Netflix Inc. NFLX and Roku Inc. ROKU are two streaming stocks moving during Wednesday's trading session. Netflix is trading lower after the company issued second-quarter sales guidance below estimates. Roku is trading lower in sympathy with Netflix.

Both stocks are nearing key lines on the chart; a break of these lines could bring about a more powerful move.

Netflix Daily Chart Analysis: Netflix gapped down to near a key level into Wednesday morning.

The stock gapped down below both the 50-day moving average (green) as well as the 200-day moving average (blue), indicating sentiment could be turning bearish.

These indicators may hold as resistance again in the future.

The stock was down 7.24% at $509.78 at last check.

Key Netflix Levels To Watch: The stock has been building higher lows throughout the last six months into what technical traders may call an ascending triangle pattern.

The ascending triangle shows a flat top resistance near the $575 level, as this is a price level where sellers have always been able to win against the buyers.

A break above flat top resistance with consolidation gives the stock a chance to push higher.

A break below the higher lows may cause the overall trend to change.

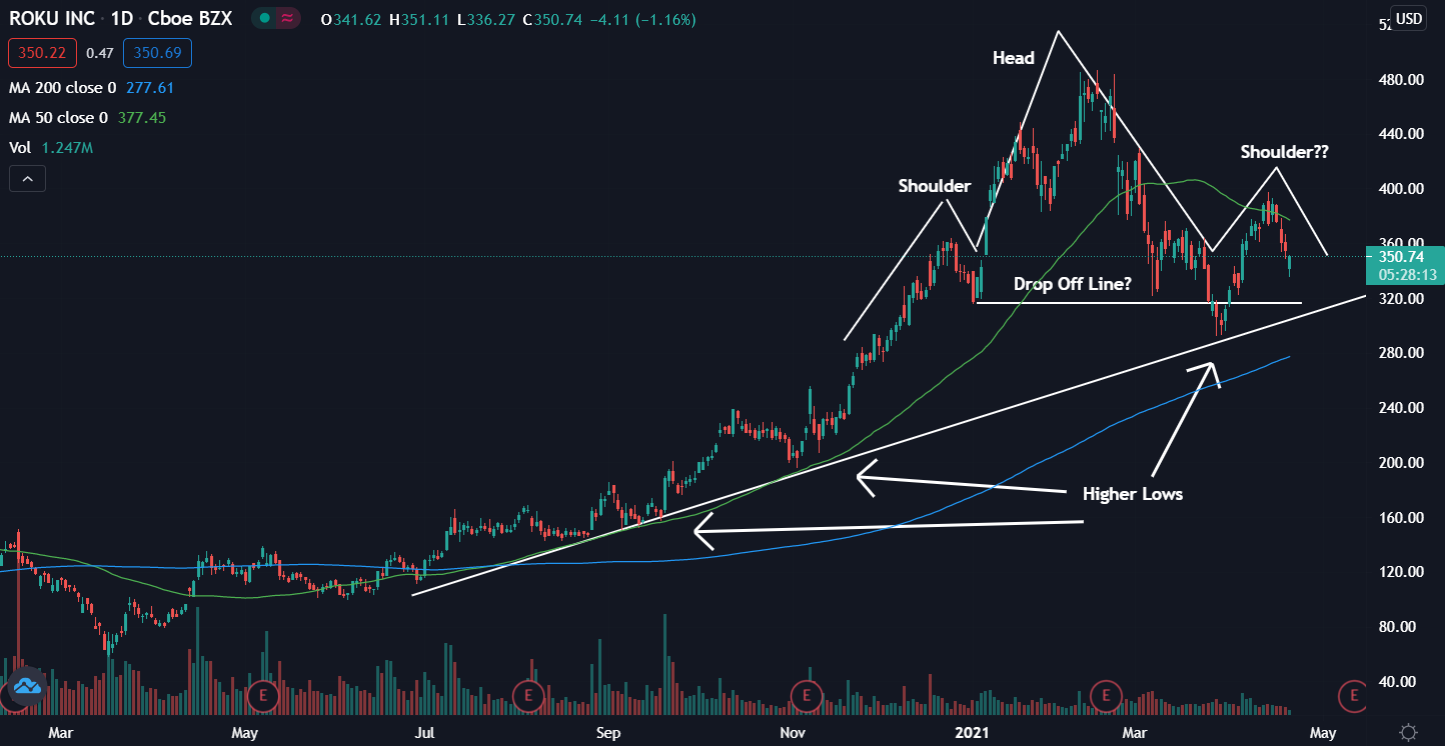

Roku Daily Chart Analysis: Roku is nearing a key level where, if it is unable to bounce, it may see a strong downward push.

The stock is trading below the 50-day moving average (green) and above the 200-day moving average (blue), indicating the stock is most likely in a period of consolidation.

The 50-day moving average may hold as resistance and the 200-day moving average may hold as support.

Roku shares were down 0.9% at $351.66 at last check.

Key Roku Levels To Watch: The Roku chart shows it may be forming what technical traders call a head-and-shoulders pattern.

The head-and-shoulders pattern is a bearish reversal pattern that may be confirmed if the stock can fall below where buyers were previously found near the $320 level.

The higher lows show the overall trend has been bullish and the line connecting the lows would need to hold as support or the stock may begin a downtrend.

Photo courtesy of Roku.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.