AUD/USD Current Price: 0.6345

- Governor Lowe expected to provide an encouraging speech despite the ongoing crisis.

- PBOC cut interest rates to support the economy, helped the Aussie to hold ground.

- AUD/USD short-term neutral, needs to advance beyond 0.6440 to turn positive.

The AUD/USD pair hovered around the 0.6350 level throughout this first day of the week, consolidating its modest Friday gains. The Aussie found support on the People Bank of China’s decision to cut interest rates at the beginning of the day, aimed to provide support to the economy. The central bank trimmed its Loan Prime Rate by 20 bps, to 3.85%.

The Reserve Bank of Australia will publish the Minutes of its latest meeting during the upcoming Asian session, followed by a Governor’s Lowe speech. The RBA surprised with a positive stance a couple of weeks ago, and the document may provide some support to the local currency, as he hopes for “smaller and less frequent purchases of government bonds” would be required.

AUD/USD Short-Term Technical Outlook

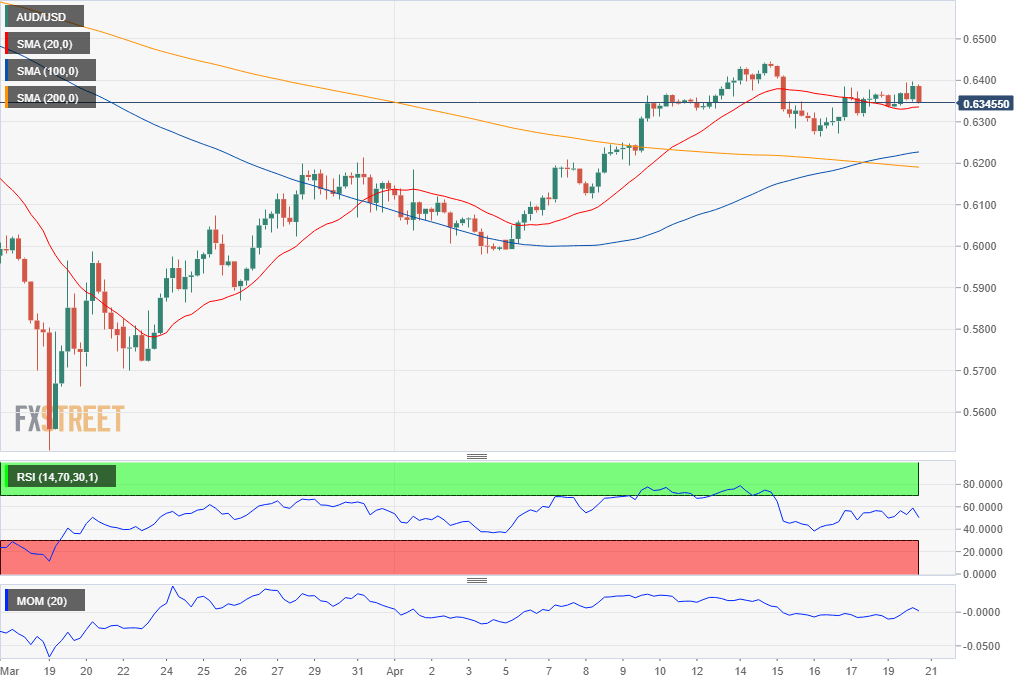

The AUD/USD pair is trading just above a flat 20 SMA, in its 4-hour chart, while the larger ones stand some 150 pips below the current level. Technical indicators, in the mentioned time-frame, have turned marginally lower within neutral levels, barely holding above their midlines. The pair could gather some positive momentum on a break above 0.6443, so far this month high.

Support levels: 0.6330 0.6300 0.6265

Resistance levels: 0.6375 0.6400 0.6440

Image sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.