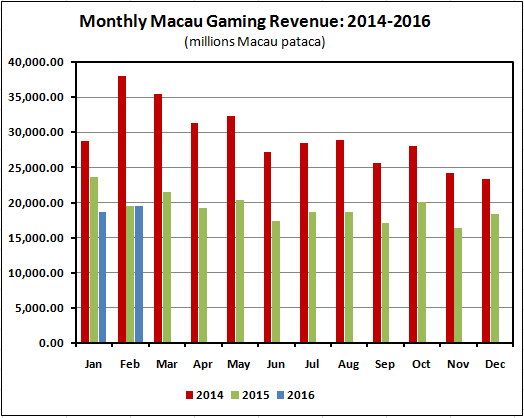

According to data released by the Macao Gaming Inspection and Coordination Bureau, gaming revenue in the month of February came in at 19.5 billion patacas, only about 0.1 percent lower than February 2016’s number.

Shares of Melco Crown Entertainment Ltd (ADR) MPEL, Las Vegas Sands Corp. LVS, MGM Resorts International MGM and Wynn Resorts, Limited WYNN were all trading higher in early trading on Tuesday by more than 1.8 percent after a mostly positive February.

Is The Bottom Finally Here?

February technically marked the 21st consecutive month of year-over-year (Y/Y) negative gaming revenue growth in Macau, but shareholders of Macau names are hoping that the essentially flat February number is an indication that the bottom is finally in.

February 2015 marked the high point for gaming revenue declines at -48.6 percent. November's GGR of only 16.4 billion patacas represented the lowest monthly gaming revenue total for Macau during the current downturn, but February’s total was the highest number in four months.

The Bad News Barrage

Macau has seen a seemingly constant stream of bad news over the past two years. In 2014, the Chinese government announced a crackdown on corruption in Macau.

Increased government scrutiny coupled with a weakening Chinese economy led to a major falloff in VIP gamblers.

In September, headlines of potential junket embezzlement of up to $258 million dollars had investors worried about even more government regulation down the road.

In addition, fears surrounding the impact of a smoking ban in Macau casinos have also weighed on share prices.

Sluggish Stocks

Shareholders of the four U.S.-listed Macau names are hoping that the downturn is a cyclical one and that the worst of the selloff is now behind them. The stocks of the four Macau names are down between 31 and 66 percent in the past two years.

Disclosure: The author owns shares of Melco Crown Entertainment and Wynn Resorts.

Image Credit: Public Domain© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.