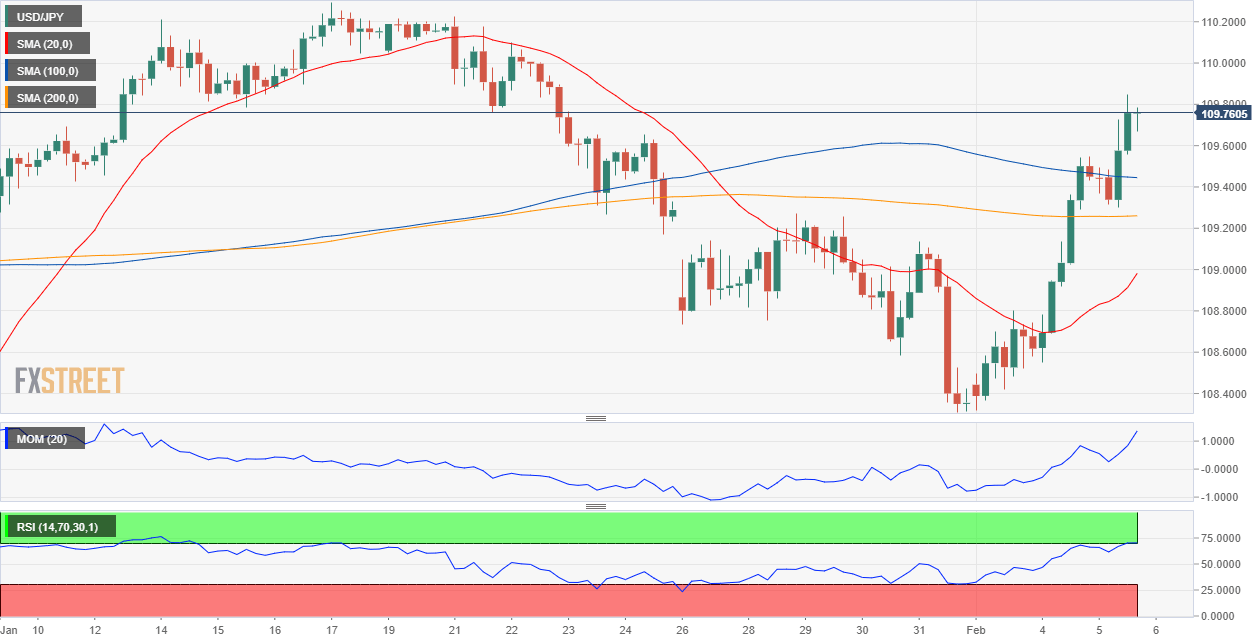

USD/JPY Current Price: 109.76

- Better-than-expected US data sent yields to fresh weekly highs.

- Japanese Jibun Bank Services PMI for January resulted at 51, below the expected 52.1.

- USD/JPY poised to challenge the 110.00 figure, scope to retest recent highs at 110.28.

The USD/JPY pair has reached a fresh 2-week high of 109.84, amid persistent dollar’s strength, compliments to robust US data and rallying equities. Ever since the week started, better-than-anticipated US macroeconomic figures have fueled demand for local equities, which slowly approach to record highs after ending January in the red. US Treasury yields advanced for a third consecutive day, with the yield on the benchmark 10-year note hitting 1.66%, and settling not far below this last.

Japan published the Jibun Bank Services PMI for January at the beginning of the day, which resulted at 51, below the expected 52.1. The country won’t provide relevant data during the upcoming Asian session.

USD/JPY Short-Term Technical Outlook

The USD/JPY pair retains its gains ahead of the Asian opening, overbought in the short-term. The 4-hour chart shows that the pair is consolidating above its moving averages, with the 20 SMA gaining traction upward below the larger ones, which remain directionless. Technical indicators have turned flat within overbought levels, reflecting the ongoing consolidation. The risk is skewed to the upside, with further gains expected once beyond 109.90.

Image Sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.