With the potential for a December Federal Reserve rate hike looming large, a number of U.S. regional bank stocks are currently trading at or near multi-year highs. In a new report, Brean Capital analyst Frank Longman took a technical look at the charts of eight U.S. regional bank stocks that could be breaking out soon.

Screening For Winners

Longman screened the Russell 2000 Value index for banks testing multi-year highs and came up with so many names, he believes a new era could be dawning for regional banks.

“We’ve long thought that someday regional banks, as a huge and diverse group could be ‘the next biotech’ (in a good way) where breakouts happen in a series,” he explained.

While Longman noted many recent breakouts could pause to re-test support and consolidate prior to moving higher, opportunistic investors can use these pullbacks to take positions at a lower cost.

Here are the top trading ideas based on Brean’s bank stock screen.

Longman sees potential for a move to $34.50 from BancorpSouth, Inc. BXS.

Longman thinks CVB Financial Corp. CVBF has a good chance to touch $21.60 in coming weeks, and a stop placed at or below $16.10 would limit downside.

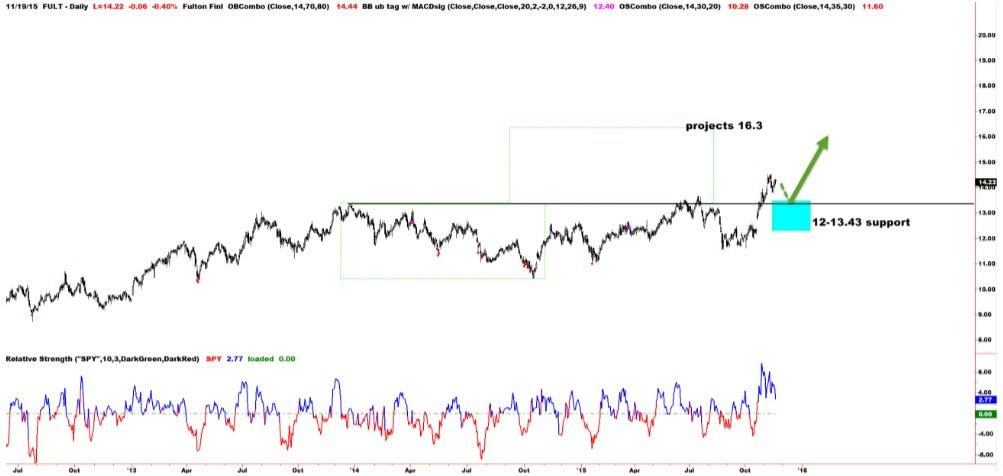

Longman sees potential for a 21.3 percent swing in Fulton Financial Corp FULT from $13.43 to $16.30.

If Glacier Bancorp, Inc. GBCI finds a way to break above resistance at $30, Longman sees a push to the $39 level.

Longman sees a stacked base near-term target of $41.50 for MB Financial Inc MBFI.

If Old National Bancorp ONB breaks above $16, Longman believes it will make a push for $19.45.

Assuming the recent move above $10.58 wasn’t a false breakout, Longman predicts that Valley National Bancorp VLY will soon hit $12.90.

Longman believes that Washington Federal Inc. WAFD’s recent breakout will ultimately take the stock to $29.20.

Disclosure: The author has no position in the stocks mentioned.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.