Trading in the major U.S. index futures suggests stocks may extend their losses for a second straight session. Caution will likely be the watchword as Fed Chairman Jerome Powell and his team kickstart a two-day monetary policy meeting on Tuesday.

Cues From Monday’s Trading:

On Monday, stocks reversed course amid Fed jitters and ended the session notably lower. The major averages opened the session lower but cut their losses in early trading, with the Dow Industrials even breaking above the unchanged line.

See Also: Best Futures Trading Software

Renewed selling dragged the indices lower, and they languished below the flat line for the remainder of the session.

The sell-off was nearly broad-based, with energy, communication services, technology and consumer discretionary sectors being the worst hit.

| Index | Performance (+/-) | Value | |

|---|---|---|---|

| Nasdaq Composite | -1.96% | 11,393.81 | |

| S&P 500 Index | -1.30% | 4,017.77 | |

| Dow Industrials | -0.77% | 33,717.09 |

Analyst Color:

Last year’s underperformers have turned outperformers so far this year, driving S&P 500 Index’s rally, LPL Financial’s chief technical strategist Jeffrey Buchbinder said in a note.

The market, operating on a forward-looking basis, ignored the not-so-positive earnings and has begun discounting a slowdown in inflation and a less hawkish Federal Reserve over the course of 2023, he said. “Although the trajectory of the rally will likely slow, seasonal indicators point to a path higher for U.S. equity markets by year-end,” he added.

