EUR/USD Current Price: 1.1117

- Investors dumped the high-yielding EUR, USD up despite limited self-strength.

- A scarce macroeconomic calendar and winter holidays keeping majors ranging.

- EUR/USD gains bearish traction, could extend its decline to 1.1065.

The EUR/USD pair is finishing Wednesday in the red, near a fresh weekly low of 1.1110, as the dollar’s benefited from persistent political uncertainties. After announcing phase one of a trade deal last Friday, China and the US haven’t provided much detail on what such deal implies, cooling down the initial optimism. Also, UK PM Johnson is determined to pull the UK out of the EU next year, reviving fears he may well trigger a hard-Brexit if required.

A scarce macroeconomic calendar helped to keep markets range-bound. Mixed German data failed to lean support to the shared currency, as the annual PPI resulted at 0.7% in November, missing the market’s expectations, although the ZEW Survey showed that Business Climate bounced in December, surpassing the market’s estimates with 96.3. The USD appreciated particularly against its European rivals. This Thursday, the EU won’t release relevant data, while the US will only publish the usual weekly unemployment data and Existing Home Sales for November.

EUR/USD Short-Term Technical Outlook

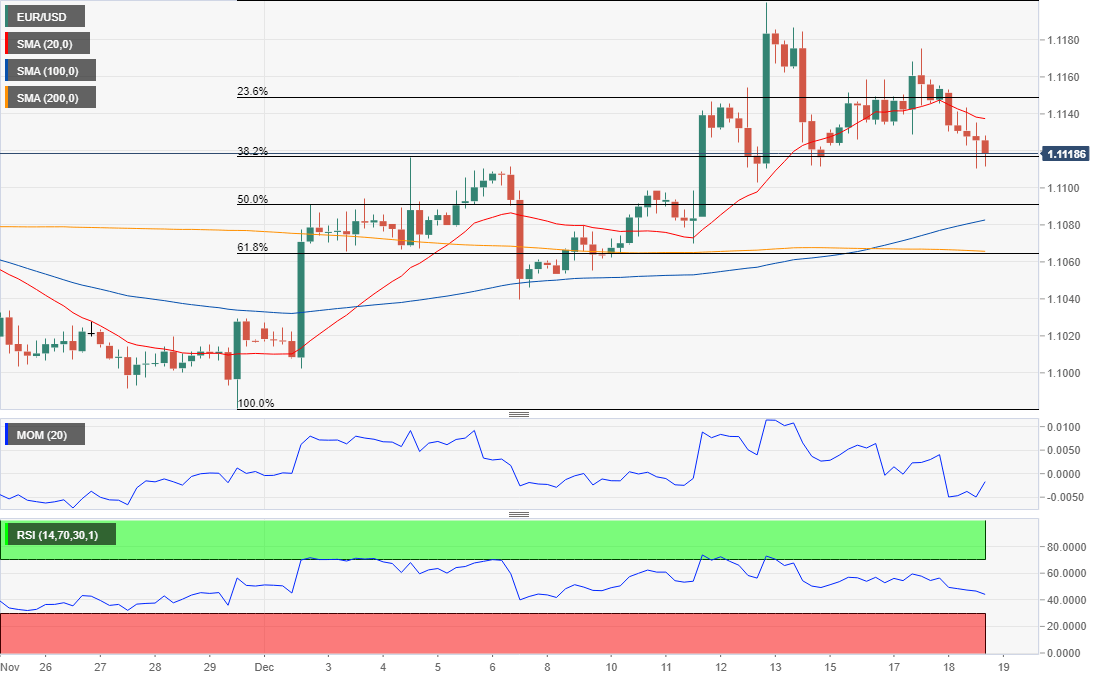

The EUR/USD pair has turned bearish in the short term, as it hovers around the 38.2% retracement of its December rally at 1.1115, the immediate resistance, with 1.1065 coming at sight.

This last has provided support/resistance in the last couple of weeks, while also stands for the 61.8% retracement of the mentioned rally. The 4-hour chart supports additional slides, as the pair is now developing below a bearish 20 SMA, while technical indicators have entered negative territory, maintaining modest downward slopes.

Image Sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.