EUR/USD Current Price: 1.2092

- Dismal EU and US data weighed on investors’ mood ahead of first-tier events.

- Market participants are cautious ahead of Fed’ decision, Q1 GDP figures.

- EUR/USD holds near the 1.2100 figure and could keep posting gains.

The EUR/USD pair hovers around 1.2090, posting modest daily losses after extending its advance to 1.2116 at the beginning of the day. Speculative interest was a bit nervous ahead of first-tier events scheduled for this week, including a US Federal Reserve meeting and the preliminary estimates of the US and the EU first quarter Gross Domestic Product.

The dollar advanced ahead of Wall Street’s opening as US Treasury yields ticked higher and stocks fell, following poor US data. March Durable Goods Orders, missed the market’s expectations by raising 0.5% vs the 2.5% expected. Nondefense Capital Good orders ex Aircraft rose 0.9%, improving from -0.8%, but missing the expected 1.5%. However, the greenback eased back as yields retreated and equities bounced.

European data failed to impress, as Germany published the April IFO survey, which showed that Business Climate unexpectedly contracted to 98.7 from 99.7 and vs the expected 99.7. The assessment of the current situation came in at 94.1, while expectations decreased to 99.5. The EU won’t publish macroeconomic data on Tuesday, while the US will publish some housing-related numbers and April CB Consumer Confidence, foreseen at 113.1 from 109.7 in the previous month.

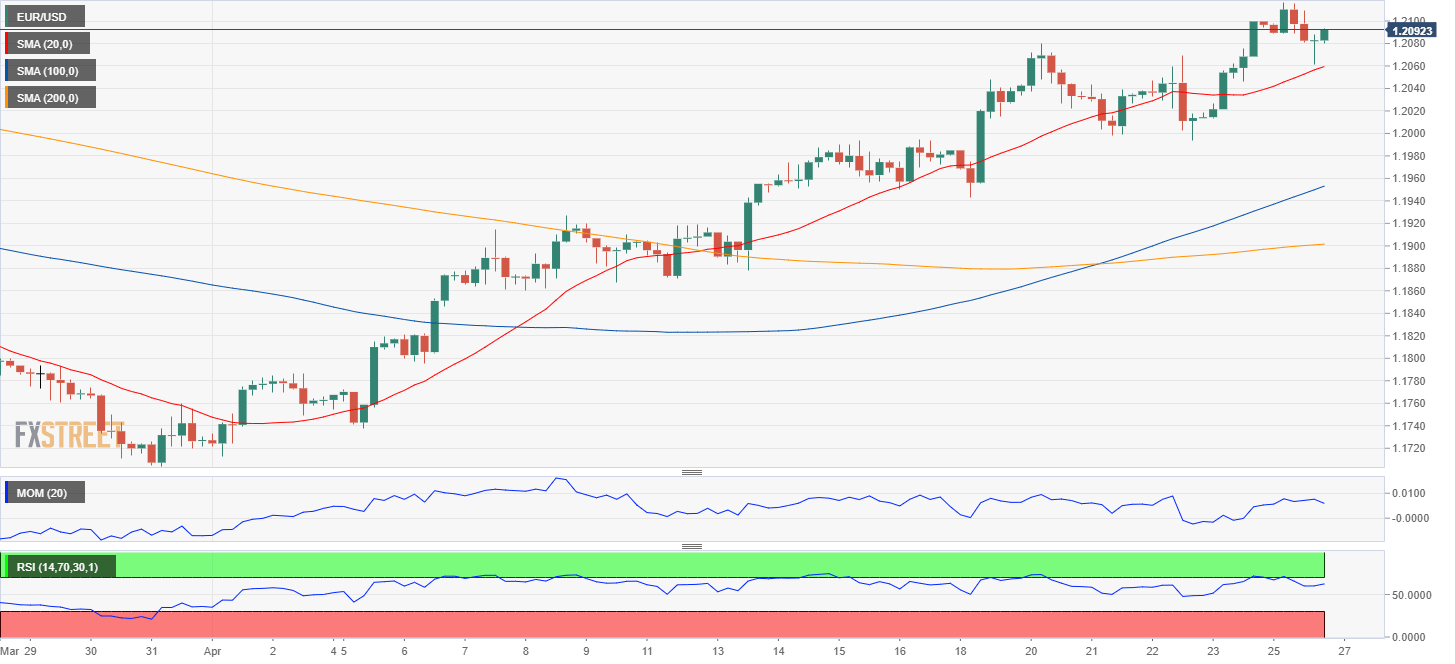

EUR/USD Short-Term Technical Outlook

The EUR/USD pair has met buyers around 1.2060, the immediate support level. The 4-hour chart shows that it approached a bullish 20 SMA, which maintains its bullish slope at around 1.2050. Technical indicators have retreated from overbought readings, with the Momentum heading lower within positive levels and the RSI stable at around 60, still indicating limited selling interest. The pair can correct to as low as 1.1960 without actually signaling a change in the dominant bullish trend.

Support levels: 1.2050 1.2005 1.1960

Resistance levels: 1.2115 1.2160 1.2200

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.