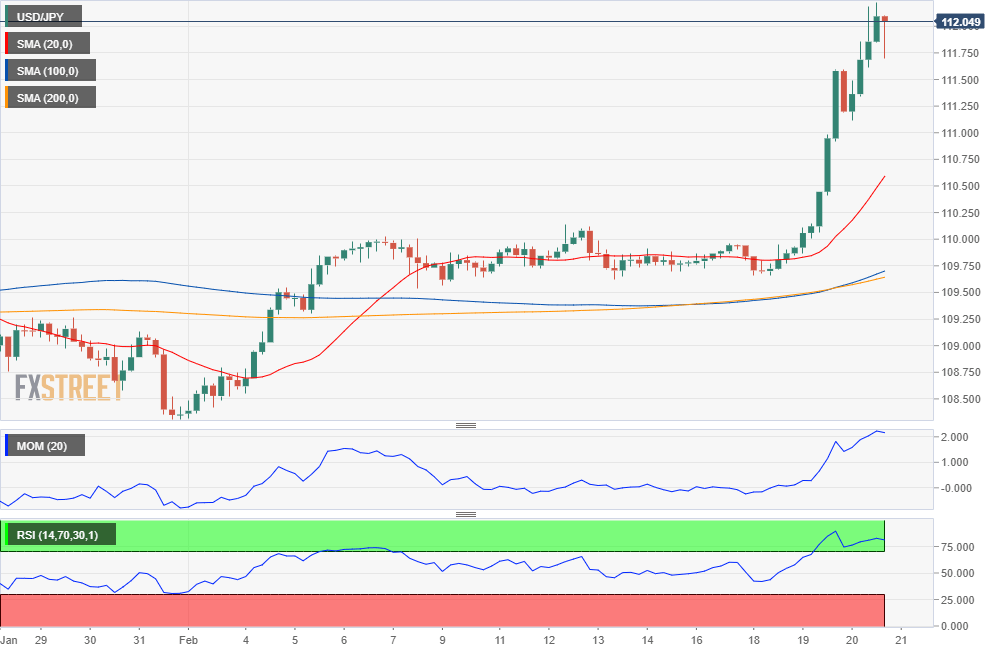

USD/JPY Current Price: 112.04

- Japanese data suggest the country is heading into a technical recession.

- The coronavirus outbreak is taking its toll on Asian economies.

- USD/JPY facing resistance at 112.40, but poised to extend its advance.

The USD/JPY pair soared to 112.22 before finally stalling, holding on to gains as the day comes to an end. The market kept ignoring the Japanese yen safe-haven condition, selling the currency on the back of dismal data released this month, and an increase in the number of cases of coronavirus in Japan. Fears are that the country is heading into a technical recession, after months of falling industrial production and Q4 GDP contracting.

Falling equities and US Treasury yields barely affected the pair, which retreated to 111.69 during US trading hours only to resume its advance. Japan will publish January National Inflation during the upcoming session, with the core ex-food and energy figure seen steady at 0.9% YoY. The country will also release the All Industry Activity Index for December, and the February Jibun Bank Manufacturing PMI for February, seen at 49 vs 48.8 in the previous month.

USD/JPY Short-Term Technical Outlook

The USD/JPY pair is trading around 112.00, consolidating gains, and with no signs of an imminent bearish corrective move. The 4-hour chart shows that technical indicators hold flat within extreme overbought levels, as 20 SMA turned sharply higher well below the current level, and above the larger ones. April’s monthly high stands at 112.39, the next relevant resistance level. Bulls may continue to buy once above it, pushing the pair toward the 113.00 level.

Support levels: 111.60 111.20 109.80

Resistance levels: 112.40 112.70 113.00

Image Sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.