Goldman Sachs sees Marvell Technology Group Ltd. MRVL as a potential M&A candidate, as a turnaround looks tough.

Revenue Growth Potential

The new management team claims Marvell can improve revenue growth, expand its gross margins and lower its R&D to sales ratio. But, the brokerage feels doing all three would be difficult.Marvell receives over 50 percent of its revenue from declining or matured markets such as HDDs (40 percent of revenue), printers (2–5 percent) and enterprise campus switching (10+ percent).

“We estimate its SSD exposure is only about 6 percent of revenue. Further, we believe lowering R&D intensity could be difficult as many competitors spend more total R&D dollars than Marvell, and as Marvell may need to invest to grow,” analyst Mark Delaney wrote in a note.

The analyst expects HDD units to decline at an estimated 8 percent CAGR and SSD units to increase at an estimated 14 percent CAGR from 2015–2020.

However, Delaney believes there is upside potential to Street gross margin estimates, as Marvell winds down its baseband business.

Strategic Options, Tailwinds

Although unconfirmed, reports from DealReporter and the NY Post suggest Marvell is exploring strategic options. Goldman Sachs assigns 30–50 percent probability of M&A for Marvell.

“Given the industry M&A trend and China’s interest in storage/memory, we believe Marvell has assets that could make it appealing as a potential M&A candidate,” Delaney noted.

Marvell also has assets in areas like WiFi and controllers that could be interesting for a company seeking to expand IoT capabilities.

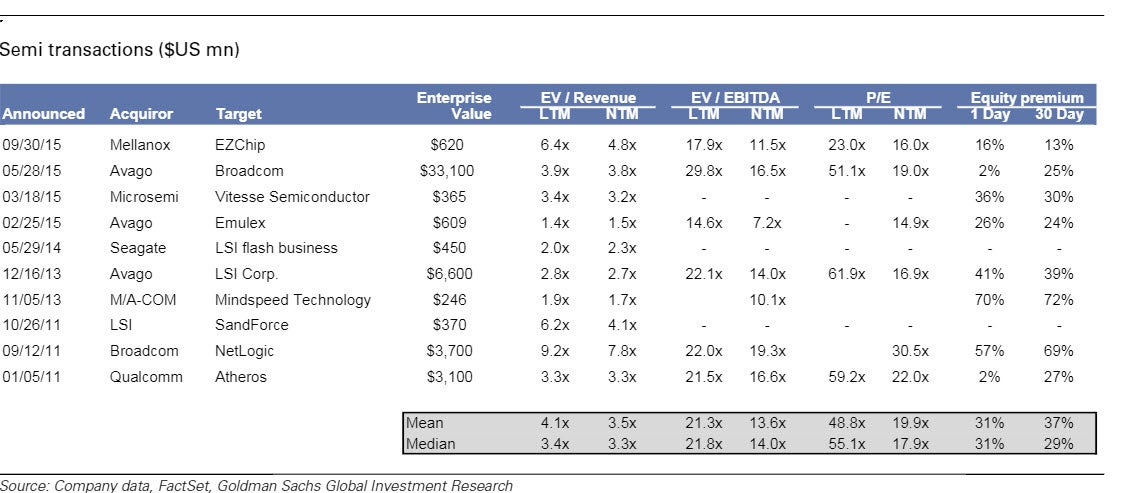

Delaney added that Marvell’s peers in controllers, WiFi and networking have been acquired at a median valuation of about 14X EV/NTM EBITDA.

Following are the semiconductor companies operated in Marvell’s markets that were acquired in the recent past:

Goldman reinstated its coverage of Marvell with a Neutral rating and $12 price target on the stock, which closed Friday’s trading at $12.94.

Full ratings data available on Benzinga Pro.

Do you have ideas for articles/interviews you'd like to see more of on Benzinga? Please email feedback@benzinga.com with your best article ideas. One person will be randomly selected to win a $20 Amazon gift card!

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.