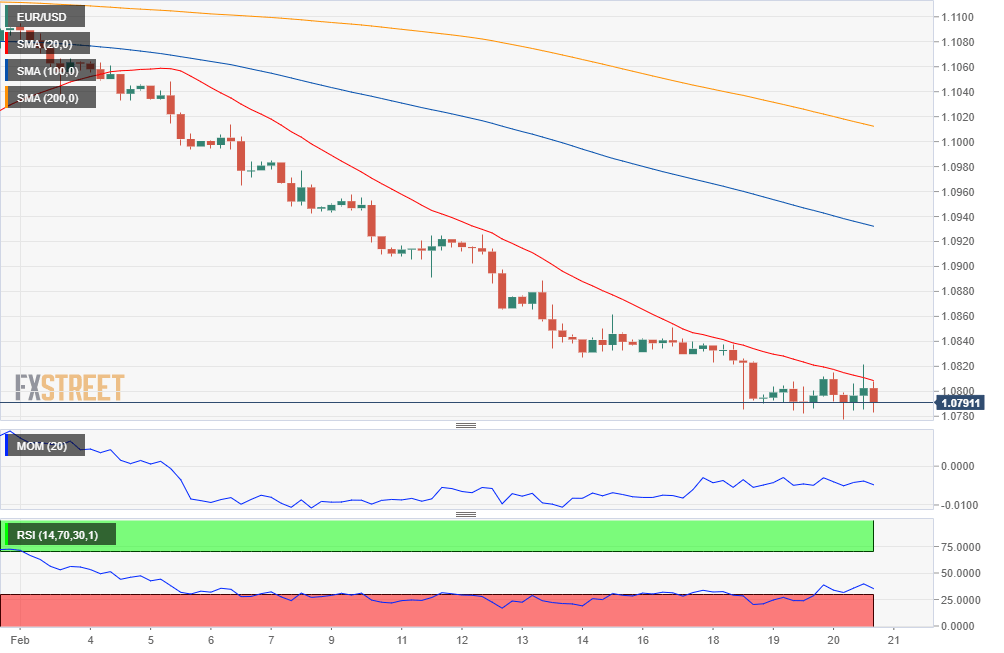

EUR/USD Current Price: 1.0791

- Risk aversion continues to dominate the financial world as the coronavirus takes its toll on economies.

- Wall Street and government bond yields broke lower, exacerbating the negative mood.

- EUR/USD holding near multi-month lows just above the 1.0770 support level.

The shared currency remained under selling pressure while the greenback kept strengthening, resulting in EUR/USD extending its multi-month decline to 1.0777. The pair bounced to peak at 1.0804 during US trading hours but was unable to hold on to gains beyond the 1.0800 mark. The financial world was once again in risk-off mode, led by coronavirus concerns at the beginning of the day, amid new death cases outside China, and a report from S&P Global Ratings warning that Chinese lenders could be hit by as much as $1.1 trillion in questionable loans. Equities were sharply down, with Wall Street giving up its weekly gains and government debt yields plummeting.

German data released this Thursday failed to impress, as the GFK Consumer Confidence Survey came in at 9.8 in March as expected, but below the previous 9.9. The country Producer Price Index for the same month rose by 0.8% MoM, much better than the 0.2% expected, and was up by 0.2% YoY, also beating the market’s expectations. EU Consumer Confidence improved in February to -6.6 according to preliminary estimates. In the US, weekly jobless claims met expectations at 210,000 for the week ended February 14, while the Philadelphia Fed business index surged to 36.7 in February from 17 in January.

This Friday, Markit will publish the preliminary estimates of the February Manufacturing PMI and Services PMI for the Union and the US. Manufacturing activity is seen contracting further in Germany, the EU, and the US, albeit holding in expansion territory in this last. Services output is also expected below that of January.

EUR/USD Short-Term Technical Outlook

The EUR/USD pair is hovering around the 1.0800 figure stuck in a range for a second consecutive day. There are some tepid signs of downward exhaustion, which anyway are not enough to confirm a bottom. In the 4-hour chart, the pair remains below a bearish 20 SMA, although the pair is barely below it. Technical indicators have recovered from oversold levels, but lost directional strength within negative levels, maintaining the risk skewed to the downside. The pair needs to break the 1.0770 support to be able to extend its slump.

Support levels: 1.0770 1.0725 1.0690

Resistance levels: 1.0840 1.0885 1.0910

Image Sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.