EUR/USD Current Price: 1.2122

- German’s GFK Consumer Confidence Survey unexpectedly fell to -8.8 in May.

- The Fed is not thinking about tapering but for sure sees things improving.

- EUR/USD holds on to intraday gains and could extend its rally towards 1.2200.

The EUR/USD pair reached fresh April highs after the US Federal Reserve announced its monetary policy decision. The US Central Bank maintained its monetary policy unchanged as widely anticipated, making just minor adjustments to the accompanying statement. US policymakers see inflation and employment performing a bit better than when they met before but maintained their cautious stance about the persistent risks to the economy. Inflation has risen, "largely reflecting transitory factors."

Earlier in the day, Germany published the May GFK Consumer Confidence Survey, which printed at -8.8 worse than the previous -6.1 and missing the expected -3.5. The US released the preliminary estimate of the March Goods Trade Balance, which printed a deficit of $-90.59 billion.

On Thursday, the EU will publish the April Economic Sentiment Indicator, foreseen at 102.2 from 101 previously. Germany will release the preliminary estimate of the April Consumer Price Index. The event of the day will come from the US, as it will publish the preliminary estimate of Q1 2021 Gross Domestic Product, expected at 6.5% from 4.3% in the previous quarter. Weekly unemployment claims are foreseen at 549K for the week ended April 23.

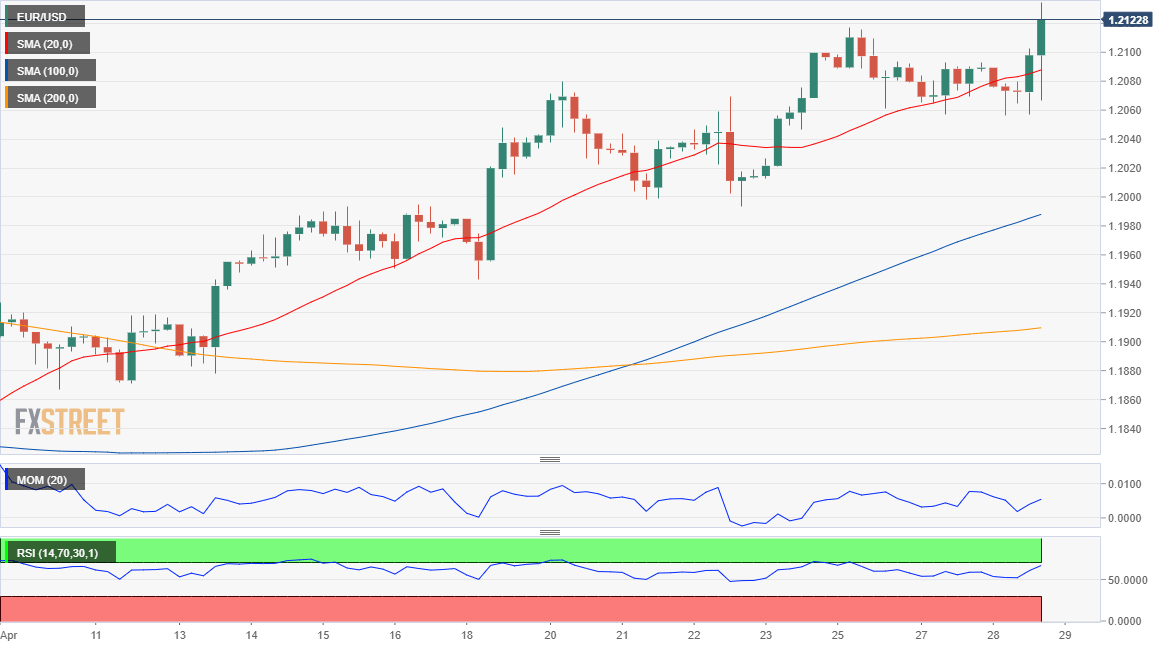

EUR/USD Short-Term Technical Outlook

The EUR/USD pair trades in the 1.2120 area after hitting a daily high of 1.2134, consolidating gains and poised to extend its advance. The near-term picture shows that the pair has accelerated north above a bullish 20 SMA after spending the last two days hovering around it. Technical indicators head north within positive levels, maintaining a clear positive momentum, as the longer moving averages head higher well below the current level. The next relevant resistance level is 1.2150, where the pair presents multiple intraday lows and high from earlier this year.

Support levels: 1.2100 1.2050 1.2005

Resistance levels: 1.2150 1.2195 1.2240

View Live Chart for the EUR/USD

Image Sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.