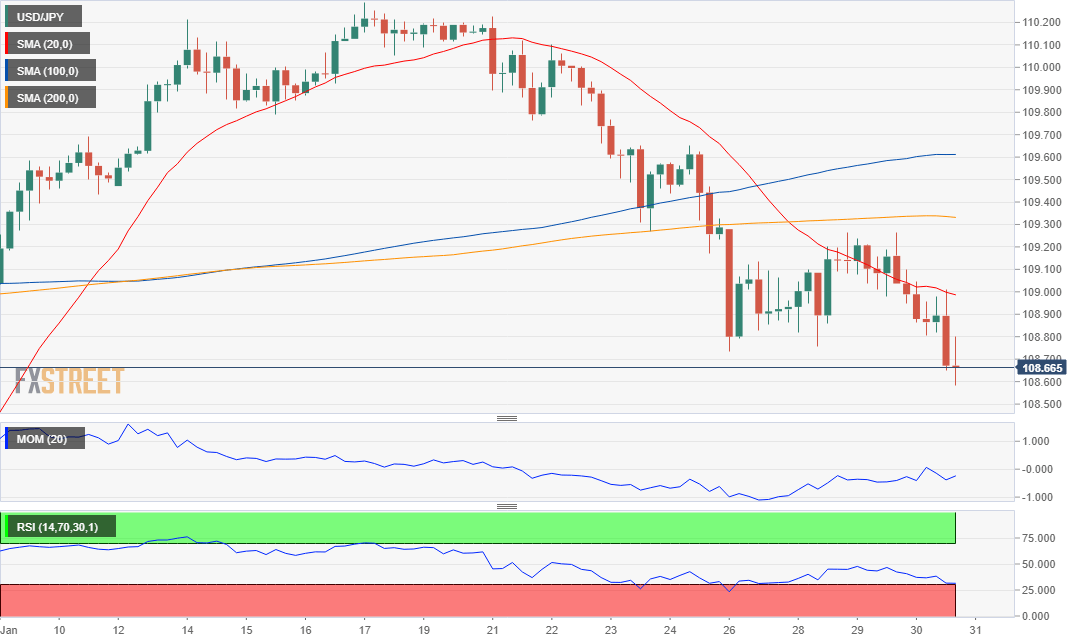

USD/JPY Current Price: 108.65

- The Chinese coronavirus keeps spreading and fueling concerns about an economic downturn.

- Japan will release Tokyo inflation, Retail Sales and Industrial Production.

- USD/JPY challenging a major Fibonacci level, at risk of falling toward 107.90.

The Japanese yen appreciated during US trading hours amid renewed demand for safety. US Treasury yields fell to fresh multi-week lows, while worldwide indexes spent the day in the red, as the Chinese coronavirus keeps spreading fueling concerns about an economic downturn. A solid US GDP report, with the country growing at a 2.1% annual pace in the last quarter of 2019, failed to avert concerns.

Japan has a busy macroeconomic calendar this Friday, as the country will publish January Tokyo inflation, foreseen unchanged from its previous estimates, December Retail Trade and Industrial Production for the same month. Later in the day, the country will publish December Housing Starts and Construction Orders.

USD/JPY Short-Term Technical Outlook

The USD/JPY pair has broken below the 61.8% retracement of its latest bullish run, now trading around the level at 108.65, and technically bearish according to the 4-hour chart. This last shows that a bearish 20 SMA capped intraday advances, now converging with the 50% retracement of the same rally. Technical indicators, in the meantime, remain within negative levels, the Momentum heading south and the RSI hovering around 32. The pair would need to recover above the 108.90/109.00 price zone to shrug off the negative stance, but at this point is at risk of falling toward 107.90.

Image Sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.