The U.S. index futures point to a mixed start on Monday, reflecting cautious sentiment ahead of the January consumer price inflation report due to be released on Tuesday. The S&P 500 and Nasdaq Composite futures gained ground, while the Dow futures were slightly lower.

Cues From Last Week’s Trading:

The major averages pulled back in the week ended Feb. 10, reacting to mixed earnings and inflation worries. This triggered concerns among traders, who have already discounted a Fed pause in the near term based on Fed Chair Jerome Powell’s “disinflation” references in his recent public speeches.

See Also: Best Binary Options Strategies

The tech-heavy Nasdaq Composite settled at its lowest level since the end of January.

| Index | Performance (+/-) | Value | |

|---|---|---|---|

| Nasdaq Composite | -2.41% | 11,718.12 | |

| S&P 500 Index | -1.11% | 4,090.46 | |

| Dow Industrials | -0.17% | 33,869.27 |

Analyst Color:

While monetary policy tightening, surging interest rates and inflation, and slowing growth caused widespread pessimism, the impressive comeback staged by stocks since the start of the year suggests “bears may be finally going into hibernation,” said LPL Financial’s Chief Technical Strategist Adam Turnquist.

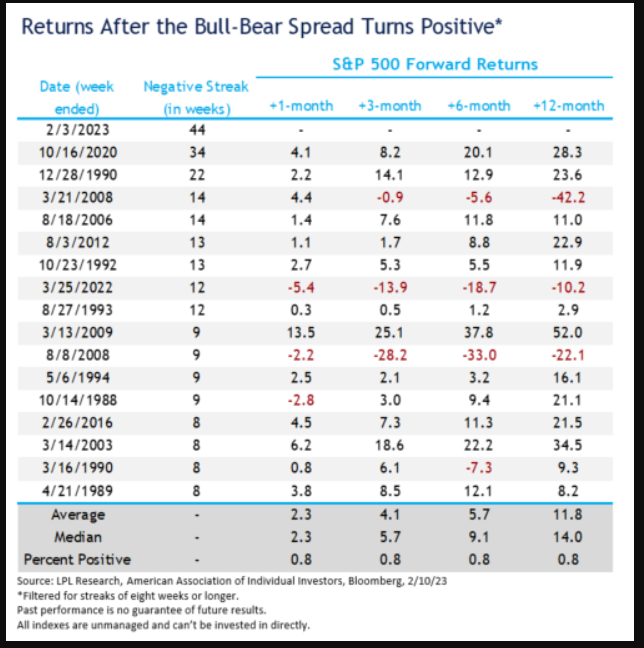

To make his case, the analyst pointed to the American Association of Individual Investor’s weekly survey, which showed the bull-bear index, calculated as a difference between bullish and bearish sentiment, turning positive in the recent week for the first time in 45 weeks, he noted. This ended the longest streak of negative readings on record, he added.

Historically after a prolonged bearish streak — more than eight weeks of negative sentiment — ends, the S&P 500 has generated positive returns, Turnquist noted.

"On a 12-month basis, the index produced respective average and median returns of 11.8% and 14.0%, with 13 of the 16 periods yielding positive returns,” he said.

Source: LPL Financial

“The recent transition toward improving optimism suggests investors are becoming more confident with the latest recovery in stocks, something absent from prior recovery periods in 2022," Turnquist said.

Futures Today

| Index | Performance (+/-) | |

|---|---|---|

| Nasdaq 100 Futures | +0.39% | |

| S&P 500 Futures | +0.10% | |

| Dow Futures | -0.05% | |

| R2K Futures | -0.13% |

In premarket trading on Monday, the SPDR S&P 500 ETF Trust SPY moved up 0.11% to $408.50, while the Invesco QQQ Trust QQQ gained 0.43% to $301, according to Benzinga Pro data.

Upcoming Economic Data:

Federal Reserve Board Governor Michelle Bowman is scheduled to make a public appearance at 8 a.m. EST.

New York Federal Reserve’s U.S. consumer inflation expectations for January are due at 11 a.m. EST. In December, the median one-year-ahead inflation expectations continued to decline, falling by 0.2 percentage points to 5%, its lowest reading since July 2021. The three-year-ahead inflation expectations were unchanged at 3%.

The Treasury will auction 3-month and 6-month bills at 11:30 a.m. EST.

Stocks In Focus:

- Nikola Corp. NKLA rose over 2% in premarket trading after Wall Street Journal reported that the company has started working on hydrogen plants and signed agreements to secure hydrogen supply for its vehicles in part of the U.S. and Canada.

- Meta Platforms Inc. META rose over 1% after a Financial Times report said the company has delayed finalizing budgets for multiple teams and is bracing for fresh job cuts.

- C3.ai, Inc. AI, which has been highly volatile amid increasing interest in AI technology, rose over 4%.

- Avis Budget Group Inc. CAR, Palantir Technologies Inc. PLTR, iRobot Corp. IRBT, Vornado Realty Trust VNO and Lattice Semiconductor Corp. LSCC are among the notable companies releasing their earnings reports after the market close.

Top Analysts’ Call

- Caterpillar Inc. CAT: Baird downgrades from Outperform to Neutral and reduces price target from $290 to $230.

- Advanced Auto Parts Inc. AAP: Roth Capital downgrades from Buy to Neural and reduces price target from $180 to $140.

- Five Below Inc. FIVE: Roth Capital upgrades from Neural to Buy and raises price target from $180 to $240.

Commodities, Bonds, Other Global Equity Markets:

Crude oil futures were reversing course on Monday, with a barrel of WTI-grade crude oil traded fetching $79.05, down 0.83%. Meanwhile, the yield on the benchmark 10-year U.S., which breached the 3.7% level on Friday, held above the mark at 3.735%, down 0,007%.

Most Asia-Pacific markets closed Monday’s session lower, as traders expressed uneasiness over the U.S. Fed rate outlook. The Chinese market, on the other hand, advanced strongly.

European stocks were seen rebounding from Friday’s declines. The major averages in the region were modestly to moderately higher in late-morning trading.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Date | ticker | name | Actual EPS | EPS Surprise | Actual Rev | Rev Surprise |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.