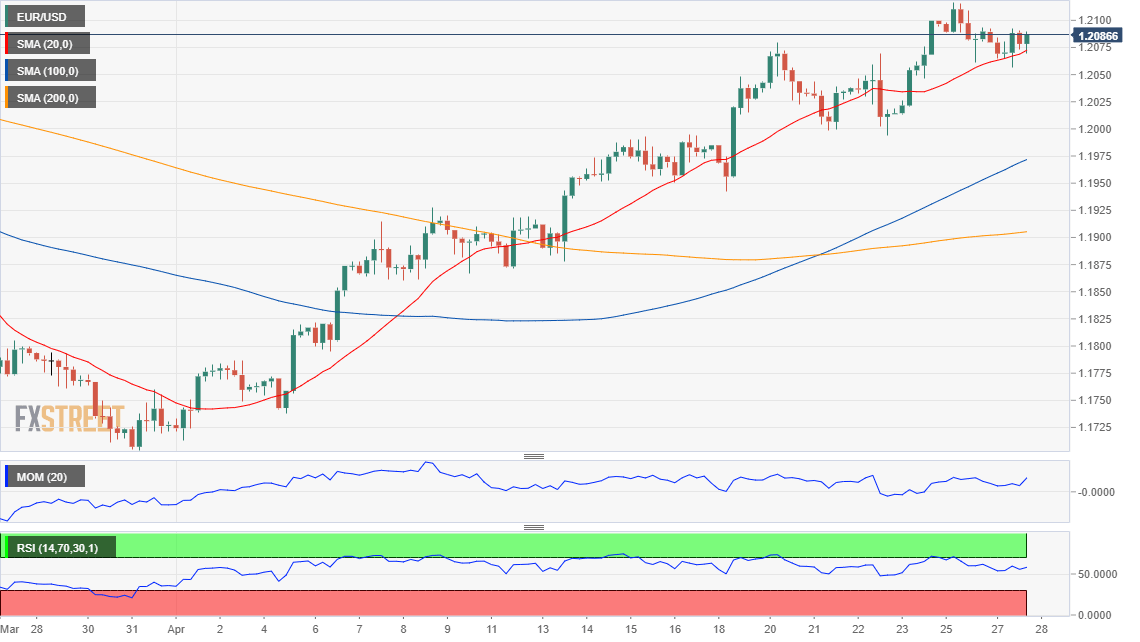

EUR/USD Current Price: 1.2086

- US data beat expectations, but investors remained in cautious mode.

- US Federal Reserve set to announce its monetary policy decision on Wednesday.

- EUR/USD is technically neutral in the near-term but holding near monthly highs.

The EUR/USD pair held within familiar levels, ending Tuesday unchanged in the 1.2080 price zone. The pair fell to 1.2060 during European trading hours, as a cautious mood prevailed. European indexes closed in the red, although not far from their opening levels, weighing on US indexes, which anyway traded mixed around their opening levels.

Investors ignored upbeat US data as the Conference Board Consumer Confidence Index rose in April to 121.7 from 109.0 in March, widely surpassing the market’s expectations. The country also published the April Richmond Fed Manufacturing Index, which held at 17, better than the expected 16. The EU didn’t publish macroeconomic data.

This Wednesday, Germany will publish the May GFK Consumer Confidence Survey, foreseen at -3.5 from -6.2 previously. In the US, the focus will be on the Federal Reserve, as the central bank will announce its decision on monetary policy. No surprises are expected this time, although investors expect chief Jerome Powell to acknowledge the improvement in the employment sector and hence, offer a more hawkish speech. Tightening will likely remain off the table, although that’s exactly what investors are waiting for, hints on reducing QE.

EUR/USD Short-Term Technical Outlook

The EUR/USD pair has lost bullish strength, but there are no signs of an upcoming decline. The 4-hour chart shows that the price is barely holding above a mildly bullish 20 SMA, while the longer moving averages remain well below the current level. Technical indicators have retreated within positive levels, currently lacking directional strength. The risk remains skewed to the upside, with another leg north expected on a break above 1.2115.

Support levels: 1.2050 1.2005 1.1960

Resistance levels: 1.2115 1.2160 1.2200

View Live Chart for the EUR/USD

Image Sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.