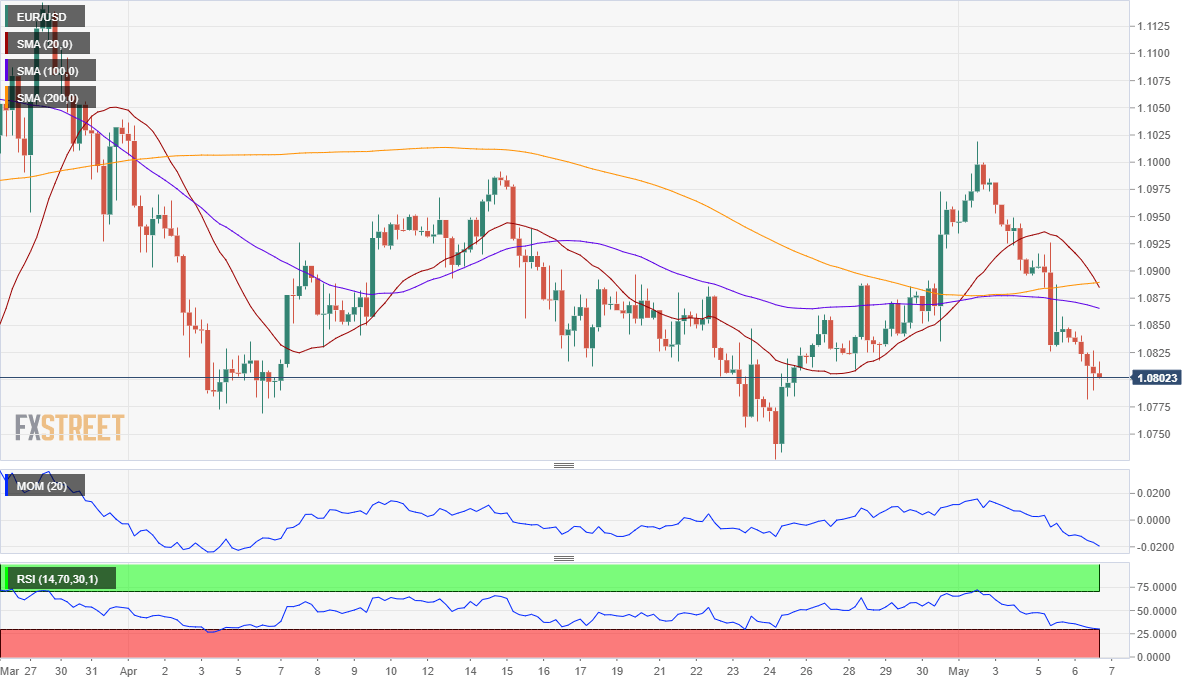

EUR/USD Current Price: 1.0802

- US April ADP survey at -20.23 million ahead of the Nonfarm Payroll report.

- Germany economic contraction steeper than anticipated weighing on the EUR.

- EUR/USD technically bearish and heading toward the 1.0700 region.

Investors seek safety this Wednesday, with the dollar and the yen stronger against most other rivals. The market’s sentiment was mixed, torn between optimism related to economic reopenings and renewed tensions between the US and China. The EUR/USD pair was under pressure for a third consecutive day, trading as low as 1.0781 to finally settle around 1.0810.

European data hit the shared currency, as March Germany Factory Orders plunged 15.6% monthly basis and fell by 16% when compared to a year earlier, worse than anticipated. The final versions of the Markit Services PMI were upwardly revised in Germany and the Union, although in Spain and France were worse than previously estimated. EU Retail Sales were better than expected in March, down anyway 9.2% in the month. In the US things were no better as the ADP survey on private job’s creation showed that during April, 20.23 million jobs were lost, although the market barely reacted to it.

This Thursday, Germany will release March Industrial Production, seen down by 7.5% when compared to February. The US will publish Q1 Nonfarm Productivity and Unit Labour Cost, alongside weekly unemployment claims for the week ended May 1, this last expected to show an increase of 3 million people. Data is relevant ahead of Friday’s Nonfarm Payroll release.

EUR/USD Short-Term Technical Outlook

The bearish pressure mounts around the EUR/USD pair, which barely holds above the 1.0800 figure. The 4-hour chart shows that the 20 SMA has turned sharply lower and is about to cross below the 100 and 200 SMA. Technical indicators, in the meantime, remain flat near their daily lows, showing no signs of changing direction. A steeper decline could be expected on renewed selling interest below 1.0790, the immediate support.

Support levels: 1.0790 1.0755 1.0710

Resistance levels: 1.0830 1.0865 1.0900

Image sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.