ROCHESTER, N.Y., Dec. 31, 2019 /PRNewswire/ -- The competitive job market continues to drive wage growth higher, according to the latest Paychex | IHS Markit Small Business Employment Watch. Steady growth in hourly earnings and hours worked – with hours worked in December posting the strongest gains since 2012 – pushed weekly earnings growth to 4.13 percent, a new all-time high for employees of small businesses. The pace of small business employment growth remains consistent, with the national jobs index increasing slightly (0.06 percent) in December to 98.16.

"Small business job gains have flattened in the second half of the year as labor markets prove very tight," said James Diffley, chief regional economist at IHS Markit. "In response, weekly earnings have accelerated, surging from 2.49 percent mid-year to 4.13 percent at year-end."

"The new high seen in weekly earnings growth this month is certainly positive news for the employees of small businesses," said Martin Mucci, Paychex president and CEO. "Not only are businesses raising wages, but they're also increasing hours for their current employees, a sure sign employers are responding to the pressures of the tight labor market."

Broken down further, the December report showed:

- The South remains the leading region for small business employment growth; the West continues as the top region for hourly earnings growth, followed closely by the Northeast.

- Tennessee remains the leader among states in small business job growth; New York leads in hourly earnings growth at the state level.

- Dallas is again the top metro for small business job growth; Los Angeles again leads metros in hourly earnings growth.

- Leisure and Hospitality tops industry sectors in all three wage growth components, hourly and weekly earnings as well as weekly hours worked.

The complete results for December, including interactive charts detailing all data at a national, regional, state, metro, and industry level, are available at www.paychex.com/employment-watch. Highlights are available below.

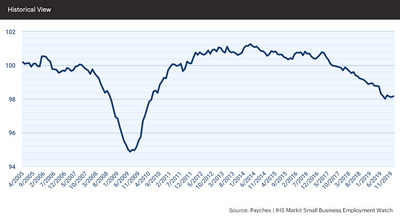

National Jobs Index

- The pace of small business employment growth increased slightly in December, up 0.06 percent from the previous month.

- In the last six months of 2019, job growth levels have been consistent, moderating slightly from 98.18 in July to 98.16 in December.

- Year-over-year the national index is down 0.73 percent, with declines concentrated in the first half of 2019.

National Wage Report

- Weekly earnings continued to accelerate throughout 2019, reaching a record of 4.13 percent year-over-year growth in December.

- Hourly earnings growth closed the year at 3.07 percent.

- Nearing one percent growth from last year, weekly hours worked reported the strongest gains since 2012.

Regional Jobs Index

- The South remains the strongest region for small business job growth at 98.87, despite experiencing a one-month decline in December (the only region to do so).

- Small business job growth was most consistent in the Northeast throughout 2019, moderating just 0.38 percent from the previous year.

Regional Wage Report

- At 3.68 percent, the West leads hourly earnings growth among regions, trailed closely by the Northeast (3.44 percent).

- The gap in earnings among regions is growing as the South and Midwest have the lowest hourly and weekly earnings as well as the weakest growth rates.

State Jobs Index

- Tennessee remains the top state for small business job growth with an index level of 100.65, up 2.11 percent year-over-year.

- Ohio and Michigan each posted large one-month gains in December, more than 0.40 percent, to move into seventh and tenth place among states, respectively.

- New York joins Washington among the states with the lowest index levels, now below 97.

Note: Analysis is provided for the 20 largest states based on U.S. population.

State Wage Report

- New York and California lead earnings growth among states, both above four percent in hourly earnings and five percent in weekly earnings.

- Texas and Arizona rank among the top three states in job growth, but are last in hourly earnings growth, both below two percent.

Note: Analysis is provided for the 20 largest states based on U.S. population.

Metropolitan Jobs Index

- At 98.10, Detroit had the strongest one-month increase in December (0.83 percent).

- Denver (99.44) has posted strong back-to-back gains and now trails only Dallas (100.21).

Note: Analysis is provided for the 20 largest metro areas based on U.S. population.

Metropolitan Wage Report

- Hourly earnings growth ranges from 4.84 percent in Los Angeles to 1.19 percent in Tampa.

- San Francisco's weekly earnings topped seven percent growth in December, aided by a 1.80 percent increase in weekly hours worked, best among metros.

Note: Analysis is provided for the 20 largest metro areas based on U.S. population.

Industry Jobs Index

- Small business employment growth in Leisure and Hospitality increased 0.29 percent in December to 97.70.

- The top three ranked sectors all slowed during the past quarter, while the bottom five sectors posted positive gains.

Note: Analysis is provided for seven major industry sectors. Definitions of each industry sector can be found here. The Other Services (excluding Public Administration) industry category includes religious, civic, and social organizations, as well as personal services, including automotive and household repair, salons, drycleaners, and other businesses.

Industry Wage Report

- Leisure and Hospitality ranks first in all three wage growth components, hourly and weekly earnings as well as weekly hours worked.

- Education and Health Services is the only industry below two percent hourly earnings growth.

Note: Analysis is provided for seven major industry sectors. Definitions of each industry sector can be found here. The Other Services (excluding Public Administration) industry category includes religious, civic, and social organizations, as well as personal services, including automotive and household repair, salons, drycleaners, and other businesses.

For more information about the Paychex | IHS Markit Small Business Employment Watch, visit www.paychex.com/employment-watch and sign up to receive monthly Employment Watch alerts.

*Information regarding the professions included in the industry data can be found at the Bureau of Labor Statistics website.

About the Paychex | IHS Markit Small Business Employment Watch

The Paychex | IHS Markit Small Business Employment Watch is released each month by Paychex, Inc., a leading provider of payroll, human resource, insurance, and benefits outsourcing solutions for small-to medium-sized businesses, and IHS Markit, a world leader in critical information, analytics, and expertise. Focused exclusively on small business, the monthly report offers analysis of national employment and wage trends, as well as examines regional, state, metro, and industry sector activity. Drawing from the payroll data of approximately 350,000 Paychex clients, this powerful tool delivers real-time insights into the small business trends driving the U.S. economy.

About Paychex

Paychex, Inc. PAYX is a leading provider of integrated human capital management solutions for human resources, payroll, benefits, and insurance services. By combining its innovative software-as-a-service technology and mobility platform with dedicated, personal service, Paychex empowers small- and medium-sized business owners to focus on the growth and management of their business. Backed by more than 45 years of industry expertise, Paychex serves approximately 670,000 payroll clients as of May 31, 2019 across more than 100 locations in the U.S. and Europe, and pays one out of every 12 American private sector employees. Learn more about Paychex by visiting www.paychex.com, and stay connected on Twitter and LinkedIn.

About IHS Markit (www.ihsmarkit.com)

IHS Markit INFO is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world's leading financial institutions. Headquartered in London, IHS Markit is committed to sustainable, profitable growth.

IHS Markit is a registered trademark of IHS Markit Ltd. and/or its affiliates. All other company and product names may be trademarks of their respective owners © 2019 IHS Markit Ltd. All rights reserved.

Media Contacts

Lisa Fleming

Paychex, Inc.

+1 585-387-6402

lfleming@paychex.com

@PaychexNews

Kate Smith

IHS Markit

+1 781-301-9311

katherine.smith@ihsmarkit.com

Tess Flynn

Mower

+1 716-880-1488

tflynn@mower.com

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/weekly-earnings-growth-ends-the-year-at-all-time-high-300980038.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/weekly-earnings-growth-ends-the-year-at-all-time-high-300980038.html

SOURCE Paychex, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Your update on what’s going on in the Fintech space. Keep up-to-date with news, valuations, mergers, funding, and events. Sign up today!