USD/JPY Current Price: 110.07

- Japanese Tool Orders plunged 35.6% in January, according to preliminary estimates.

- A better market mood kept demand for safe-haven assets in check.

- USD/JPY set a fresh February high at 110.12, holds nearby early Asia.

The USD/JPY pair peaked at 110.12 during London trading hours, a fresh February high, holding on to gains by the end of the day but showing no aims to extend its advance. The pair found support in a better market mood, as despite the coronavirus outbreak continued taking its deadly toll, markets seemed less concerned about it, hoping it would remain contained within China, and that the worst is now behind. Worldwide equities closed in the green, with US indexes flirting with all-time highs.

Japanese data released at the beginning of the day disappointed, as January Machine Tool Orders plummeted a 35.6%, after losing in December 33.6%, according to preliminary estimates. This Thursday, the country will publish the January Producer Price Index, seen unchanged monthly basis and up by 1.5% when compared to January 2019.

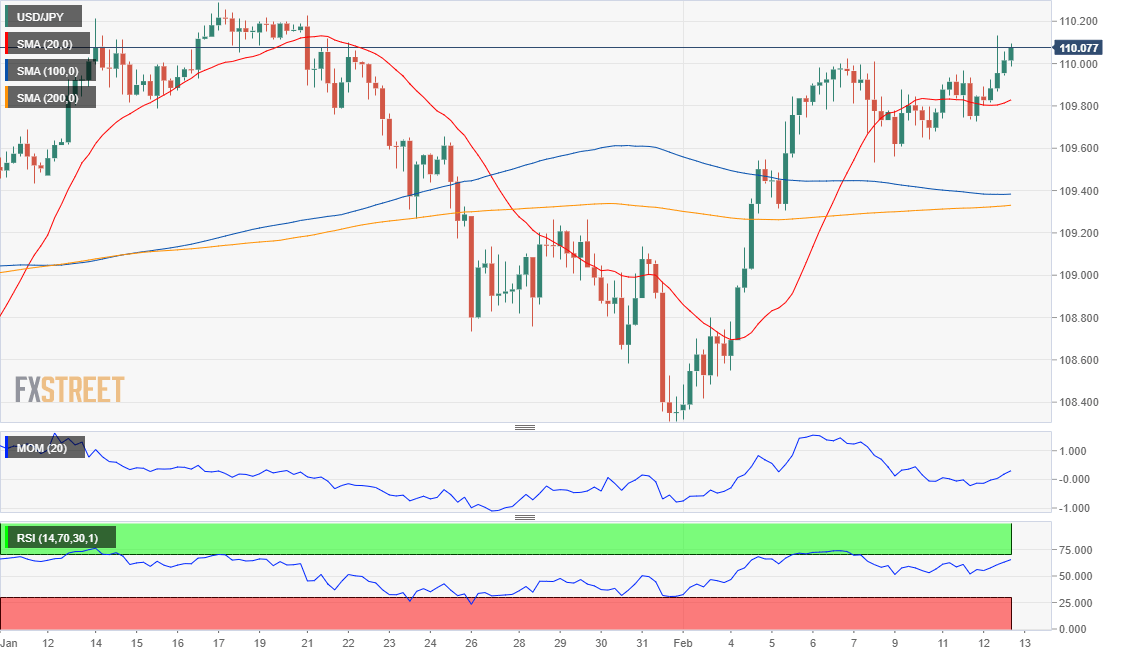

USD/JPY Short-Term Technical Outlook

The USD/JPY pair heads into the Asian opening with a neutral-to-bullish according to the 4-hour chart, as it continues to develop above all of its moving averages, which anyway lack directional strength. Technical indicators hold within positive levels, but the Momentum is losing strength upward just above its mid-line, while the RSI stalled its advance just ahead of overbought levels. The pair would need to run pass 110.28, January high, to turn bullish and be able to extend its gains toward the 111.00 figure.

Support levels: 109.40 109.00 108.65

Resistance levels: 110.35 110.70 111.00

Image by Sofia Terzoni from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.