Current Price: 1.1462

- Russia and Saudi Arabia set off a price war, and financial markets collapse.

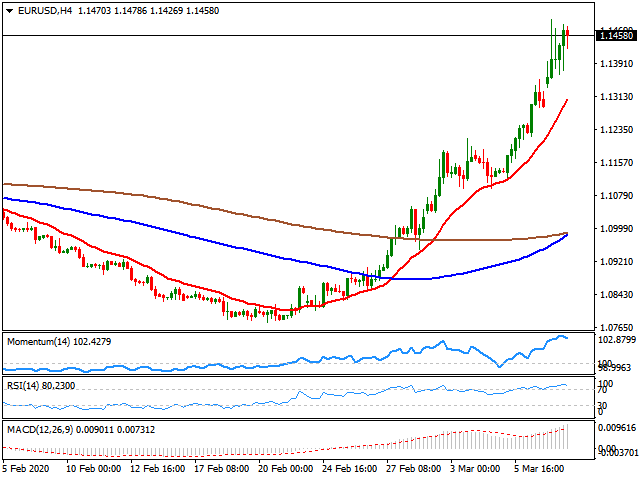

- EUR/USD posts highest close in a year, likely to face resistance at 1.1500/15.

The EUR/USD pair posted substantial gains on the day crude oil prices collapse triggering chaos across financial markets. The German government said it will announce measures to bring liquidity to companies. After Monday’s events now some action from the European Central Bank on Thursday is expected. ECB could announce some kind of QE and even more. The rise in Italian government bond yields and the negative economic outlook could weigh on growth expectation at the EZ. On Tuesday, EZ Q4 GDP data is due. It is all pre-coronavirus, so those numbers are old and not relevant. Attention will continue to focus on markets and potential announcements from government and central bank officials. The usual measures “to guarantee liquidity” could prove to be not enough. Mora rate cuts at the Federal Reserve are priced in and some analysts expect it to drop all the way to 0%.

Short-Term Technical Outlook

The upside bias and Momentum remain healthy for the euro. Technical indicators in the daily and four hours chart show overbought extreme readings, but still not turning south. The rally of EUR/USD was capped by 1.1500 that is a significant barrier, likely to be rechallenged in the short-term. A consolidation above 1.1515 would point to further gains; the next resistance stands at 1.1570 (January 2019 high). If the euro fails at 1.1500 or breaks higher and then reverses, a correction will likely follow. The 1.1400 area has become the immediate support. The decline from current levels could extend to 1.1285/1.1300; as long as it remains above the upside bias will hold.

Image Sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.