The following post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga.

Farmland has historically outperformed most major asset classes like stocks, bonds, and even real estate. With less and less land available, and more mouths to feed, the basic economics of supply and demand prove favorable for the continued growth of this asset class.

U.S. farmland has produced average annual returns of almost 12% for nearly 30 years, according to the National Council of Real Estate Investment Fiduciaries. These returns, notably, were achieved with significantly less volatility when compared to the majority of other asset classes as well. This is because farmland investments are typically made using little or no debt, thus it has been less risky than other levered assets.

Of recent note, farmland is also a highly uncorrelated asset class. The S&P 500 and Farmland have had a -0.03 correlation over the past three decades, which means the performance of one has virtually no impact on the other. This helped farmland investors achieve better-than-average results through the last economic downturn as indicated below.

As is the case for most alternative assets, the biggest challenge for retail investors has been lack of access to farmland. But that is starting to change.

Different Options For Land Investing

Outside of simply purchasing farmland, avenues to invest in farmland have historically been quite limited. Farmland investment funds, Real Estate Investment Trusts (REITs), and outright ownership of land all provide solutions for investing in farmland, however, each has advantages and drawbacks. AcreTrader, an online investment platform, uses elements of crowdfunding to present investors an attractive alternative to adding farmland to their portfolio.

Institutional Funds

The attractiveness of farmland as an investment has attracted capital from private equity funds and large family offices like the Bill and Melinda Gates Foundation, who have invested in farmland via Agricultural Land Funds. But while there has been significant momentum of professional investors moving into farmland, investing through funds can have very expensive barriers of entry.

Many of these funds measure their assets in the hundreds of millions or even billions of dollars. This type of scale provides great leverage in farming, back-office functions, and the ability to participate in auctions of large farms. However, these funds typically require an investment minimum of $1 million, often with 10-year lockups on capital.

For context, the professionalization of this asset class is still in a very nascent stage. While institutional investments in farmland are now estimated to be over $30 billion (up from $3 billion ~10 years ago), this remains just one percent of the over $3 trillion market. These farm funds have an important place in the U.S. market, and some of these funds have great teams, processes, approaches, and returns. However, the barriers to entry and high fees preclude the overwhelming majority of investors looking to diversify their portfolio with farmland from participating.

REITs

Investors are also able to access farmland by participating in a publicly traded REIT. However, this option has been more correlated with the stock market than the underlying value of the land, which defeats two of the most attractive reasons investors are interested in farmland in the first place: to get away from the stock market and to reduce volatility.

For context, over the past five years, the correlation between the two large farmland REITs, Gladstone Land LAND and Farmland Partners FPI and the S&P 500 have been 0.66 and 0.78 respectively. In addition to market exposure, a lack of disclosure and the burden of debt can further complicate investing in farmland REITs.

Outright Ownership

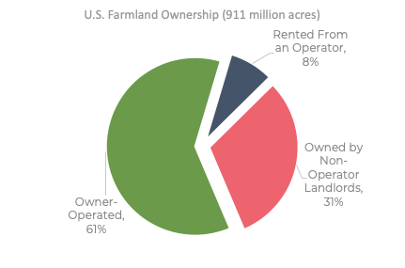

The most common method to invest in farmland is direct ownership. Despite the exceptional friction and headache that can accompany owning land outright, over 30% of U.S. farmland is owned by non-operator landlords:

Though direct ownership in farmland is well established, it requires investors to commit large amounts of upfront capital, as well as manage the business and it’s associated complexities.

In addition to the capital requirement, investors must also be prepared to search for and identify attractive land, conduct due diligence, negotiate terms with the seller, coordinate a lengthy closing process, identify a manager and/or farmer for the land, open bank accounts, negotiate leases and contracts, manage payments and collections, pay taxes and insurance, deal with problems that arise, and constantly monitor operations.

An Attractive Alternative

Each of the above options provides exposure to the asset class, however, these investment options tend to work only under certain circumstances and leave the majority of investors without a real ability to invest in agricultural land.

That's the problem that AcreTrader, a real estate investing platform that makes it easy to buy shares of farmland and earn passive income, is trying to solve. Unlike Agricultural Land Funds, investors can start out with as little as $10,000 on the AcreTrader platform. And unlike outright ownership, AcreTrader provides investors with transparency, flexibility, and ease of use while handling all aspects of administration and property management.

AcreTrader carefully reviews each farm, selecting less than 1% of the total parcels considered, then places each farm offering in a unique legal entity and offers shares to investors through their online platform. Investors can make money two ways: 1) annual distributions from farmers renting out the land, and 2) appreciation of the land during the holding period.

Buying farmland is very difficult. But, AcreTrader helps eliminate the friction involved by allowing investors to buy farmland directly while removing the aforementioned headaches. See their current offerings and to get started today.

Photo by John Reed on Unsplash

The preceding post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga. Although the piece is not and should not be construed as editorial content, the sponsored content team works to ensure that any and all information contained within is true and accurate to the best of their knowledge and research. This content is for informational purposes only and not intended to be investing advice.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.