Current Price: 1.1303

- US stocks remain volatile, and tensions elevated, eyes turn to coronavirus economic stimulus packages.

- EUR/USD fills the weekly opening gap on US dollar recovery.

The US dollar staged a recovery that gained speed during the American session on Tuesday, sending EUR/USD back under 1.1300. US President Trump and advisors meet with Republican senators to discuss an economic stimulus package. Speculations about other stimulus measures dominated the news flow during US trading. Wall Street recovered some of its losses on another wild day. Data from the Eurozone showed the GDP grew by 0.1% during the fourth quarter, in line with previous estimates.

A recession in the EZ seems likely particularly if the impact of the coronavirus persists. On Thursday, the European Central Bank is expected to announce easing measures. US inflation data is due on Wednesday but it could be irrelevant for market participants. The annual CPI rate is seen at 2.2% in February down from 2.5%.

Short-Term Technical Outlook

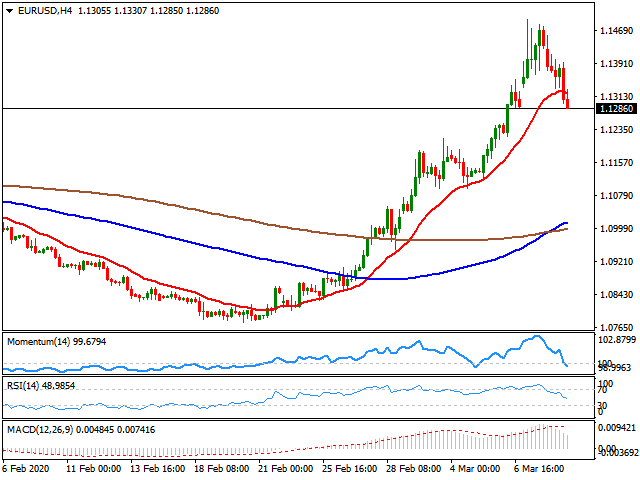

The EUR/USD lost relevant technical levels, like 1.1330 and extended the correction. It bottomed at 1.1275. In the four hours chart, price is back below the 20-SMA and Momentum dropped below 100; also the RSI is moving south, far from oversold readings suggesting there is more room for the pair to slide. The next target might be located around 1.1250; below, the 1.1180 area emerges as a strong support that should be respected. A recovery back above 1.1335/40 would put the euro back into business and ready for a test of 1.1400. Overall, the 1.1500 zone remains a crucial resistance, unlikely to be broken on the next sessions, particularly if volatility continues to diminish.

Image by Bruno /Germany from Pixabay© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.