The escalating tussle between globalization and nationalism could have profound implications for global financial markets, traditional investment frameworks and developed market geopolitical risk analysis, says a new report from PGIM, Inc., the investment management business of Prudential Financial, Inc. (NYSE: PRU).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20180509005139/en/

(Graphic: Business Wire)

Never before in human history have people, information and capital moved across borders at the speed, frequency and volume seen today. These global forces have blunted the ability of individual sovereign states to shape their own economic destinies, giving rise to a surge of nationalism in response.

In The End of Sovereignty? PGIM argues that traditional monetary and fiscal policy frameworks may be inadequate to understand the shifting global landscape.

"Successful long-term investors who navigate this environment will place developed market geopolitical risk high on their agenda when making investment decisions," said Taimur Hyat, chief strategy officer for PGIM. "Investors will want managers who understand how to separate political theater from true political risk that can move financial markets."

PGIM identifies five ways investors can rethink their investment approach:

- Decrease reliance on top-down country-level factors, which have a diminishing role in driving equity, corporate debt and real estate returns. Continuing their steady decline, country-level factors now account for only 20 percent of global equity returns, for example.

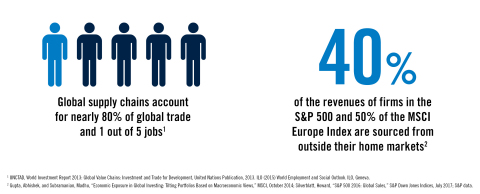

- Apply a global framework for all investment decisions. Regional stock index performance is no longer solely determined by local economic growth; for example, 40 percent of S&P 500 company sales occurred outside the U.S. over the last decade. Investors must consider the impact that decisions taken around the globe will have on their domestic investment portfolios.

- Ensure developed market risk is embedded in decisions. The 2016 Brexit vote left many investors scrambling to evaluate their exposure to the U.K. Investors should work with their asset managers and consultants to understand their true regional exposures; at a minimum, investors will want to ensure they have access to local, on-the-ground expertise to stay abreast of rising geopolitical tensions.

- Position the portfolio for greater volatility and uncertainty. Long-term investors should be wary of traditional measures of risk, that may not fully capture the potential costs of low-probability, high-risk events. Investors might look at firms' geographic makeup to measure country- or region-specific economic exposure, and potentially consider targeted use of tail risk hedging strategies.

- Prepare to be viewed as an agent of change on global challenges. In an era of diminishing sovereign influence, civil society will increasingly look to asset owners and managers to act as agents of change on cross-country issues.

"What's unique to this current phase of globalization is the acceleration of capital and information flows, which makes it harder than ever for governments to keep pace with the opportunities and challenges that result," said Nathan Sheets, head of global macroeconomic research at PGIM Fixed Income. "Investors need to understand how companies might benefit from globalization or withstand backlash by a sovereign actor."

Download PGIM's latest white paper: The End of Sovereignty?

About PGIM and Prudential Financial, Inc.

With 15 consecutive years of positive third-party institutional net flows, PGIM, the global asset management businesses of Prudential Financial, Inc. PRU, ranks among the top 10 largest asset managers in the world3 with $1.2 trillion in assets under management as of March 31, 2018. PGIM's businesses offer a range of investment solutions for retail and institutional investors around the world across a broad range of asset classes, including fundamental equity, quantitative equity, public fixed income, private fixed income, real estate and commercial mortgages. Its businesses have offices in 16 countries across five continents. For more information, please visit pgim.com.

Prudential's additional businesses offer a variety of products and services, including life insurance, annuities and retirement-related services. For more information about Prudential, please visit news.prudential.com.

0507-0800

1. UNCTAD (United Nations Conference on Trade and Development), World

Investment Report 2013: Global Value Chains: Investment and Trade for

Development, United Nations Publication, 2013. <http://unctad.org/en/PublicationsLibrary/wir2013_en.pdf>;

ILO (International Labour Organization) (2015) World Employment and

Social Outlook. ILO, Geneva.

2. Gupta, Abhishek, and Subramanian,

Madhu, "Economic Exposure in Global Investing: Tilting Portfolios Based

on Macroeconomic Views," MSCI, October 2014; Silverblatt, Howard, "S&P

500 2016: Global Sales," S&P Down Jones Indices, July 2017; S&P data.

3.

As ranked in Investment & Pensions Europe Top 400 Asset Managers list,

June 2017; based on PFI total worldwide assets under management as of

December 31, 2016.

View source version on businesswire.com: https://www.businesswire.com/news/home/20180509005139/en/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.