You might have been playing with the idea of trading binary options or spreads. If you attended the Trader’s Expo in Las Vegas, you probably noticed there were many booths and classes dealing with trading spreads and binaries.

How are they different? How can you trade them? What if you trade something else? Can you incorporate binaries or spreads into your trading? This article will define the basic differences.

Binary Options

Binary options are traded on many instruments. There are different exchanges or brokerages that offer to help you trade, but the best way to trade is by using a CFTC regulated exchange. North American Derivatives Exchange, Nadex, is a U.S. regulated exchange. This means that member funds are held in segregated bank accounts within the US. They offer full transparency on every trade and you have no need for a broker. You can also open a demo account free and try out trading without risking anything. Nadex offers both binary options and spreads. Visit www.nadex.com and learn more.

A binary option is a Yes/No or True/False statement as of expiration. You are stating that either you agree with a statement or you do not. At expiration, a binary trade settles with all or nothing. If your trade answered the binary’s statement correctly, you get the full payout of $100 minus the amount you risked upon entry. If your trade did not answer correctly, your trade lost and you get zero. You always know your risk/reward before you place each trade. Your risk is capped and you can never lose more than your initial collateral. There are no margin calls.

The image below shows both an order ticket and a screenshot for a USD/JPY binary option. On the ticket, marked by the green arrow, you will see the True/False statement, which in this case says the underlying price of the USD/JPY will be greater than 120.67 at 3 a.m. ET on October 29, 2015. If you agree with that statement, you would buy. If you think the statement is false, you would sell. By selling, you are saying that the underlying price will be at 120.67 or below. The green arrow on the scanner shows the corresponding strike.

To view a larger image, click HERE.

The blue arrows point out the risk/reward and the max profit and loss, all of which are known before you even hit the button to place your order for the trade.

However, winning and losing can come down to the difference of one tenth of a tick. You may risk $80 and that one tenth of a tick can allow you to lose it all. It can be exciting or stressful. You do not have to stay in a trade until expiration. You may exit at any time in order to protect your profits or cut your losses.

Binaries are a statistical trading vehicle, so you need to be familiar with the stats and expected ranges of the markets you want to trade. You cannot blindly trade binaries and expect to be profitable.

Spreads

If you have been trading Binary options, you have to stop thinking like a binary trader, when you trade spreads. Spreads are not an all or nothing settlement. They are based on one tick difference. With spreads, one tick equals one dollar.

Binaries vs. Spreads

With all the things you may hear about binary options, you might feel they are very exciting. Binary options are easy to understand, but they are harder to trade than spreads without statistical backing of a system for a longer period of time.

Spreads are harder to understand but easier to trade. Once you understand the basics and understand the risk/reward, you will love spreads! Most beginners and even intermediate traders would be better off trading spreads than binaries, especially those with smaller accounts.

It isn’t always easy to find a binary where you can risk $15 to make $15. It is much easier to find that on a spread. There are several markets that have low bid/ask spreads such as Nadex US Tech, Gold, S&P.

Many times when trading binary options, traders will go in and put up $50-80 to make $10-20. When trading spreads, with each tick being worth one dollar, it isn’t hard to get 15-20 ticks of movement, day or night, even without a lot of movement happening in the market. It may be hard to get 80 or 100 ticks of movement, but not 15-20. Don’t let the $15 limit you! You can do more contracts. You don’t need a lot of movement.

How Do Spreads Work?

On a spread, there is a top and a bottom, known as the floor and the ceiling. The floor and the ceiling are defined and set for you by Nadex. You cannot win or lose more than the floor or the ceiling, depending on the direction of your trade. For example, suppose you are trading USD/JPY. The floor is 120.10 and the ceiling is 121.10. The spread is the difference between the floor and the ceiling. Forex pairs move in pips because you have two different currency pairs. Other instruments move in ticks. Each tick/pip is worth one dollar and there are 100 pips in this example. This spread is worth $100.

If you sell at 121.00, your risk is the difference between the ceiling 121.10 and the sell price 121.00, so your risk would be $10. Your max profit would be $90, but the market would have to move 90 pips to make max profit.

It works the same way if you are buying. If you bought at 120.20, your risk would be the difference between your buy price 120.20 and the floor 120.10 or $10. Your max profit would be the difference between your bought price and the ceiling, 90 pips or $90.

Spreads are for simple directional trades. If you think the market is going up, you buy. If you think it is going to go down, you sell. When the spread expires, it will close at the settlement price at the time of expiration. The settlement price is based on the underlying market price. If you bought at 120.20 and the market settled at 120.90, you would make $70. However, if you bought at 120.20 and the market moved against you down to 119.50, you would only lose $10 because it is capped risk. This is a relaxing way to trade.

