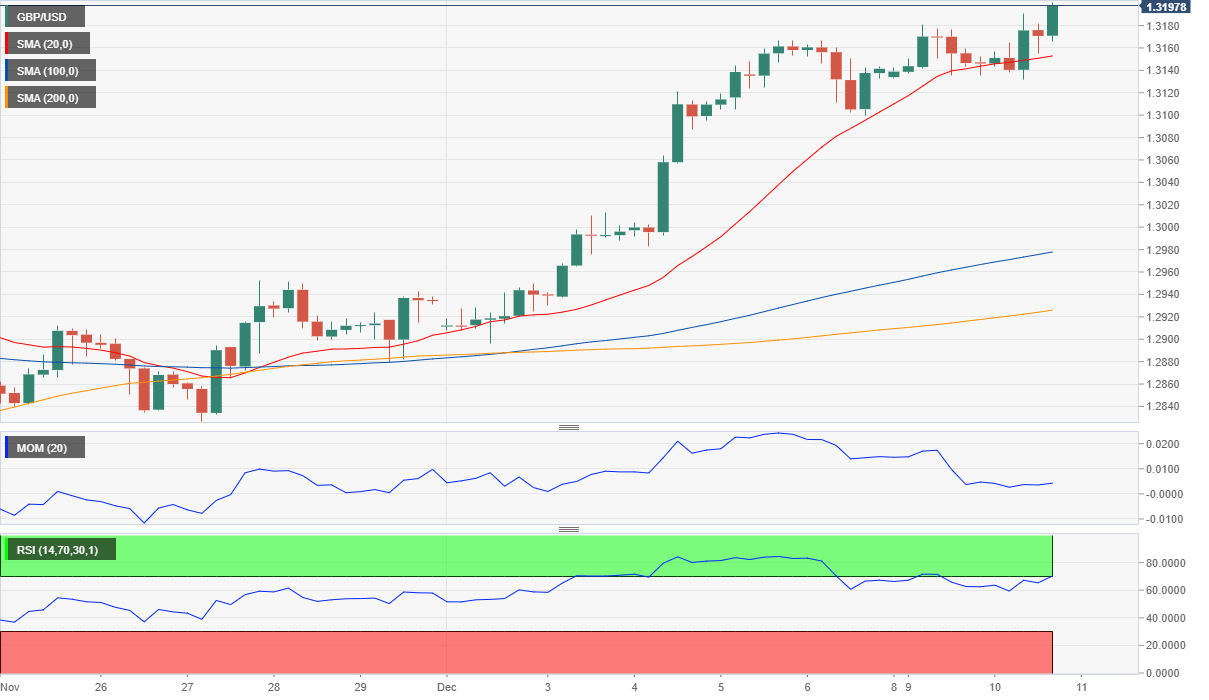

GBP/USD Current Price: 1.3198

- UK data missed the market’s expectations but didn’t affect the Sterling.

- Hopes that UK PM Johnson will win the general election persist.

- GBP/USD holding near a multi-month high, firmer advance expected once above 1.3220.

The GBP/USD pair has reached a fresh 7-month high of 1.3199 to settle a few pips below it, backed by prevalent hopes UK PM Johnson will win the upcoming general election. Data released in the UK was generally discouraging, as the October Trade Balance posted a larger-than-expected deficit of £-14.486B in October, while Industrial Production in the same month rose a modest 0.1% when compared to September, and fell by 1.3% when compared to a year earlier.

Furthermore, the monthly GDP estimate came in flat vs. an expected advance of 0.1%. Nothing affected the pound, with the market waiting for the outcome of elections before deciding whether to push it further or unwind longs. The UK won’t release relevant data this Wednesday.

GBP/USD Short-Term Technical Outlook

The GBP/USD pair is trading within limited intraday ranges, but retaining its bullish stance in the short-term. In the 4-hour chart, a bullish 20 SMA continued to provide support, currently at around 1.3150, as technical indicators advance, the Momentum well above its mid-line and the RSI entering overbought levels.

A bearish corrective movement could take place with a break below 1.3150, while the advance should accelerate on an advance beyond 1.3220 a relevant mid-term resistance.

Image Source from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.