As a general statement, most retail investors and traders dislike volatility. To an extent, that certainly makes sense.

After all, when volatility picks up the market is typically in the midst of a decline. In addition, it can be very difficult to navigate the larger swings that inherently come with those declines.

However, investors would most likely invite increased volatility if it were to the upside. So, why not be prepared for a market rise by having stocks selected with higher volatility?

One of the most common ways to measure the volatility of a stock is via its beta.

Beta is a quantitative measure of the volatility of a stock relative to the S&P 500. Specifically, beta is the performance the stock has experienced as the S&P 500 moved 1 percent up or down.

A beta of 1 indicates the stock's price will move with the S&P 500. A beta of less than 1 means it will be less volatile than the S&P 500.

Keep in mind though that beta measures volatility, but it does not predict direction. A stock that does 50 percent worse than the S&P 500 and a stock that does 50 percent better than the S&P 500 will both have a high beta.

So, which biotech names have the highest 1-year annualized beta?

The biotech company with the 3rd highest beta is Arrowhead Research ARWR.

Arrowhead develops targeted RNAi therapeutics in the United States. The company’s product candidates include an RNAi-based therapeutic that has completed a Phase 1 clinical trial for the treatment of chronic hepatitis B virus (HBV) infection.

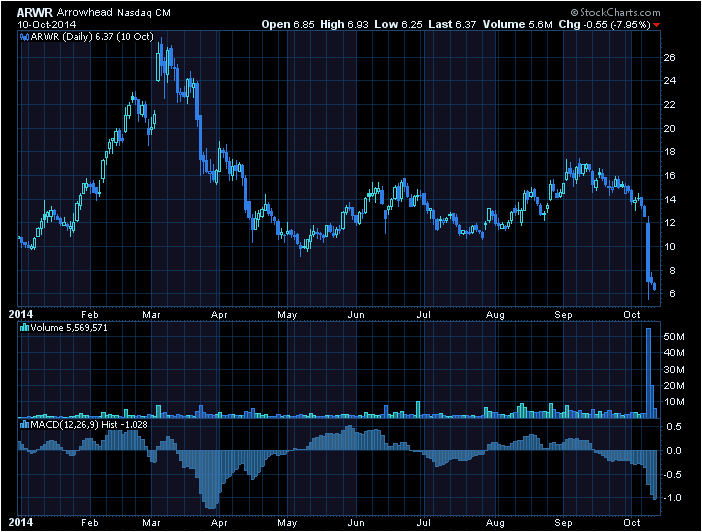

Arrowhead’s 2.58 beta is certainly on display in the chart above. From $10, up to $27, and now back down to $6, the stock can certainly move. Unfortunately, most of the movement as of late is downward.

Number 2 on our list of the most volatile biotech stocks is that of Inovio Pharmaceuticals INO.

Inovio discovers, develops, and develops synthetic vaccines and immune therapies focusing on cancers and infectious diseases.

Although Inovio’s overall range is narrower than that of Arrowhead, a beta of 2.6 means the stock is moving an awful lot within that range.

And finally, coming in as the #1 most volatile biotech stock is Vanda Pharmaceuticals VNDA.

Vanda engages in the development and commercialization of pharmaceutical products. Its product portfolio includes HETLIOZ, a product for the treatment of Non-24-Hour Sleep-Wake Disorder.

The stock has a 3.92 beta and has been anywhere from $9 to $19 over the last 12 months. It’s a name that can certainly run when it decides to go.

So, what can be gained from these 3 stocks? Great moves IF you can isolate the best times to enter the trade. As a whole, none of the 3 appear to be ripe for the pickings just yet.

The screening criterion utilized to identify this top 5 was one that isolated biotech stocks trading above $5/share with at least 500K/shares per day (90 day average volume).

Obviously, investors must conduct their own due diligence before investing in any stock. However, biotech stocks that can embark on larger, yet volatile, runs are certainly ones worth taking a look at for your own portfolio.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.