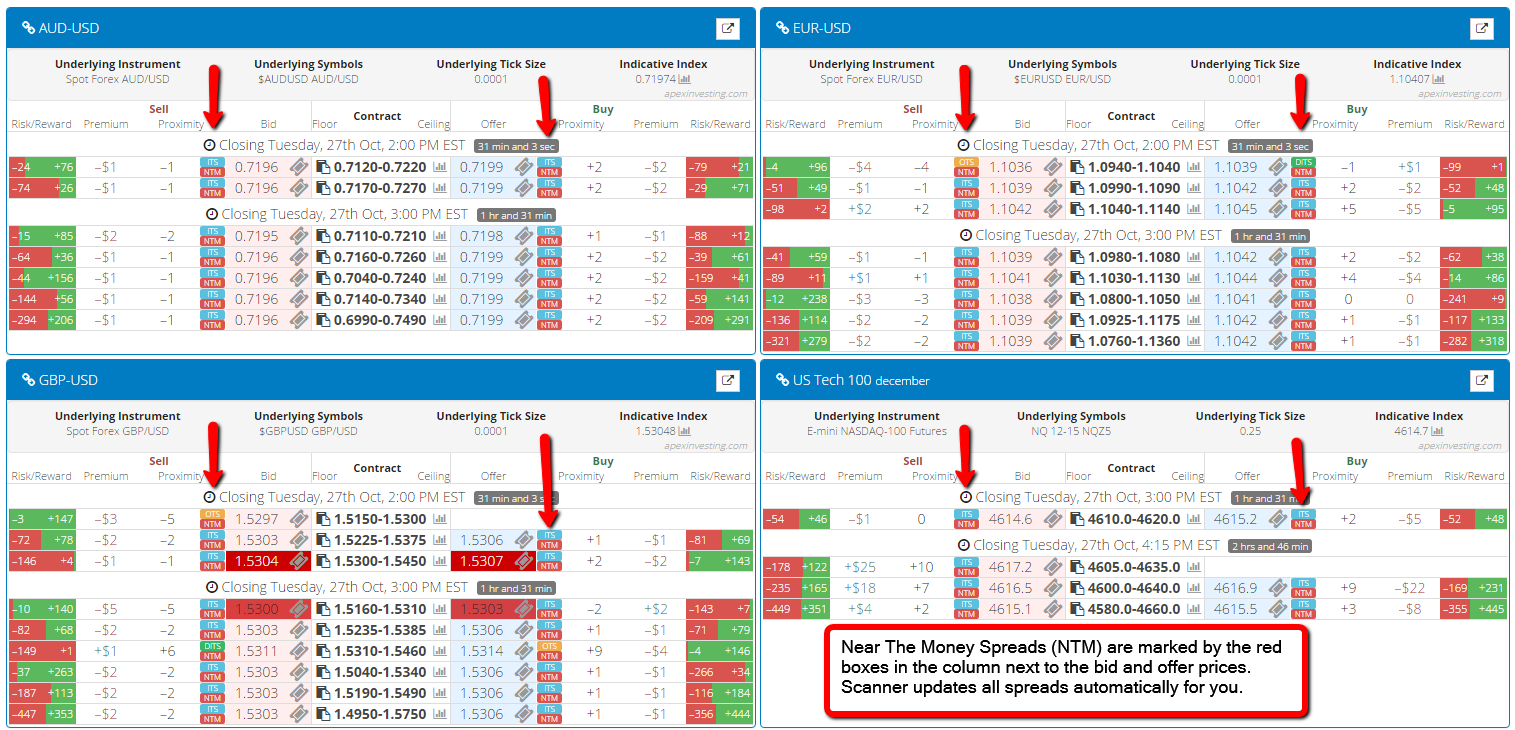

To make it even easier, you can visit apexinvesting.com where you can use the spread scanner free and find Near the Market spreads, shown as NTM and highlighted in red on the scanner. This will enable you see spreads that are closest in proximity to strike prices thus helping you choose your trades.

To view a larger image, click HERE.

Duration and Expiration

There are Intraday, and Daily spreads available to trade. Intraday expire in as little as two hours. Daily can go up to 22 hours and 15 minutes. The larger time frames will always have a wider range between the floor and the ceiling. Shorter time frames will be narrower. The expiration time will always be quoted in Eastern Time.

Spread Range

The spread range is the distance between the floor and ceiling of the spread. There will be three spreads offered per expiration per range: one in the middle of the range with one above and one below.

To view a larger image, click HERE.

The basics of spreads are easy to understand. They have a floor and a ceiling with capped risk and reward. You can buy and sell having each tick or pip worth one dollar.

Choosing to trade binary options or spreads will depend on the type of trading you want to do as well as the type of trading personality you possess. Learn more about the ins and outs of trading both binary options and spreads by visiting www.apexinvesting.com. There you can also utilize the free binary and spread scanners, a service of Darrell Martin.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.