EUR/USD Current Price: 1.1762

- The US ISM Manufacturing PMI surged to 54.2 in July, much better than anticipated.

- The European Markit Manufacturing PMIs were upwardly revised in July final versions.

- EUR/USD bearish potential remains well limited by lack of interest in the greenback.

The American dollar remained on the winning side throughout the first half of Monday, paring its advance after Wall Street’s opening and the release of encouraging US data. The ISM Manufacturing PMI rose to 54.2 in July, beating the market’s estimate. Stocks were on the rise since early London, with European indexes closing with solid gains. As for the greenback’s early advance, there was no particular reason behind it, but positions adjustments at the beginning of the month. It didn’t take long until the better mood took its toll on the dollar.

Markit published the final versions of the July Manufacturing PMIs for both economies. EU figures were mostly positive, as the German’s index was confirmed at 51 from an initial estimate of 50, while for the whole Union, manufacturing output reached 51.8, better than the flash 51.1. The US manufacturing PMI, however, was downwardly revised to 50.9 from 51.3, also missing the market’s expectations. This Tuesday, the EU will publish the June Producer Price Index, while the US will unveil June Factory Orders, seen up by 5% after advancing 8% in the previous month.

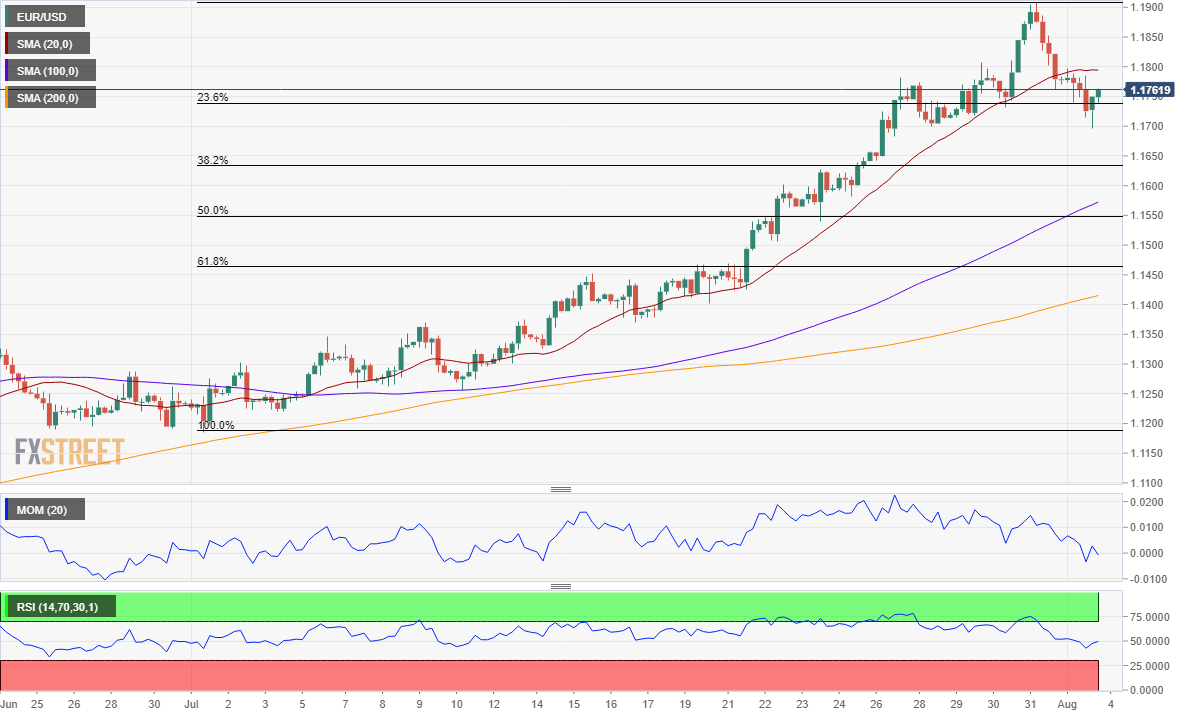

EUR/USD Short-Term Technical Outlook

The EUR/USD pair bottomed for the day at 1.1695, bouncing later to the 1.1760 area, where it stands as the day comes to an end. The pair briefly pierced the 23.6% retracement of its July rally at 1.1736 but is ending the day above it. The 38.2% retracement of the same rally comes at around 1.1630, a line in the sand for the latest bullish trend. From a technical point of view, and in the short-term, the bearish potential seems limited, as technical indicators recovered from daily lows, now struggling with their midlines. The 20 SMA has capped advances ever since the day started, providing a dynamic resistance at around 1.1790, the level that the pair needs to surpass to recover its bullish potential.

Support levels: 1.1735 1.1690 1.1650

Resistance levels: 1.1790 1.1825 1.1860

Image source from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.