The SPDR S&P 500 SPY gapped down 0.67% lower Tuesday morning and by late morning had fallen another 1.8%.

On Monday, U.S. Senate Republicans blocked a bill to avert a government shutdown and suspend the debt limit.

The deadline to pass a funding measure is Sept. 30, and on Tuesday, Democratic Whip Dick Durbin told MSNBC the Democrats are exploring every possibility to avert the shutdown of federal agencies.

Investors may fear the bill won’t pass in time, however, and when markets opened Tuesday, the options trading activity of institutions leaned heavily bearish, with an overwhelming amount of SPY put contracts being purchased.

See Also: Treasury Yields Hit Highest Level Since June, Weighing On Tech Sector In Particular

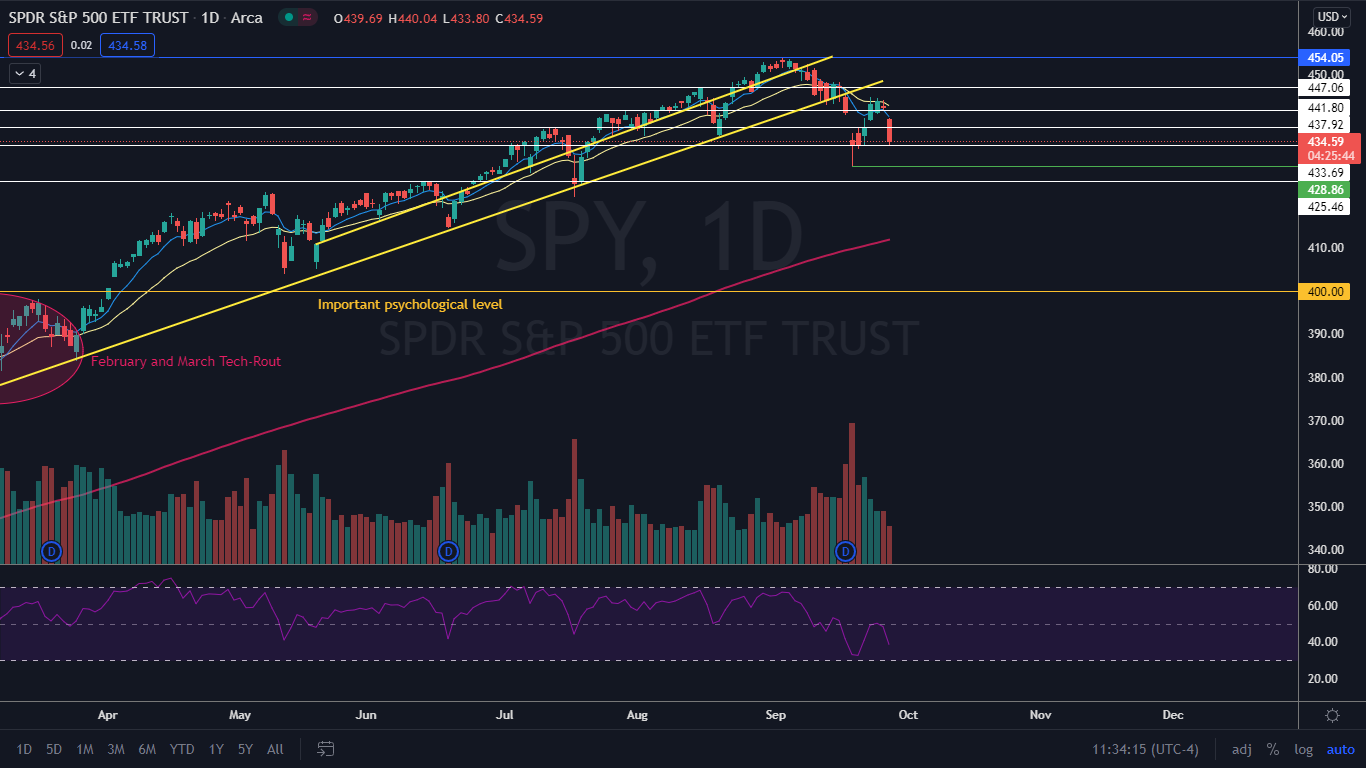

The SPY Chart: The bearish volume on Tuesday morning was well above average in the SPY on the 5-minute chart, and on the daily chart this forced the ETF to drop straight through a support level at $437.92.

There is a lower support at the $433.69 mark, which is a key area because the SPY has not closed a trading session below the level since July 20.

Technical traders may have seen the selloff coming when the SPY lost the support of a lower ascending trendline that had been propping it up since March 4.

When the SPY lost the trendline, it entered into a downtrend that was confirmed by a Sept. 23 lower high of about $445. If the SPY falls below the Sept. 20 low of $428.86, it will create a lower low; otherwise, the ETF may tighten into a pennant.

The SPY is trading below the eight-day and 21-day exponential moving averages, with the eight-day EMA trending below the 21-day, both of which are bearish indicators. The SPY is trading above the 200-day simple moving average, however, which indicates overall sentiment remains bullish.

- Bulls want to see big bullish volume come in and push the SPY back up above the $437.92 level, which would cause the SPY to print a bullish hammer candlestick and indicate higher prices were in the cards for Wednesday. The SPY has resistance above the level at $441.80

- Bears want to see sustained big bearish volume push the SPY down to close near its low-of-day, which would cause it to print a bearish marubozu candlestick and indicate lower prices may be on the horizon. The SPY has support below at $433.69 and $428.86.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.