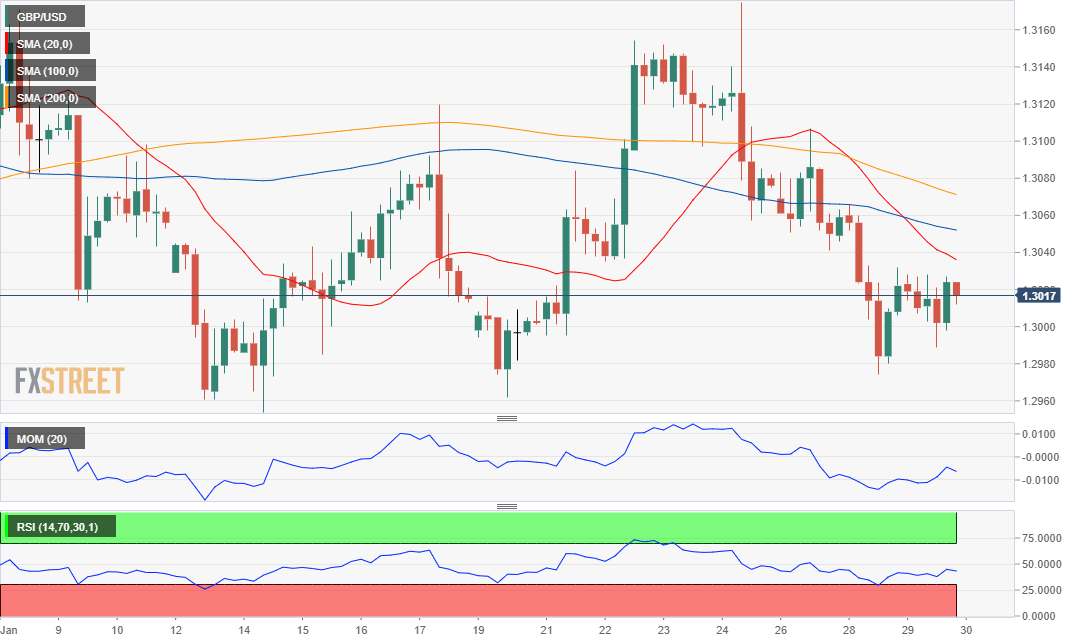

GBP/USD Current Price: 1.3016

- Pound ignoring US events unaffected by the market’s sentiment.

- Market believes that the BOE could surprise with a rate cut this Thursday.

- GBP/USD holding below 1.3040 which skews the risk to the downside.

The GBP/USD pair spent the day within familiar levels, stuck around 1.3000. The market shifted to cautious mode ahead of the US Federal Reserve announcement but in the case of Sterling, the quietness was exacerbated by upcoming UK news.

UK first-tier events will start this Thursday with the Bank of England monetary policy decision.

The central bank is expected to keep rates on hold, although at least one more MPC is expected to vote in favor of a rate cut. However, there’s a good chance than more than one policymaker adding his voice to the current 2 members in favor of a cut. Governor Carney’s speech will be closely scrutinized afterward. Anyway, things don’t look good for the Pound, with Brexit scheduled for Friday.

GBP/USD Short-Term Technical Outlook

The GBP/USD pair is ending the day little changed at around 1.3020, and the short-term technical picture indicates that the risk remains skewed to the downside, as the pair has spent the day below a Fibonacci level at 1.3040, the immediate resistance. In the 4-hour chart, the pair develops below all of its moving averages, and with the 20 SMA below the larger ones. Technical indicators have recovered from daily lows, but remain below their midlines. There are little chances that the pair will move ahead of BOE’s decision.

Image Sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.