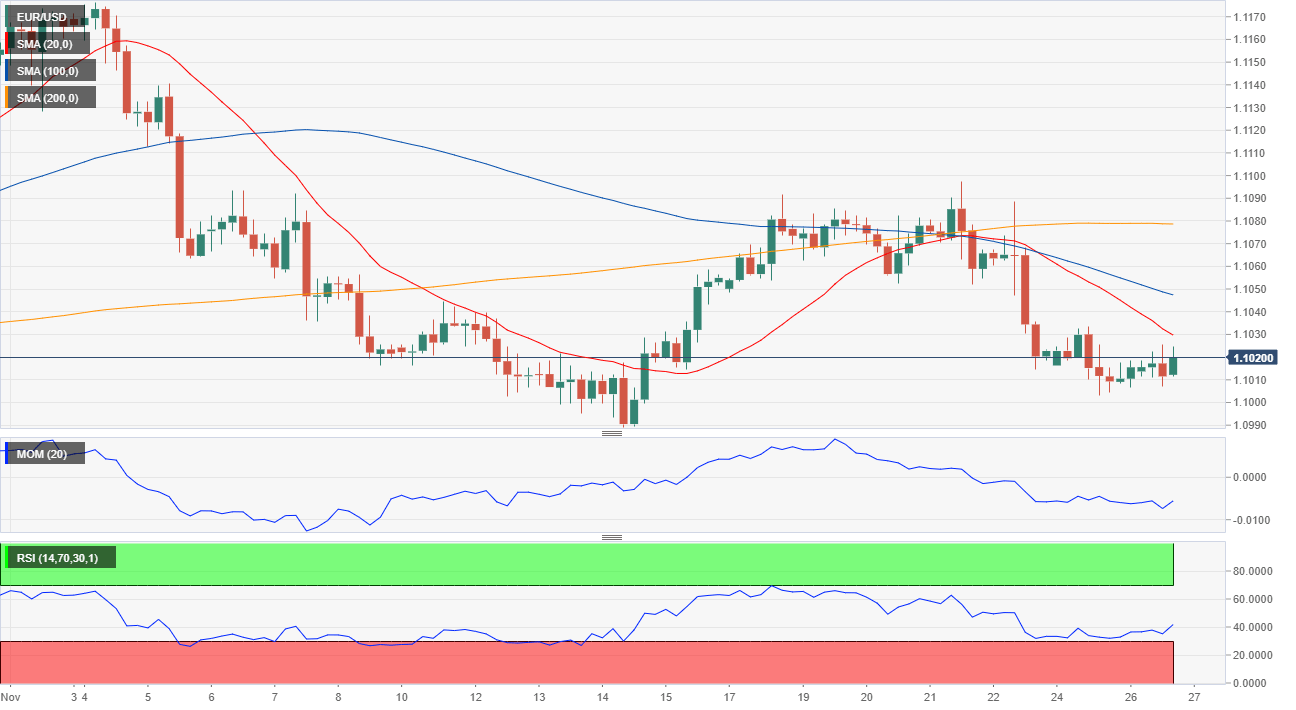

EUR/USD Current Price: 1.1021

- US-Sino trade talks continue, but the market needs more than optimistic words.

- US Consumer Confidence fell modestly in November to 125.5, according to CB.

- EUR/USD holding within Monday’s range, risk skewed to the downside.

Little happened around the EUR/USD pair in the last 24 hours, still confined to a tight range between Fibonacci levels. Investors lacked motivation, as, despite positive comments from US and Chinese authorities, there are no material signs of progress. Data coming from these two economies failed to impress, despite mixed. Germany released the December GFK Consumer Confidence Survey, which printed at 9.7, surpassing the previous and the expected 9.6. The most relevant figure released by the US, the CB Consumer Confidence Index, fell in November to 125.5, although the October number was upwardly revised to 126.1.

Mid-US session, US President Trump said that the US is in the "final throes" on reaching a trade deal with China, although the market’s reaction to the headline was quite limited, as loads are being said but little done.

This Wednesday, the focus will be on US October Durable Goods Orders, and the second estimate of the Q3 Gross Domestic Product, this last, foreseen unchanged at 1.9%. There are some other figures scheduled for release, including Pending Home Sales and Personal Income and Spending. US growth will be critical, as a worse-than-expected outcome could revive fears of an upcoming recession.

EUR/USD Short-Term Technical Outlook

The EUR/USD pair has traded within Monday’s range, heading into the Asian session with a neutral-to-bearish stance, as, in the 4-hour chart, it continues developing below all of its moving averages. The 20 SMA has accelerated its decline, now nearing a Fibonacci resistance at 1.1030, the immediate resistance. Technical indicators lack directional strength and remain well into negative territory. The pair would likely accelerate its decline on a break below the 1.0990 price zone, where it has the next Fibonacci support and this month low.Image Sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.