Wall Street parades into July 4 with stocks at record highs and with jobs data and earnings season straight ahead. At the same time, small-cap stocks are lagging a bit and Treasury yields continue to forecast some caution.

The situation now is one that many are struggling to understand. Yesterday’s theme might have been, “Buy all assets,” as stocks rose and bonds rallied sharply. The relationship between stocks and bonds is an odd one, with equities building in new highs almost every day and the yield curve still getting flatter.

A number of things could help explain this steady fixed income rally. The bond market could be flashing a warning sign about the economy, it could be caution ahead of Friday’s jobs report, or it could be a result of overseas demand for U.S. Treasuries that command higher yields than those in places like Europe.

With today a shortened one ending at 1 p.m. ET for the major U.S. stock exchanges, focus could continue to veer away from the tariff truce and toward Friday morning’s U.S. jobs report. Expectations in the analyst community are leaning toward a rebound in June job growth from the May disappointment. This could be one of those days where people show up for 30 minutes, check to make sure nothing is getting away from them, and leave. It’s probable most participants decided to get out of Dodge and not come back until Friday morning.

Before that, investors can chew on May factory orders and June ISM non-manufacturing data, both out this morning. Factory orders might get more attention than usual considering the spate of weak manufacturing data from the U.S. and overseas that crossed newswires lately.

The S&P 500 Index (SPX) finished at another record-high close Tuesday, and bulls got an additional boost when Tesla Inc TSLA delivered an upside surprise with Q2 production and delivery numbers. TSLA hit record production with 87,048 vehicles and record deliveries of approximately 95,200. The stock quickly jumped more than 7% in post-market trading, so it could be interesting to see if that carries through into Wednesday.

It wasn’t just TSLA. The entire market got a late charge yesterday after spinning lower through most of the session. Selling interest just couldn’t be sustained much once the SPX fell briefly below 2960, and that could be a positive sign. On the other hand, it’s a thinly-traded market this week with exchanges closed for the holiday tomorrow, so it’s probably not the best idea to try and extrapolate any lasting trends.

Back From Holiday to Jobs Data Friday

When people do return from barbecues and beaches early Friday, they’ll face a huge data point right away with the June jobs report. As of mid-week, analysts expect to see 180,000 jobs created in June, according to Briefing.com. That would be a hefty boost from the disappointing 75,000 jobs added the previous month that came as a bearish surprise.

When the new data surface Friday, consider paying special attention to the revision of the previous month’s figure. If the government revises the 75,000 number upward, it could reassure investors that things weren’t actually so bad, and that maybe the Labor Department just missed some jobs in its first estimate. However, if the number is the same or falls, that could make the June data even more important. The question then becomes whether May was an anomaly or the start of a trend.

Construction and manufacturing data for May and June released earlier this week didn’t really provide much cheer for investors hoping job growth might have picked up after the May numbers got counted. Both fell from the previous month, adding to worries that business investment is slowing.

The other major component of the report is wages, and third-party consensus views see another rise of more than 3% year-over-year. What’s tough to figure out is why higher wages don’t seem to be leading to any inflation bump.

How Low Can They Go? (Treasury Yields, That is)

What’s really puzzling at least at first glance is the way Treasury yields keep pushing lower this week even as the SPX set new record highs Monday and Tuesday. It seems like investors are trying to have it both ways—bullish and bearish about the economy at the same time.

Financial sector stocks had a tough day Tuesday in part due to the 10-year yield falling back below 2% to finish the day at 1.976% and then slipping below 1.97% early Wednesday. That’s the lowest it’s been since November 2016, a time when the SPX was trading below 2200 (it set record highs earlier this week above 2970).

Some of the pressure on yields could be from investors seeking protection ahead of Friday’s jobs report, though there’s no investment that can really promise complete protection. Even as Treasury yields plunge, volatility is also on the decline. The Cboe Volatility Index (VIX)—the market’s most closely-watched “fear gauge”—finished Tuesday down more than 8% and below the 13-handle. Just last week it was trading above 16.

It might stand to reason that if investors are worried enough about the market to pile into Treasuries (and, for that matter, into gold, which is also on a roll), they might also want to scoop up some volatility protection. That doesn’t seem to be the case, however, and it might say more about recent VIX history than anything else. Apparently, people have been burned so many times buying VIX, with VIX rallying above 20 more than once over the last six months only to meet solid resistance. There might be some muscle memory of how VIX spent much of the last three summers trading below 15.

One possible issue with people buying Treasuries at these current highs (the underlying Treasury price rises as yields fall), is widespread sentiment that it would be hard to see this rally continue from these levels. Even at the 2016 lows, the 10-year yield barely dipped below 1.4%. That’s still 60 basis points away, roughly, and the economy seems to be on firmer footing today than it was coming out of the earnings recession we saw back then.

Still, as long as there’s risk with the China trade negotiations, it might be hard for yields to mount much of a comeback. That risk might be showing up in the strong performance of so-called “defensive” sectors like Utilities and Real Estate on Tuesday, even as Financials and Technology cooled off a little from their recent sizzling pace (though Technology did manage slight gains). Some of the semiconductor shares that had been so hot late last week and Monday took a beating.

