What Happened: Bitcoin’s massive correction in May has led to retail traders moving out of the cryptocurrency and back into popular meme stocks like AMC Entertainment Holdings Inc AMC and GameStop Corp. GME.

Year-to-date, both AMC and GME are up over 1000%, while Bitcoin BTC/USD is up only 25%, having erased most of its gains in the last month alone.

“We continue to see the rotation out of crypto and back into stocks favored by the Reddit crowd,” Lev Borodovsky, editor of The Daily Shot newsletter, wrote in an email to CoinDesk. “I’ve noticed this connection a couple months ago.”

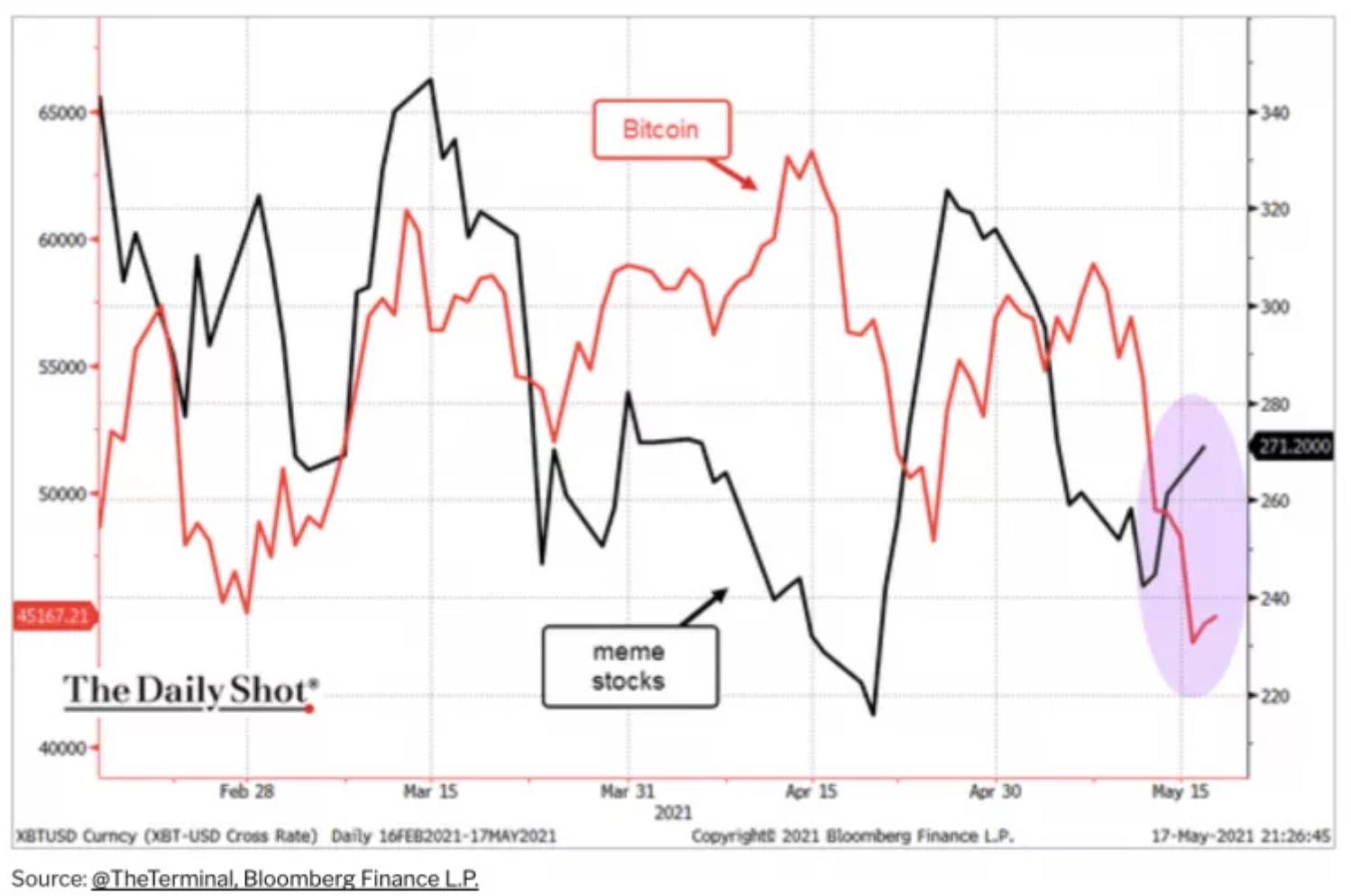

Using an equal-weight basket of seven popular meme stocks overlayed with the price of Bitcoin, Borodovsky demonstrates the rotation over the past few months.

Why It Matters: Only two weeks ago, the trend was completely reversed, with retail traders appearing more interested in crypto than meme stocks.

Analytics platform Quiver Quantitative revealed that the volume of posts on Reddit’s main cryptocurrency forum ‘r/Cryptocurrency’ increased by over 82%, while popular meme stock discussion forum ‘r/WallStreetBets’ dropped by over 42% over the same period.

“Many active retail investors don’t just want to see numbers in their Robinhood [brokerage] account go up, they also want to invest in a narrative,” said Quiver Quantitative founder James Kardatzke.

Price Action: AMC was trading at $49.07, 14.62% higher than in the pre-markets.

GME shares were up 5.16%, at $231.76 at press time.

Meanwhile, Bitcoin gained 17% since its low of $31,317 on June 8. At press time, the leading digital asset was trading at $37,236 with a daily trading volume of over $38 billion.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.