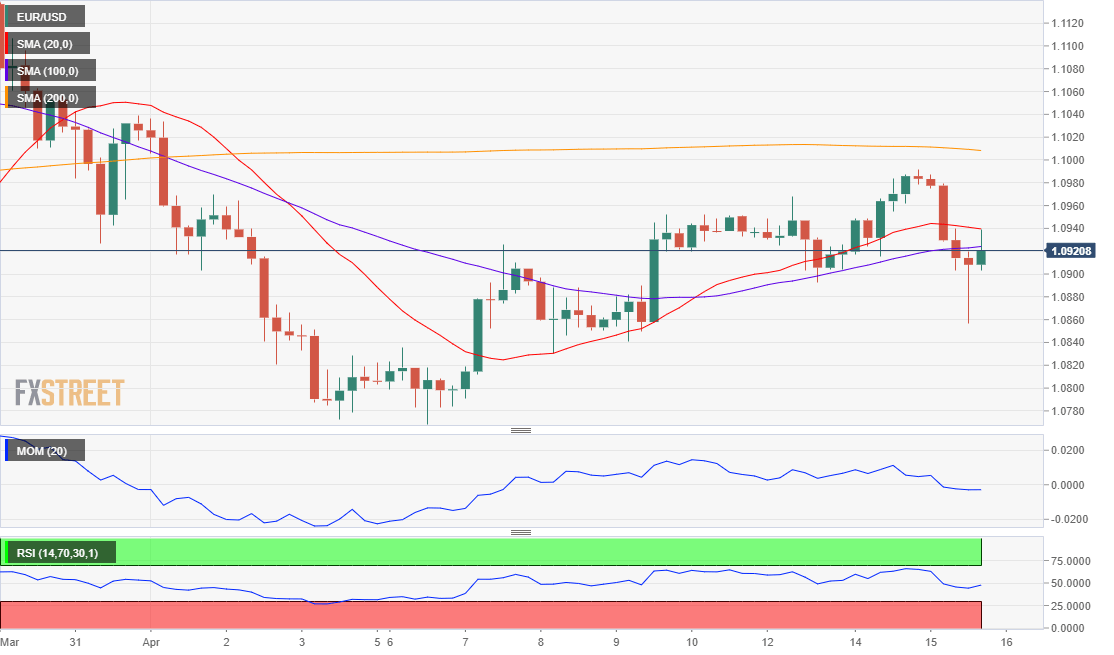

EUR/USD Current Price: 1.0921

- Global stocks edged lower amid renewed fears of a global recession.

- US data came in much worse than anticipated, March Retail Sales fell 8.7%.

- EUR/USD turned neutral in the short-term, risk to turn south on a break below 1.0830.

The American Dollar soared this Wednesday reaching fresh weekly highs against most major rivals. The EUR/USD pair traded as low as 1.0860 but finally recovered to settle around 1.0920. The greenback rallied at the beginning of the day amid a worsening market mood, spurred by renewed concerns about a global recession as a result of the coronavirus pandemic. Two factors weighed on the sentiment: the IMF warned it could be the worst since the Great Depression, while the earnings season in the US kick-started with reports showing sharp declines in revenues.

The US released several macroeconomic reports, none of which brought good news. March Retail Sales plunged 8.7%, worse than the market’s forecast of 8.0%. The April NY State Empire Manufacturing Index sunk to -78.2 from -21.5 and vs the -35 expected. Finally, Industrial Production in March contracted 5.4%. The batch of negative news initially fueled the dollar’s rally, as Wall Street came under additional pressure, although these last managed to bounce from their lows, sending the greenback lower across the board.

This Thursday, Germany will report March inflation data, while the EU will publish February Industrial Production. The US has a packed calendar, although the focus will be on Initial Jobless Claims for the week ended April 10, seen at 5100K.

EUR/USD Short-Term Technical Outlook

The EUR/USD pair has been rejected from near the 1.1000 level, and settled below the 38.2% retracement of its latest daily advance at 1.0950, the immediate resistance. In the 4-hour chart, technical indicators have recovered from their daily lows and turned flat around their midlines. The pair settled around a directionless 100 SMA, and below the 20 and 200 SMA, which also lack directional strength. A steeper decline seems likely on a break below 1.0830, the 61.8% retracement of the mentioned rally.

Support levels: 1.0900 1.0860 1.0830

Resistance levels: 1.0950 1.0990 1.1025

Image sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.