Wall Street bonuses fell 26% last year. This was the biggest drop since 2008. Wall Street is estimated to be responsible for 16% of all economic activity in NYC.

Wild nights out for ibankers slowing down?

Market

Prices as of 4 pm EST, 3/30/23

Macro

-

As Q1 comes to an end, small banks find themselves in a tough position. Keep interest rates low and watch deposits continue to wane. Raise interest rates to compete for deposits with increasingly attractive money market funds and risk cutting into profits and hurting stock prices. Either way, regional bank growth and inequality are set to take a hit.

-

In the meantime, banks are still leaning on the Fed’s new lending facilities. Borrowing from the Bank Term Funding Program (BTFP) rose by ~$10 billion to $65 billion in the week ended March 29. On the other hand, usage of the Fed’s discount window fell by $22 billion to $88 billion over the same period.

-

While GDP was little changed from the previous estimate, GDI (Gross Domestic Income)–which measures the income generated and cost incurred from producing goods and services–fell by 1.1% in the fourth quarter, the biggest drop since the onset of the pandemic. At the same time, corporate profits tumbled by the most in 2 years, falling 2% as companies face rising costs, weaker demand, and elevated borrowing costs.

-

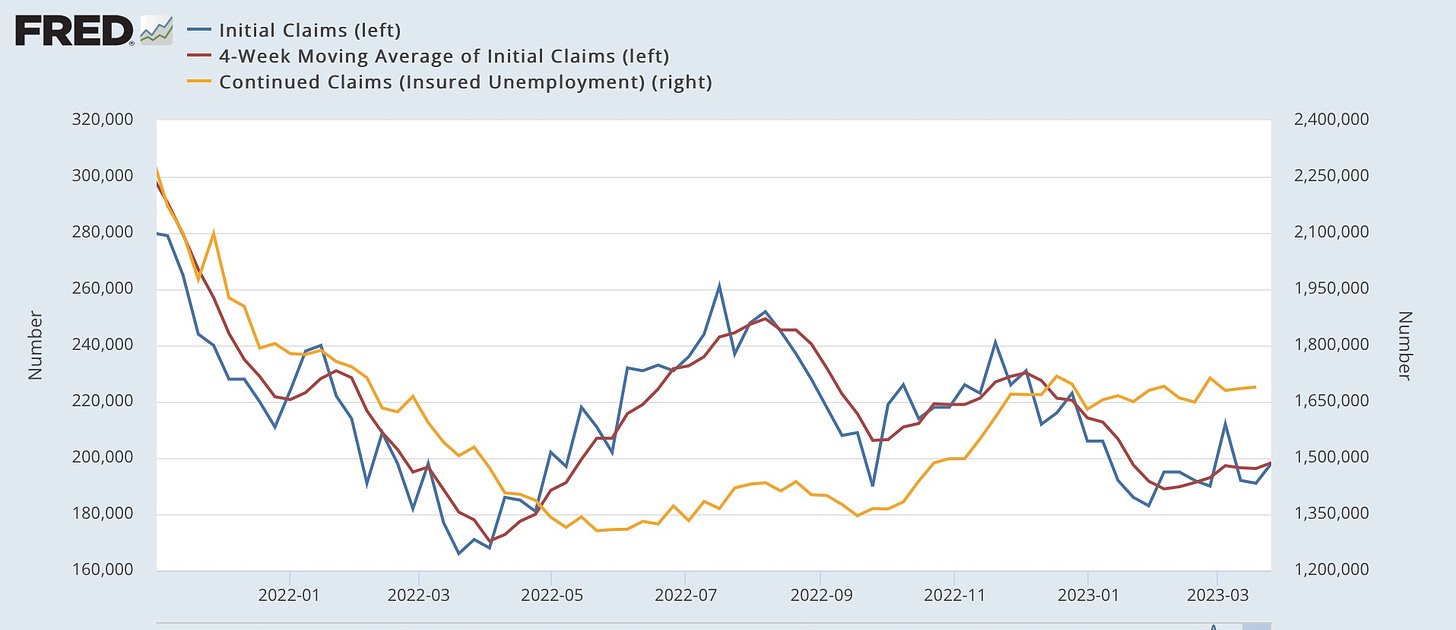

Initial jobless claims edged higher last week but still point to a healthy (tight) labor market, something which runs counter to the Fed’s objectives. Initial claims rose to 198,250 (vs. 196,000 expected) while continuing claims ticked up by 4,000 to 1.689 million (vs. 1.697 million expected).