Crude Crushed

Energy also got slammed Tuesday as crude prices collapsed more than 4%. So much for OPEC getting a spark from extending production cuts. Growing supplies out of the U.S. and other non-OPEC producers combined with analyst and industry expectations for slowing demand growth worldwide kept crude on the defense as it fell below $57 a barrel in the U.S. for the first time in more than a week.

Another weak spot Tuesday was small-caps, with the Russell 2000 (RUT) index of small-cap names falling 0.6%. The RUT remains a few points behind the SPX year-to-date, though it’s up a solid 15.6%.

There’s a bit of news on the merger and acquisition (M&A) front this morning, with Broadcom Inc AVGO apparently close to a deal to acquire cybersecurity group Symantec Corporation SYMC for more than $15 billion, the Financial Times reported.

Just a friendly reminder that Market Update won’t be published tomorrow due to the holiday. We’ll be back Friday with an early analysis of the jobs data.

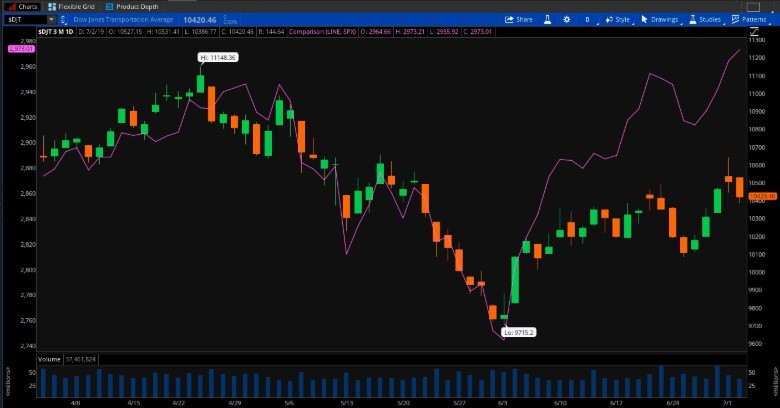

Figure 1: STUCK IN TRAFFIC: The Dow Jones Transportation Average (candlestick) had been keeping close pace with the S&P 500 Index (purple line) for much of Q2, but then began to lag over the last few weeks. This might bear watching, because transports can sometimes be a barometer for economic demand. Data Source: S&P Dow Jones Indices. Chart source: The thinkorswim® platform from TD Ameritrade. For illustrative purposes only. Past performance does not guarantee future results.

Jobs and the Fed: If you pull back a little farther and look at how jobs have grown the last few months, it’s clear that the boom-boom gains of 2017 and 2018 are starting to slow. In two of the last four months, jobs growth has been under 100,000, and it’s averaging about 164,000 a month, vs. above 200,000 for a lot of 2018. This kind of stands to reason. Employers only have so many jobs to fill, and eventually it becomes a matter of diminishing returns with the unemployment rate at 50-year lows. Investors will probably closely watch different job categories to see if there was a June pick-up in manufacturing and construction sector position growth.

Another poor showing for overall job growth in June probably would reinforce ideas about the Fed cutting rates later this month and possibly again at its following meeting. At this point, the futures market builds in 100% chances of a July rate cut and 80% chance of another cut in September. It might be worth checking how that September number reacts to the jobs report.

FAANGs Vs. WPPCKs: It’s not the Hatfields and McCoys yet, but give it time. Over the year ended June 30, FAANGs climbed 5.7%, Barron’s reported. During the same time span, a group of stocks that Barron’s calls the “WPPCKs” rose 27.1%. The WPPKs consist of Walmart Inc WMT, Procter & Gamble Co PG, PepsiCo, Inc. PEP, Costco Wholesale Corporation COST, and The CocaCola Co KO.

The FAANGs vs. WPPCKs competition looks even more interesting if you recall that from June 2017 to June 2018, FAANGs rose 52%, vs. a 13% rise for the SPX. As Barron’s noted, the five FAANGs were “on top of the world” a year ago. Not so much now. Besides reflecting the troubles FAANGs have encountered over the last year with privacy issues, China trade, and Apple Inc. AAPL earnings, this turnaround also could highlight a theory that investors have switched their love to more traditional, “defensive” stocks since mid-2018. It also might suggest that lower interest rates are making Staples and other dividend names seem more appealing to some participants.

C-Note: For insight into global economic health, some analysts think it’s worth watching how two major industrial commodities—crude oil and copper—are behaving. Judging from the way they’ve acted lately, it looks like both got taken for a trip to the woodshed. Copper is down 11% from its May high for the year, and U.S. crude is down 15% from its April high. Both appeared to get only the slightest bounce from the U.S./China trade truce, while still apparently suffering from global economic data that could signal weaker industry demand ahead. The latest blow might have been soft purchasing managers’ data from China, the Eurozone, and Japan on Monday that followed a surprisingly weak Chicago PMI number last Friday. PMI data is often considered a good monitor for business optimism, and it’s not making much of a showing lately. That could help explain why crude continued to flag early this week despite OPEC extending production cuts.

Another traditional economic indicator, the Dow Jones Transportation Average ($DJT), was down 1% or more at times on Tuesday, as airline, railroad, trucking, and delivery stocks turned lower. The $DJT is off 6% from its April high.

Information from TDA is not intended to be investment advice or construed as a recommendation or endorsement of any particular investment or investment strategy, and is for illustrative purposes only. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Image Sourced From Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.