strength. The timberland REIT is paying investors a 2.09% dividend.

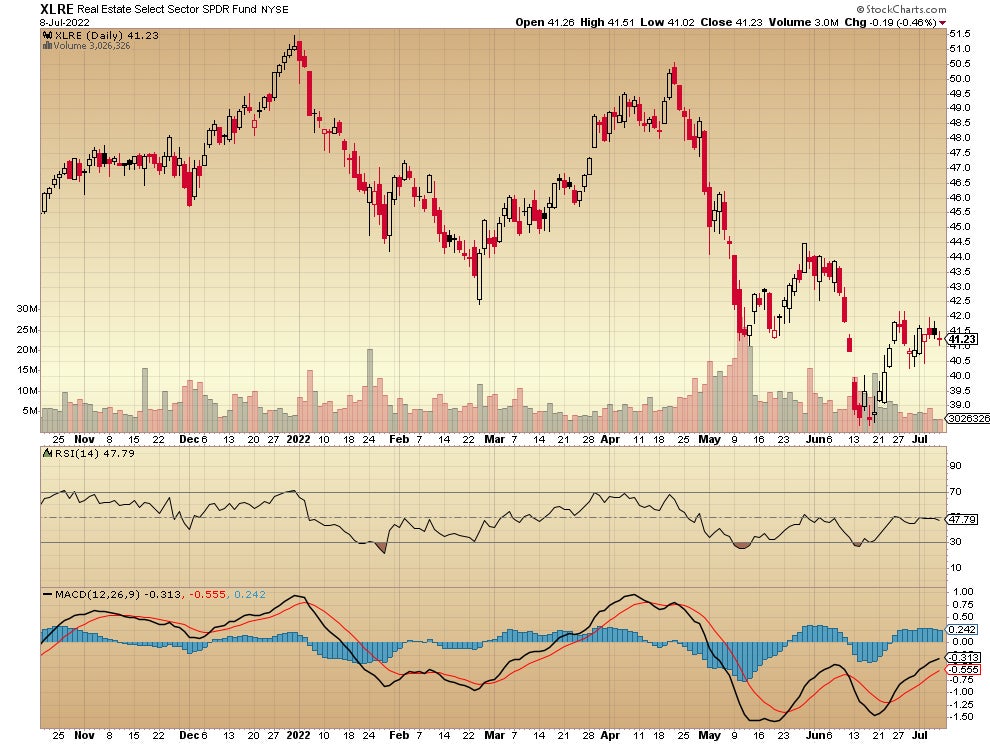

The benchmark for the REITs, the Real Estate Select Sector SPDR XLRE closed the day lower by .46%:

The close for the widely followed REIT “index,” composed of many different components, suggests a lack of excitement Friday for most of the sector.

Read Next: This Non-Listed Real Estate Fund Continues To Outperform Publicly Traded REITs

Not investment advice. For educational purposes only.

Charts courtesy of StockCharts

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.