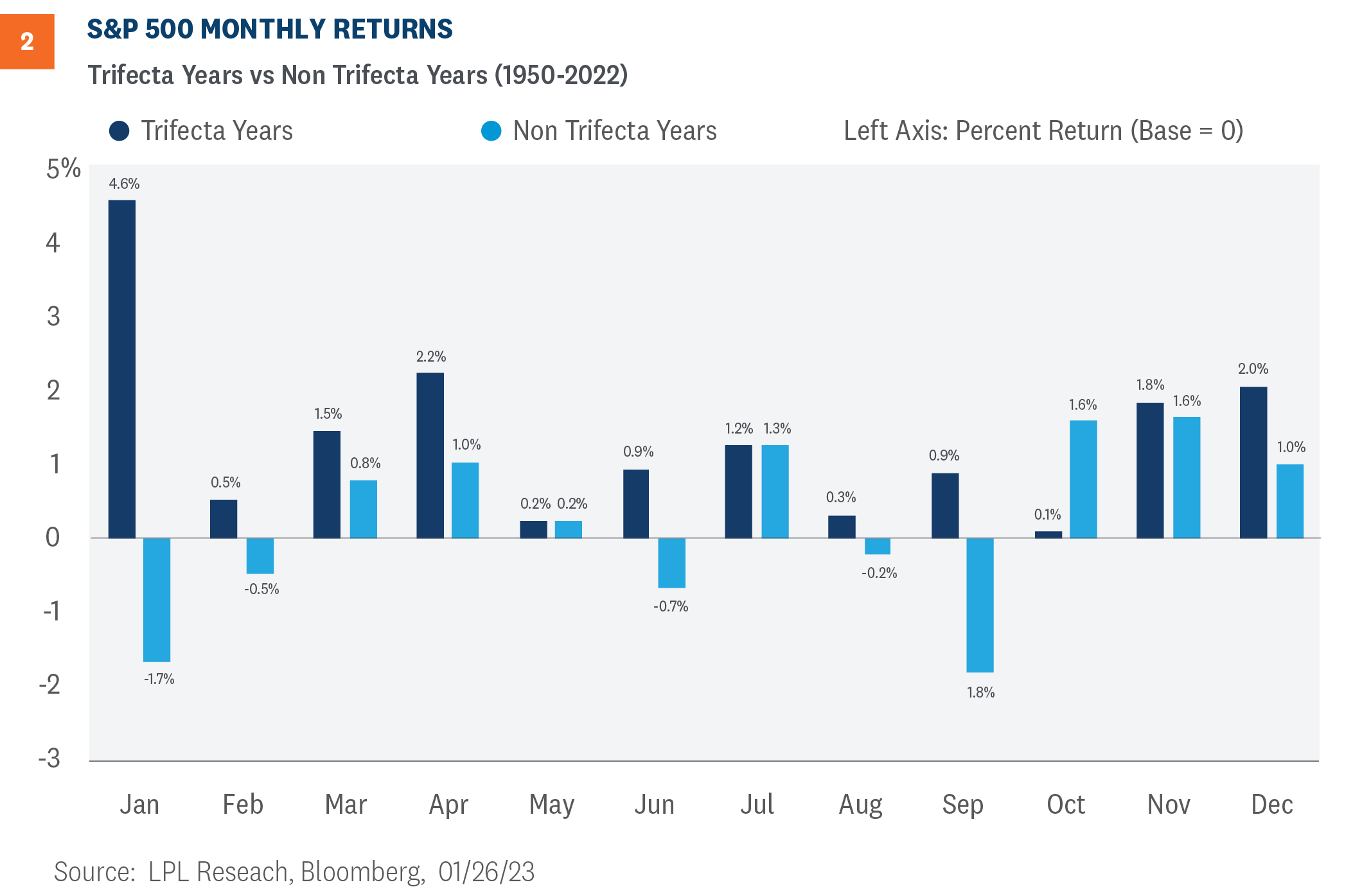

The analyst highlighted a trifecta of a Santa Claus rally, the first five days of the year and the January barometer, and said if all three are positive, market returns have been very strong historically.

Source: LPL Financial

He noted that the S&P 500 was up 0.2% from the last five trading sessions of 2022 to the first two trading sessions of 2023. And the first five sessions of 2023 generated a 1.4% return for the S&P 500 Index. The index looks set to end January with a gain.

Futures Today:

| Index | Performance (+/-) | |

|---|---|---|

| Nasdaq 100 Futures | -0.63% | |

| S&P 500 Futures | -0.46% | |

| Dow Futures | -0.39% | |

| R2K Futures | -0.64% |

In premarket trading on Tuesday, the SPDR S&P 500 ETF Trust SPY fell 0.45%, to $398.79, and the Invesco QQQ Trust QQQ retreated 0.68%, to $288.30, according to Benzinga Pro data.

Upcoming Economic Data:

The Labor Department is scheduled to release its fourth-quarter employment cost index at 8:30 a.m. EST. The index is widely expected to rise 1.1% quarter-over-quarter, almost flat with the 1.2% increase in the third quarter.

The Federal House Finance Agency’s house price index for November is due at 9 a.m. EST. House prices may have dropped 0.4% month-over-month compared to unchanged prices in October.

The results of the S&P Case-Shiller house price survey are also expected at 9 a.m. EST. The 20-city composite index is expected to drop 0.6% month-over-month in November, faster than the 0.5% decline in October.

The ISM-Chicago’s regional Chicago purchasing managers’ index for January will be announced at 9:45 a.m. EST. The headline business barometer index is expected to remain in contraction territory, although seeing a slight improvement from 44.9 in December to 45.1 in January.

At 10 a.m. EST, the Conference Board will release its consumer confidence index for January. Economists, on average, expect the index to improve from 108.3 in December to 109.0 in January.

Stocks In Focus:

- NXP Semiconductors N.V NXPI fell over 4% in premarket trading following the chipmaker’s lackluster guidance.

- Carvana Co. CVNA extended its recent rally that has been fueled by an options frenzy.

- Caterpillar Inc. CAT, Exxon Mobil Inc. XOM, General Motors Corp. GM, McDonald’s Inc. MCD, Pfizer Inc. PFE, Spotify Technology SA SPOT and United Parcel Service Inc. UPS are among the high-profile companies reporting earnings ahead of the market open.

- Notable companies reporting after the close include Snap Inc. SNAP, Amgen Inc. AMGN, Advanced Micro Devices Inc. AMD, Electronics Arts Inc. EA and Western Digital Corp. WDC.

Commodities, Bonds, Other Global Equity Markets:

Crude oil futures were extending their slide and traded under $77-a-barrel and the 10-year U.S. Treasury note hovered above 3.5%.

The Asia-Pacific markets ended Tuesday’s session lower amid apprehensions concerning the Fed rate decision. The Indian market bucked the downtrend with a marginal gain.

European stocks are trading notably lower, with Fed rate worries and some negative economic data from the region weighing on sentiment. The German economy unexpectedly contracted in the fourth quarter, data released by the German Federal Statistical Office, raising prospects of a potential recession.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Date | ticker | name | Actual EPS | EPS Surprise | Actual Rev | Rev Surprise |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.