Stocks

-

After halting production in February due to an EV battery fire, Ford F has resumed full production of its electric F-150 Lightning. It’s also jacked up prices on some of its models, including its lower-cost version which now comes with a $60,000 price tag, 50% higher than its original starting price of $40,000 announced last year.

-

Netflix is restructuring its film group to focus on quality over quantity. The company plans to consolidate units that produce small- and mid-size movies in a move that will result in some layoffs as well as the departure of two of its most experienced executives.

-

Citigroup C has upgraded US stocks to overweight while downgrading their European counterparts to neutral. The bank also raised global tech stocks (to overweight) and lowered expectations for global financials (to neutral), citing lingering concerns in the sector as well as a looming credit crunch.

-

Just under 2 months ago, on the heels of a fierce rally in equities to start the year, Michael Burry published a one-word tweet: “sell”. True to form, the tweet provided no explanation and was soon deleted. Yesterday, however, Burry offered a follow-up to the not-so-cryptic message and admitted he was wrong to have advised investors to get out.

Energy

-

Ongoing disruptions to Iraqi exports have boosted oil prices which are on pace for a 7% gain this week as an ongoing disagreement between Baghdad and Kurdistan has resulted in reduced production. The two parties are set to meet next week, however, which could lead to the resumption of more than 400,000 bpd.

-

Meanwhile, after surging to record highs in 2022, coal prices have dropped significantly as competition from renewables stiffens. In fact, last year was the first ever in which renewables–including wind, solar, hydropower, and biomass–accounted for more US power generation than coal.

Earnings

-

I-Mab IMAB

-

Tingo TIO

-

Bioventus BVS

-

Ascent Industries ACNT

News

-

Criminal charges: For the first time ever, a former US president (one Donald J. Trump) will face criminal charges.

-

Ya think?: Treasury Secretary Janet Yellen said yesterday it may be possible that efforts to support the US financial system are incomplete.

-

Recession confirmed: Even though it’s all anyone is talking about, Jim Cramer says he’s still looking for the first sign of a recession.

-

Europe inflation: Despite a record drop in headline inflation (6.9% from 8.5%), core inflation in the region hit a record 5.7% in March.

-

China rebound: Activity in China’s services sector jumped to its highest in more than 10 years in March, suggesting the country’s economic recovery is well underway.

Crypto

Prices as of 4 pm EST, 3/30/23

-

SBF charges: Sam Bankman-Fried has pleaded not guilty to five new federal charges, bringing the total number of criminal counts to 13.

-

USDC: Outflows from Circle’s USDC—the world’s second-largest stablecoin—have resulted in a $10 billion decline in market cap over the last 2 weeks.

-

Killer use case: Citi predicts that tokenization of real-world assets will reach between $4 to $5 trillion by 2030.

-

Trump NFTs: Following his indictment by a New York grand jury, sales of Donald Trump’s NFTs spiked by more than 500%.

-

BTC weaponized: A US Space Force major is arguing the country should support and adopt Bitcoin or risk losing its status as a global superpower.

Deals

-

Communications: Rogers has received the green light from the Canadian government to move forward with its $14.8 billion acquisition of rival Shaw.

-

Weak M&A: Global dealmaking saw its worst Q1 in a decade as values plunged 45% from last year.

-

Shuttered: After failing to secure funding, Virgin Orbit will cease operations and lay off nearly all of its workforce.

-

Logistics: Cainiao Network Technology–Alibaba’s $20 billion logistics arm–is prepping for a Hong Kong IPO as soon as this year.

-

Minimum tax: Many smaller US companies are concerned that one-time activities like the sale of business units will trigger the new 15% corporate minimum tax that otherwise wouldn’t apply to them.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.