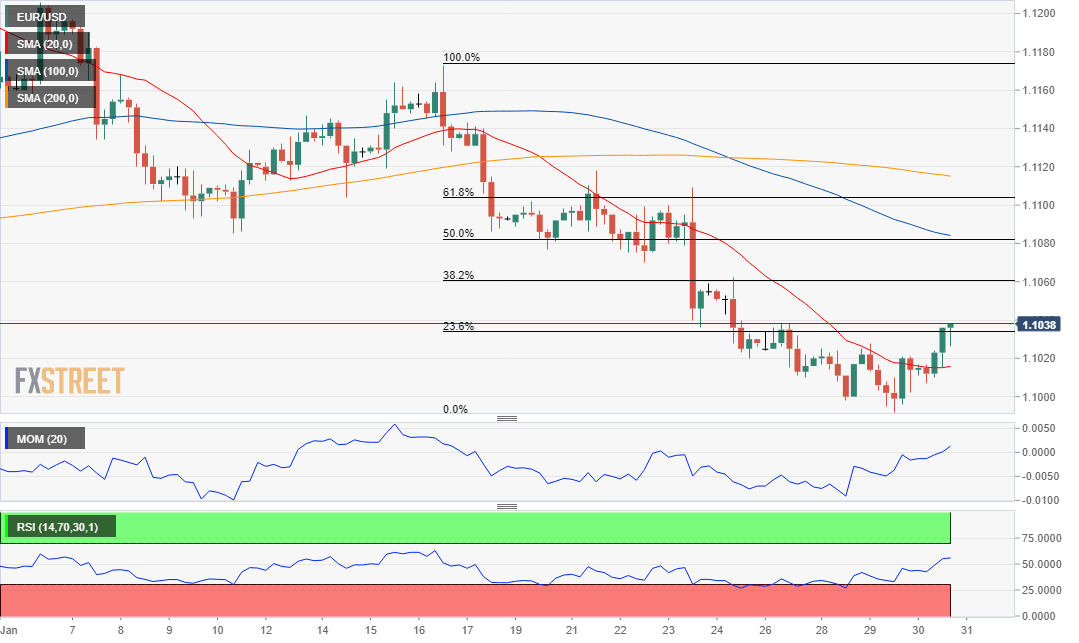

EUR/USD Current Price: 1.1038

- US Q4 GDP matched the previous and the expected with 2.1%.

- Coronavirus outbreak continues to weigh on the market’s mood.

- EUR/USD in recovery mode, but bullish potential limited.

Once again macroeconomic data was overshadowed by sentiment as renewed concerns about the coronavirus outbreak led the way. Indeed, US data released this Thursday failed to impress, as the preliminary estimate of Q4 GDP met the market’s expectations printing at 2.1%. The quarterly core PCE inflation missed the market’s expectations, down to 1.3% from 2.1%. Initial Jobless Claims for the week ended January 24 were at 216K, better than the previous 223K but above the expected 215K.

The greenback edged lower, with the EUR/USD reaching 1.1036 as European data beat expectations. The EU Economic Sentiment Indicator improved in January to 102.9 from 101.3. German inflation came in-line with the market’s forecast in January.

On Friday, Germany will release December Retail Sales, seen up by 5.0%, while the EU will publish the preliminary estimate of January inflation, foresee at 1.4% YoY. The Union will also publish Q4 GDP, expected at 0.2%. As for the US, the macroeconomic calendar will bring the December PCE price index, with the core reading foreseen at 1.6%.

EUR/USD Short-Term Technical Outlook

The EUR/USD pair is in a corrective phase, but additional gains are still unclear, as the intraday advance stalled around the 23.6% retracement of its latest decline, measured between 1.1172 and 1.0991. In the 4-hour chart, the pair has advanced above its 20 SMA for the first time this week, while technical indicators slowly grind higher within positive levels. The 38.2% retracement of the mentioned decline stands at 1.1060, with a break above it suggesting a more consistent advance.

Image Sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.