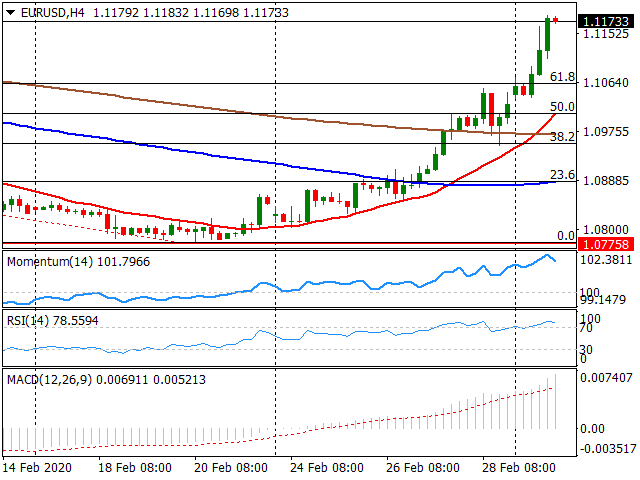

Current price: 1.1173

- EUR/USD climbed to fresh highs on Monday, approaches 1.12 mark.

- Markets expect central banks to step in to counteract coronavirus damage.

The EUR/USD pair extended gains on Monday, stretching to a nearly two-month high of 1.1184 as the greenback continues to face selling pressure amid rising bets that the Fed will cut interest rates as soon as March. While the market had already priced in a 25 bp cut, odds of a 50 bp cut jumped after Fed’s Chairman, Jerome Powell, stated that they would act as appropriate to support growth. The Federal Reserve is expected to cut rates as a preemptive move to counteract the potential negative impact of the Chinese coronavirus on the US economy.

Meanwhile, Luis de Guidos, Vice President of the European Central Bank, said that the bank “stands ready to adjust all its instruments, as appropriate.” The ECB rhetoric joins a series of comments from central bank chiefs around the world, indicating that a coordinated global monetary response to the epidemic is a possibility.

Soft manufacturing data from the US contributed to dollar weakness. The Markit Manufacturing PMI fell to 50.7 in February slightly below the 50.8 expected, while the ISM Manufacturing Index dropped to 50.1 below the 50.4 forecasted.

EUR/USD Short-Term Technical Outlook

From a technical view, the EUR/USD short-term bias has turned bullish after the price broke above the 100 and 200-day SMAs and the 61.8% Fibonacci retracement of the December-February descendent move. The 20 and 200 SMAs in the 4-hour chart have made a bullish cross supporting the perspective, although indicators in the same time frame continue to offer signs of exhaustion, favoring a corrective pullback. The initial support level is seen at 1.1100, where the psychological level converges with the 200-day SMA. On the other hand, above the recent highs, the pair could aim at the 1.1200 area after correcting overbought conditions.

Image Sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.